March 17, 2023

The banking crisis has now swallowed three U.S. institutions — Silvergate, Silicon Valley Bank, and Signature Bank — and threatens First Republic Bank. There was a legitimate fear that other regional banks could have similar difficulties. Despite all this, the general presumption is that the banking system as a whole seems healthy. But in today’s world any fear – warranted or not – can go viral in minutes and threaten an otherwise healthy financial institution and conceivably jeopardize the entire banking system. Perception matters. For now the FDIC’s action to make all depositors whole, the Fed’s announcement of a Bank Term Funding Program to provide liquidity, and the $30 billion cash injection for First Republic by a group of the country’s largest banks, appears to have stabilized the markets.

The economic fallout from the latest banking crisis has yet to be determined. At the moment, investors have concluded that this crisis will dramatically shrink liquidity and trigger a recession within months. Specifically, the market expects the Fed to raise the funds rate by 0.25% to 5.0% by May, but then cut rates sharply with the funds rate falling to 4.0% by yearend. The markets once again anticipate an imminent recession. But is that right? We do not think so.

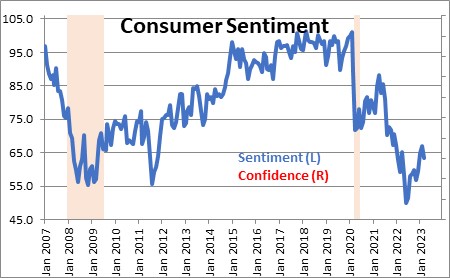

Consumer spending. Consumers matter because consumer spending represents about 60% of GDP. Consumer sentiment has risen somewhat since hitting its low point in June of last year, but it remains below the low point reached in the 2020 recession. That seems absurd. Do we feel significantly worse today than in April 2020 when COVID was spreading rapidly? Do we feel as nervous today as we did in 2008-09 when the housing market was collapsing and the so-called “Great Recession” was underway? We doubt it. Nevertheless, when asked, people say they are very worried. The latest financial market scare could cause sentiment to fall anew. But how much farther can it go? It is already at an almost unbelievably low level.

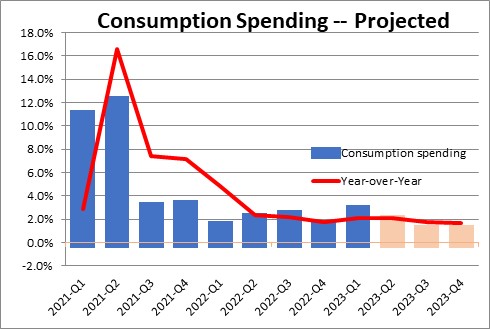

While consumer sentiment is very low, consumer spending has not slowed. Consumer spending rose 2.3% in the third quarter, 1.4% in the fourth, and is poised to rise 2.8% or so in the first quarter. If we are so scared, why are we still spending? We think the answer is that we do not have any fear of losing our job. The unemployment rate currently is near a 50-year low of 3.6%. If a worker gets laid off from one job, he or she can quickly find another. Because there is no fear of losing their income stream, consumers seem willing to keep spending – even if they have to borrow to maintain their lifestyle. If the financial crisis makes us nervous, do we finally begin to curtail spending? Probably not. We suggest that will not happen until the unemployment rate begins to rise steadily.

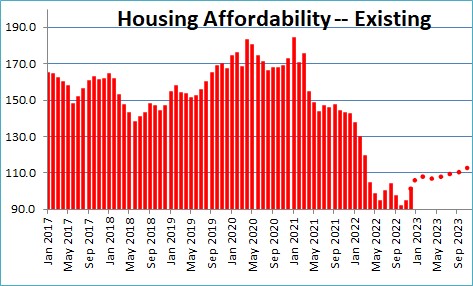

Housing. Everybody is worried that higher mortgage rates will produce further weakness in the housing market. Mortgage rates today are 6.5%. We project a peak mortgage rate of 7.0% in the fall – not much higher than it already is. And if the current low level of the 10-year note is sustained, mortgage rates could fall to 6.0-6.25%.

Mortgage rates are only one part of the housing affordability equation. Household income is a second piece. If the economy keeps cranking out 200+ thousand jobs per month and hourly earnings continue to climb, household income will also rise.

The third part of the affordability equation, home prices, have fallen sharply in each of the past six months and are likely to continue to do so.

As a result, housing affordability is going to increase in the months ahead which means that some lower income families will be back in the hunt looking for a new home. This is a big deal because housing subtracted 1.2% from GDP growth in the second half of last year. It will no longer act as a brake on growth in 2023.

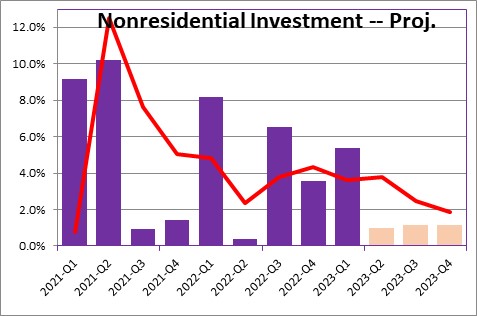

Nonresidential investment. The nonresidential investment component of GDP rose 6.2% in the third quarter of last year, 3.3% in the fourth quarter, and is likely to increase 5.1% in the first quarter of this year. That growth was largely attributable to the intellectual property or technology component which climbed at an 8.5% rate in the past year. However, in the wake of the recent financial crisis, banks are likely to tighten up on their lending standards for the tech community, start-up operations in particular. This is the most likely place for fallout from the recent financial sector difficulty to materialize. We expect nonresidential invest to grow 1.9% this year.

When we put all this together we end up with a projected GDP growth rate of 1.2% for the year – 2.0% in the first quarter and growth averaging 0.9% in the final three quarters of the year.

This leaves the Fed in a pickle. Inflation is still deeply entrenched with the core CPI at 5.5%, or more than double its 2.0% target. It cannot afford to leave rates unchanged at its meeting this week. To do so would suggest that it is giving up on its long-stated desire to reduce inflation to the 2.0% mark. It cannot raise rates by 0.5% given the financial market difficulties. So, our bet is that it will raise rates 0.25% for now to 5.0%. Where it goes beyond that will depend upon what happens to the economy and inflation. Will the economy remain relatively resilient and inflation sticky as we expect? Or will the fallout from the recent financial crisis weaken growth more than we anticipate?

Stephen Slifer

NumberNomics

Charleston, S.C.

Steve, thank you for your usual prescient analysis of the current turmoil. I cannot help but think that this is a precursor of future financial issues since social media now acts as an accelerator of panic(s). People no longer have to wait 1930’s style for long lines of depositors outside of bank doors to rush to withdraw money…all that is required is whispers or chatter on Twitter, Facebook, et. al, and the “run is on.” I see no control of this sort of increased inspired volatility. My concern is that it can be weaponized for systemic instability.

Hi Sidney,

Unfortunately, the internet genie is out of the bottle and we cannot put it back in. But was social media the cause of the problem, or did it merely expose already existing weakness? In my opinion, the bank created many of its own difficulties. From one of the charts I have seen, SVP had far too much of its asset holdings categorized in the hold-to-maturity category compared to other big banks. As I recall the numbers were 70% for SVP vs. about 18%. Its holdings were concentrated in the tech sector, the tech sector in the Silicon Valley vicinity in particular. I would bet that even an MBA student might be able to figure out that is a problem. Something happened within the management structure of SVA that missed that potential risk. Ditto for the FRB of San Francisco. They appear to have been asleep at the switch. Clearly, once the problems began social media accelerated the fallout dramatically. Now investors around the globe are trying to sniff out bad management at other banks. Once the problems are discovered, it becomes difficult for that institution to survive. Everybody is pointing the finger at everybody else from Dodd-Frank, to the Fed, to the FDIC, and all of them share some of the blame. But perhaps the right place to focus that blame is on bad management at the bank itself — SVB, Signature, and Credit Suisse.

I am not a big fan of social media. But, in this case, I think the blame should be elsewhere. Does that make sense?

Steve