April 30, 2025

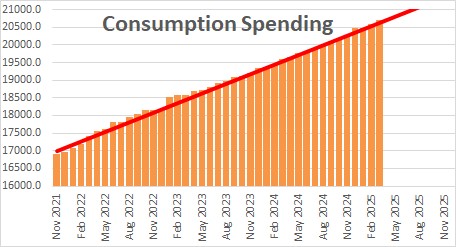

Personal consumption expenditures rose 0.7% in March after having climbed 0.5% in February and having being unchanged in January. In the past year nominal spending has risen 5.6%

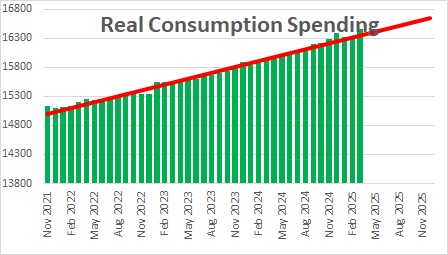

What we are really interested in is “real” or inflation-adjusted spending. That is what goes into the GDP calculation. After adjusting for inflation real consumption spending rose 0.7% in March after gaining 0.1% in February after declining 0.4% in January. In the past year real spending has risen 3.3%.

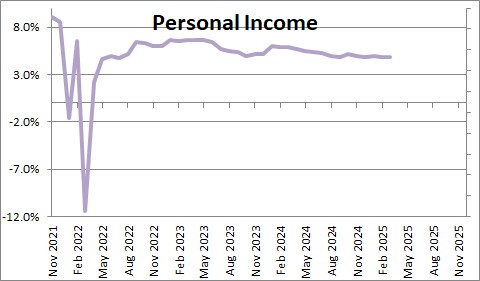

Personal income rose 0.5% in March after climbing 0.7% in February after gaining 0.6% in January. In the past year personal income has climbed 4.9%.

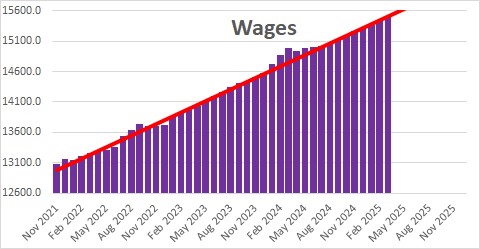

The growth in income is being fueled partially by wages which rose 0.5% in March after increasing 0.4% in February after having risen 0.3% in January. In the past year wages have risen 3.6%. Transfer payments have risen 7.0% in the past year which is further adding to income growth. Medicare payments have risen 10.0%, Medicaid has gained 5.5%, and Social Security 5.8%.

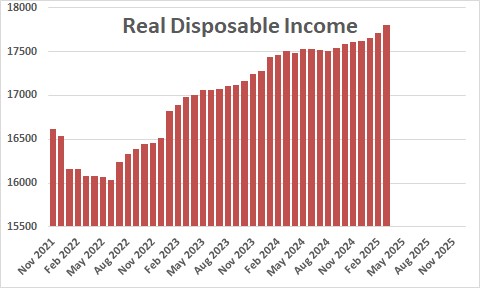

Real disposable income — what is left after paying taxes and adjusted for inflation — rose 0.5% in March after climbing 0.4% February and 0.2% in January. In the past year it has risen by 1.7%, but in the past three months it has accelerated to 4.1%.

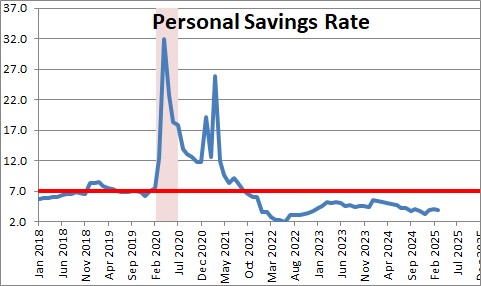

The savings rate fell 0.2% in March to 3.9% after having risen 0.2% in February to 4.1% after having gained 0.6% in January. Consumers are saving less of their paycheck each month than what they have done historically. In the 10-years prior to the 2020 recession the savings rate averaged 7.0%. At 3.9% the savings rate is far below its historical average. Having said that the savings rate has been significantly below the historical 7.0% mark for three years. It appears have used credit card borrowing or some of their newfound gains in their net worth to supplement spending. We expect consumers to spend at a 1.7% pace throughout 2025.

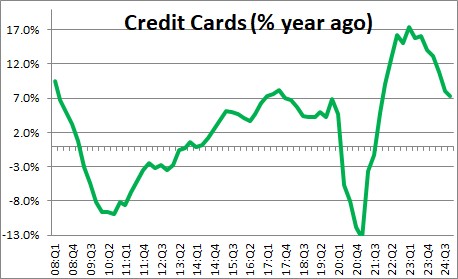

A year or so ago consumers were rapidly running up their credit card bills. But the rate of growth in credit card borrowing has slowed to about 7.0%.

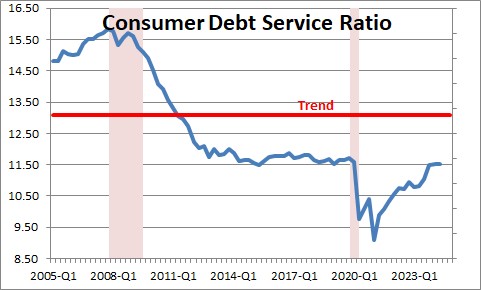

The consumer debt service ratio has been rising as the result of the additional credit card borrowing, but it is still essentially where it was prior to the recession.

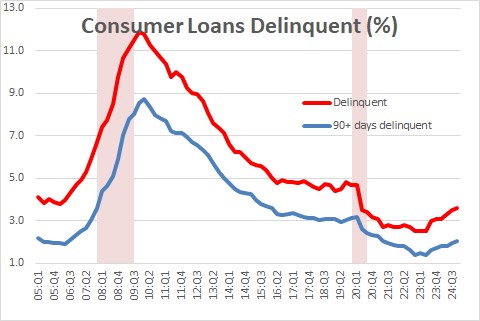

Thus far the additional debt has not been a problem. If that were the case, delinquency rates on consumer debt should have begun to rise. They have inched higher but that is all and remain below where they were prior to the recession.

Steady job gains and significant wage growth will provide enough fuel to keep the economy growing at a moderate rate in the months to come. We look for GDP growth of 2.5% in the second quarter and 1.9% growth in 2025.

Stephen Slifer

NumberNomics

Charleston, SC

Excellent analysis and charts. I am amazed home high consumer confidence remains with all the talk of recession in the media. I just added your site to my sites list of recommended economic links.

I think consumer confidence is based to a large degree on what is happening to the stock market. We all read the stuff that is published in the print media, magazine articles, blogs, tweets, etc. But perhaps there is so much information out that that we get ourselves confused and go back to how all that is affecting the stock market. If we as consumers were seeing obvious signs of prices rising because of the tariffs being applied to Chinese goods perhaps we would be less confident. That may be coming, but we are not there yet.

All the best.

Steve