April 30, 2025

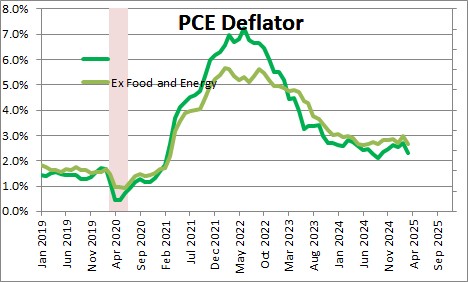

There are many different measures of inflation, but the one that the Federal Reserve considers to be most important is the personal consumption expenditures deflator, in particular the PCE deflator excluding the volatile food and energy components.

The PCE deflator was unchanged in March after having risen 0.4% in both January and February. The year-over-year increase now stands at 2.3%.

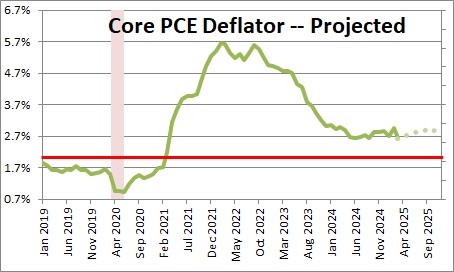

Excluding the volatile food and energy components the PCE deflator was unchanged in March after having risen 0.5% in February and 0.3% in January. The year-over-year increase is now 2.6%. This is the inflation measure that the Fed would like to see rise by 2.0%. The problem is that in the past three months this core measure of inflation has risen at a 3.4% pace. As a result, we now expect the core PCE to rise 3.0% in 2025 after having risen 2.9% in 2024. If that forecast is correct there is no way that the Fed can cut rates this year.

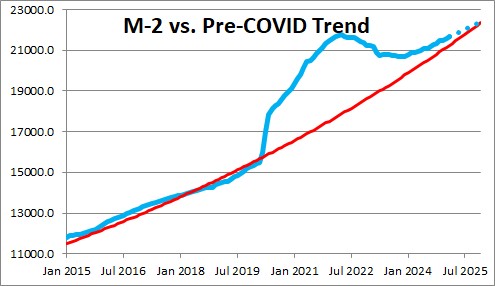

The purchases of Treasury securities by the Fed in 2020 and 2021 caused money supply growth to surge. We all learned back in our basic economic classes that money growth is the cause of inflation. However, the length of time between a pickup in money growth and an increase in inflation is both long and variable. Thus, the earlier increase in money growth caused the inflation rate to climb well above the Fed’s 2.0% target for a protracted period of time. However, as the Fed has been running off some of its holdings of U.S. Treasury and mortgage backed securities, the money supply has declined in recent months. The problem is that the earlier rapid growth pushed the level of M-2 far higher than its trend path would suggest. At its peak that difference was $4.0 trillion which represented surplus liquidity in the economy. At the moment that difference is $0.4 trillion. If the Fed keeps shrinking its balance sheet, this surplus liquidity will eventually be eliminated which should prevent the core inflation rate from growing too quickly in 2025.

We expect to see GDP growth of 2.5% in the second quarter and 1.9% in 2025.

Stephen Slifer

NumberNomics

Charleston, SC

Steve – In the fourth paragraph above, third sentence, shouldn’t “invariable”

be “variable”.

Hi Frank. Yes. Good catch. I just changed the original. Proofreading is not my strong suit!

Thank you Stephen. Great and illuminating analysis, as usual.

Fed Chair Powell specifically said at one point last year that, as a starting point for getting to feel comfortable about monetary policy being sufficiently restrictive to prod inflation lower, he’d want to see positive real rates across the curve.

As you point out, even at the shortest (overnight) range, the Fed Funds rate is basically 0% (or maybe even -0.20% if you use the lower bound of the current 4.5%-4.75% target range).

While T-Bills and the 2-YR Treasury Note sport positive real rates based on the core PCE deflator’s 4.7% level, the rest of the maturities on the curve still have negative real rates.

My question to you, if I please may ask, is:

1) what do you make of the Treasury breakeven rates, which fell hard last year and are still telegraphing Fed success in taming inflation given the diminutive readings in the most relevant breakevens (5-Yr B/E at 2.50% and the 10-Yr B/E at 2.38%)?

And, 2) Given the inflation outlooks implied by these breakevens and the market’s likely continued support for Treasuries beyond the shortest maturities in light of expectations the Fed’s tightening will cause a recession, how will there ever be positive real rates ‘across the curve’, as Powell wants?

I obviously understand the answer to #2 would be for the core PCE deflator to fall to facilitate that, all else being equal, but it seems more and more that a meaningful decline in the annualised core PCE deflator is not imminent.

Is the market overpricing the longer maturity Treasuries and what might cause a repricing lower to get their real yields positive?

Japan’s BOJ Governor nominee Ueda san seems in no rush to end their yield curve control, the end of which may have pressured Treasury yields higher.

And even with today’s firming in the PCE deflator and its core measure, the 10-Yr T-Note couldn’t vault above that key 4% yield level.

In the absence of a significant drop in the core PCE deflator, will Powell simply keep pushing the Fed Funds rate higher, but in the more traditional 25 basis point increments? And leave the car in cruise control? How far do you think he’ll go and for long will he really keep the peak in place?

The implied rate on January’24 Fed Funds futures seem to have hit a new cycle high today at 5.27%, which reflects the market’s estimate for the 30-day average effective Fed Funds rate that month.

The market’s finally pricing in a Fed Funds rate at the end of 2023 that’s in the range of 5.25%-5.50%. But barely so; although the pricing is more solid for July’23 as there’s belief Powell will do 3 more, 25 basis point hikes through this June.

While the market’s priced out cuts in H2’23, the market’s still looking for nearly 150 basis points of cuts to the Fed Funds rate in 2024.

Has the market been simply brainwashed by nearly 15 years of ultra-accommodative monetary policy and just can’t fathom the idea of both elevated inflation and cost of money for any meaningful amount of time? It’s as if market memory of decades prior to 2008’s Great Recession and the Global Financial Crisis has been erased.

Thank you

Hi Kevin,

There are a lot of questions in your note. Let me give a go at answering some of them.

First, when the Fed talks about wanting a positive real rate, he is really talking about a positive real funds rate. That is because the funds rate is the only interest rate that it can control. He might like to see positive real 2-year, 5-year, and 10-year rates, but the market control them — not the Fed. You are right in your interpretation that the markets think he will be successful soon. The economy will slow a lot (or even go into a recession), inflation (by any measure) will quickly drop back close to the Fed’s 2.0% target, and that the Fed will begin to lower rates in the second half of this year.

But in the past week or so the markets have come to the realization that the economy has a lot more momentum than it thought, and that inflation is not slowing down as quickly as it hoped. As a result, rates across the board have risen by 0.5% or so.

You also ask when I think the funds rate might come down. The markets had been looking for that to happen in the second half of this year. I thought that it would happen in the early part of 2024 — but only if the Fed rises the funds rate further from 4.75% today to 6.0% by September. If inflation has slowed to 4.7% or so by that time, then the real funds rate would be +1.3%. That might be enough to do the trick — slow the economy substantially and actually trigger the long-awaited recession, and get the inflation rate to start falling more quickly.

You might want to look at what I wrote last Friday — “On the road to 6.0%” — and also look at my GDP, unemployment rate, inflation, and interest rate forecasts quarterly from now through the end of next year which are on this website. I am expecting the Fed to raise the funds rate to 6.0% by September. That will cause the recession in the first half of 2024. The recession will allow the funds rate to decline to 3.0% by the end of 2024. By the end of 2024 the core CPI will have slowed to the 3.0% mark — still not quite where the Fed wants it to be, but getting close and moving that direction quickly.

I hope this helps.

Steve

Steve