August 12, 2022

The markets survived the recession scare in the first two quarters of this year. However, they remain convinced that the peak in interest rates is not too far distant. Thus, they believe that growth will have slowed enough, and inflation will have subsided enough, that the Fed will be in a position to cut rates by the middle of next year. Good luck with that.

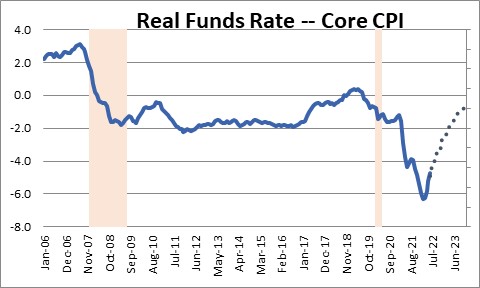

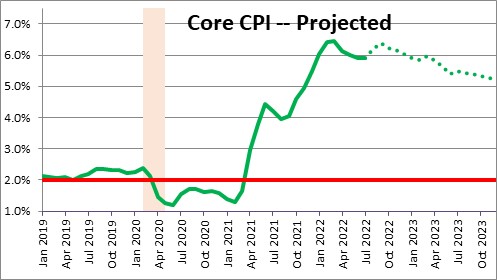

We agree that ultimately the Fed will raise rates enough to break the back of inflation. But we disagree that the Fed is close to the peak in rates. We continue to believe that the Fed will not induce enough economic weakness to bring inflation back to the desired 2.0% pace between now and the end of next year. They first need to produce a positive real federal funds rate. If the Fed raises the funds rate to 4.0% by the end of this year and the core CPI climbs by 6.0%, the real funds rate will be -2.0% at the end of this year. At the end of 2023 with the funds rate presumably at 4.5% and the core CPI at 5.2%, the real funds rate will still by -0.7%. The Fed will not significantly slow the pace of economic activity with a negative real funds rate.

The Fed seems to understand this as well. In its long-term forecasts the Fed believes the funds rate will be 2.5% with inflation at the desired 2.0% pace. Thus, the Fed recognizes that it needs a positive real funds rate of about 0.5% to achieve its objective. Fed officials in the past week or two have re-iterated the notion that they will be continuing to raise rates into 2023. Thus far, nobody is listening.

To achieve a positive real funds rate, additional rate hikes will be required. We do not know whether it will be 0.75% hike in September or 0.5%. Data still to be release will make that determination. But whatever happens in September will be just another step along the way toward higher rates.

The idea that the Fed can soon begin to slow the pace of rate hikes should eventually disappear. Consider the following:

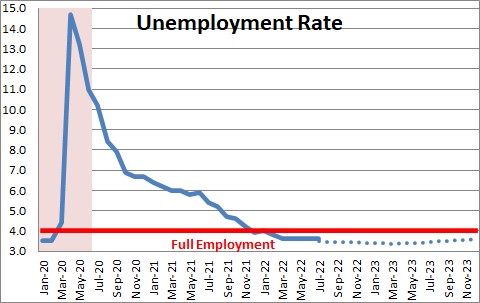

The economy still has a head of steam with job gains averaging in excess of 400 thousand per month and the unemployment rate at 3.5% which is far below anybody’s estimate of its full employment threshold.

Even with the unexpected softness in the CPI for July the year-over-year increase in the core CPI is 5.9% and at the end of the year we expect it to be 6.0%. Neither of those figures is even remotely close to the Fed’s 2.0% targeted inflation rate. The Fed cannot ease off as long as that is the case for fear of damaging its credibility by appearing to back away from its commitment to do whatever it takes to bring the inflation rate back to its target.

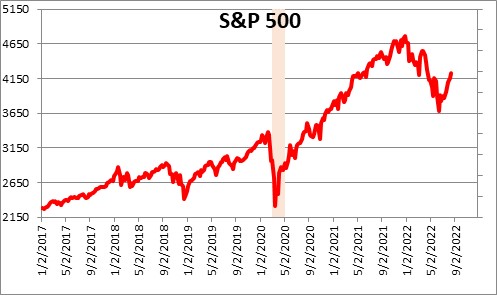

The stock market has soared in the past several weeks as the markets have come to believe that the end of Fed rate hikes is in sight. After having fallen 21% below its yearend peak, the S&P 500 index is now just 11% below its prior high. Stock gains of this magnitude are certainly to bolster consumer confidence and enhance their willingness to spend.

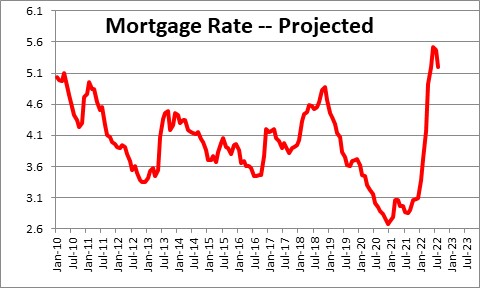

Mortgage rates have fallen about 0.6% from a peak of 5.8% in late June to 5.2% in the past several weeks. The yield on 10-year Treasury notes has fallen by roughly a comparable amount from 3.5% to 2.9%. With respect to housing the lower mortgage rates will boost housing affordability and, presumably, increase home sales.

For all of these reasons we expect GDP growth in the final two quarters of the year to average 2.0%. The economy’s speed limit is presumably 1.8%. Growth at or slightly in excess of the speed limit with little slack in the economy (think the unemployment rate at 3.5% vs. 4.0%) is not going to curtail inflation. Thus, in our opinion, the economy is going to continue to chug along at a moderate pace until such time as the Fed boosts the real funds rate into positive territory. We doubt it will be willing to do that any time soon. A recession may be coming but it seems likely to be a 2024 event at the earliest.

Stephen Slifer

NumberNomics

Charleston, S.C.

The notion that the Fed can control inflation that is being fueled by supply disruptions, pandemic leftover spending, oil and grain shortages provoked by a war in Ukraine and a China in perennial lockdown is ludicrous. The inflation we are experiencing is a global phenomenon affecting every single nation on earth at this moment. It is high time we stop thinking that the Fed can effect any meaningful policy with the only instrument they have at hand, interest rates. Hiking interest rates only squeezes the population that depends on credit for survival. Like taxes, the rich can always avoid the effects of higher interest rates. Only the poor and middle class end up suffering.

Using interest rates to try to curb this global inflation is akin to performing brain surgery with a dull machete.

Hi Tania,

All of the items that you mentioned are certainly contributing to the run-up in inflation. But there is one item that you did not mention and that is the money supply. That was Fed generated during the pandemic. It has slowed sharply since the beginning of the year. However, it grew at an excessive rate for almost two years. As a result, the level of M-2 is currently about $3.6 trillion higher than it should be. No wonder we have an inflation problem. If money growth is flat or declines between now and the end of next year much of that surplus liquidity will be eliminated. That should reduce inflation. But it obviously will take time. Could drop from 8-9% to perhaps 5% between now and then. But getting it from 5% to 2% will, in my opinion, require higher rates. I do not agree that the impact of higher rates only falls on the poor and middle class, but I will agree that it hits that group the hardest. The Fed created most of this problem. It can solve it, but it would have been a lot less painful if it had started early last year.