May 15, 2025

The Producer Price Index for final demand includes producer prices for goods, as well as prices for construction, services, government purchases, and exports and covers over 75% of domestic production.

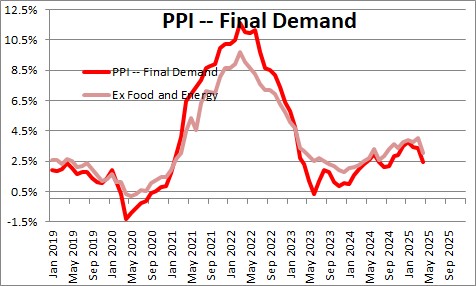

Producer prices for final demand declined 0.5% in April after having been unchanged in March. In the past year the PPI has risen 2.4%. The PPI has been relatively stable in recent months.

Excluding the volatile food and energy categories, final demand prices declined 0.4% in April after having risen 0.4% in March. Over the past 12 months this index has been unchanged.

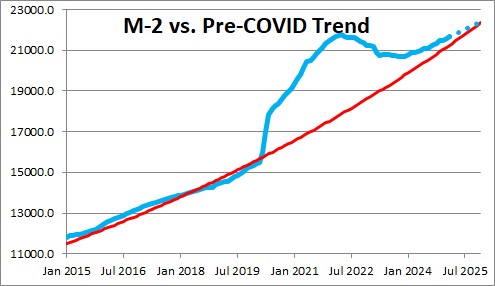

We have seen relatively high inflation because of surplus liquidity in the economy. The cumulative effect of monthly gains in the money supply consistently in excess of the 6.0% M-2 target from March 2020 until March 2022 pushed M-2 almost $4.0 trillion above target. M-2 began to decline in April of 2022 but is still $0.4 trillion above where it should be. It appears that the removal of $3.6 trillion of surplus liquidity is helping to bring inflation back down toward the Fed’s target. If that surplus liquidity continues to shrink we should look for all measures of inflation — including the CPI and the PCE core rate of inflation — to move closer and closer to the Fed’s target.

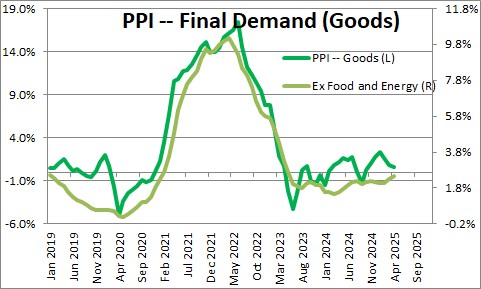

The overall PPI index can be split apart between goods prices and prices for services.

The PPI for final demand of goods was unchanged in April after having fallen 0.9% in March. Excluding the volatile food and energy categories the PPI for goods rose 0.4% in April after climbing 0.3% in March. This core goods sector inflation index has risen 2.5% in the past year.

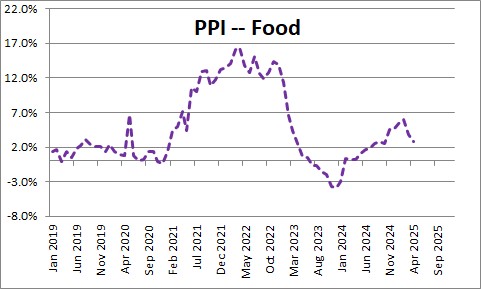

Within the goods sector, food prices fell 1.0% in April after declining 2.1% in March. This category includes a breathtaking 39.4% decline in chicken egg prices in April.. Egg prices have still risen 50% in the past year. This is a volatile series. It increases sharply for a few months and then drops back a few months later. In the past year food prices have risen 2.9%.

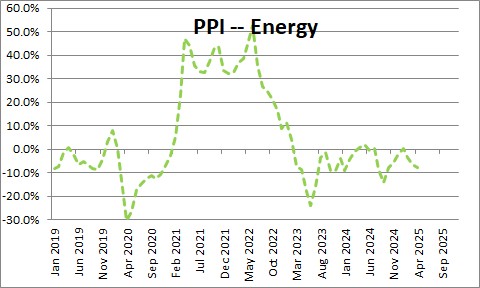

Energy prices fell 0.4% in April after declining 3.8% in March. It, too, is a volatile series. In the past year energy prices have declined 7.8%.

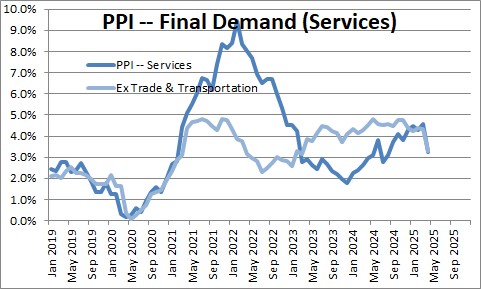

Prices of services declined 0.7% in April as wholesale and retail margins fell sharply after having risen 0.4% in March. In the past year prices of services have risen 3.3%. Ex transportation and warehousing, service sector prices have climbed 3.3%. The increase in this core services group in the past year is fairly widespread — portfolio management, property and casualty insurance, travel accommodations services, recreational activity services, dental care, and legal services.

Because the PPI measures the cost of materials for manufacturers, it is frequently believed to be a leading indicator of what might happen to consumer prices at a somewhat later date. However, that connection is very loose. It is important to remember that labor costs represent about two-thirds of the price of a product while materials account for the remaining one-third. Those labor costs are better captured in the CPI. Also, the CPI is being inflated by the shelter component, led by rents but also automobile insurance and car repairs..

The core CPI is expected to increase 3.1% in 2025 which suggests an increase in the core personal consumption expenditures deflator of about 2.8% in 2025.

Stephen Slifer

NumberNomics

Charleston, SC

The vertical axis on your graphs is not labeled and is confusing. It appears the scale reflects the interval change in the rates, not the absolute rates.

Hi Frank. Thanks for your comment. I looked at the PPI chart and I am not sure I understand your confusion. It is the year-over-year percent change in each series. I typically do not show the monthly change in my charts because they tend to be so volatile. With the y-o-y change you can more easily see the change in trend.

Steve Slifer

Steve –

Don’t understand your comment above that the money supply will remain elevated

throughout 2022. I thought the Fed was going to stop QE bond purchases after March and start to shrink their inventory after that. Why will the money supply

remain elevated?

Hi Frank,

A couple of things. First of all, the Fed has said that it will stop its monthly purchases of securities by the end of March. Between now and then its balance sheet and, presumably, money growth will continue to be rapid. It has not yet said when it will begin to actually shrink its balance sheet. Details of that will probably come some time in the first quarter. But at that point it will begin raising interest rates. It seems to me that they will probably not do both simultaneously — kind of a double dose of tightening.

If that is the case, then money supply growth will slow from about 13% currently to perhaps 8% or so next year (remember the Fed keeps buying securities through March). Historically, it needs 5-6% growth (roughly in line with desired nominal GDP growth). But 8% is faster than 5-6%, hence money growth will remain elevated. But going even farther, money growth has been so rapid for so long that its level is far above where it would have been if it had growth 5-6% throughout that period. It actually need 0% money growth for a while to get the level of the money stock back in line with where it should be. To put that another way, it needs to wipe out the excess liquidity that is currently in the economy.

Does that make sense?

Steve