May 2, 2025

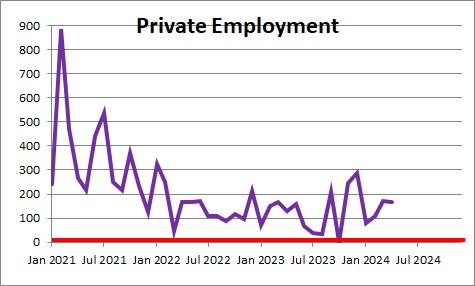

Private sector employment climbed by 167 thousand in April after gaining 170 thousand in March and 107 thousand in February. The job gain exceeded market expectations which were for an increase of 140 thousand. In the past three months private sector employment has risen on average 148 thousand per month.

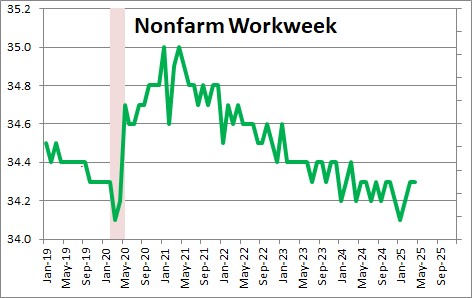

In addition to hiring workers employers can also alter the length of the workweek for their existing workers. The nonfarm workweek was unchanged in April at 34.3 hours after rising 0.1 hour in March. Prior to the recession the nonfarm workweek was averaging 34.4 hours so it is roughly the same as it was five years ago.

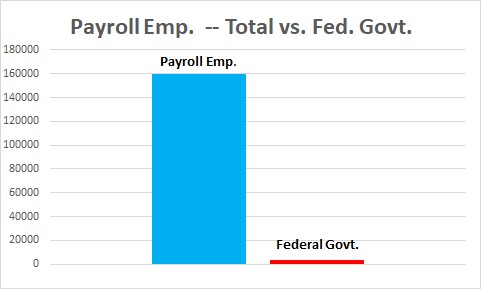

There are few signs that the fear of tariffs on the economy has caused firms to change their view about hiring. They may not be replacing a worker that leaves the company and thereby reducing headcount by attrition but even that seems to be small in the bigger scheme of things. Federal government layoffs are also a minor factor. That is not surprising since Federal government employment is only 2% of the total. Federal government reached a peak in January at 3,015 workers. It is currently 2,989 thousand — a total decline of just 26 thousand or about 9 thousand per month.

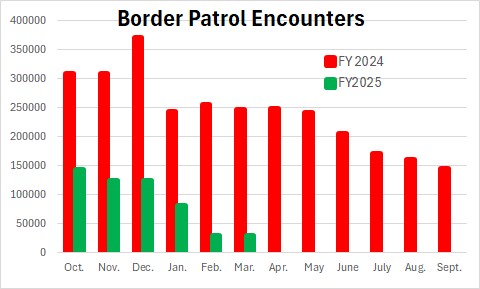

Similarly, people were worried about the loss of immigrant workers. The border has been essentially closed for the past several months, and it is hard to discern any particularly impact on total employment.

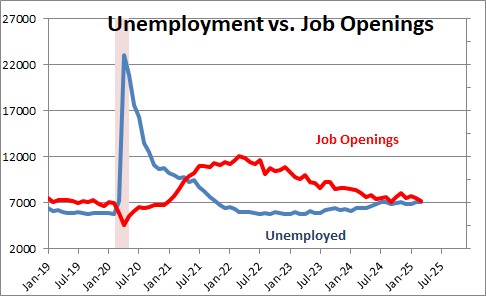

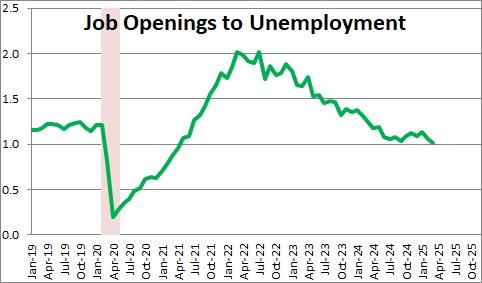

Job openings have fallen from a record high level of 11.7 million in early 2021 to 7.2 million. Prior to the recession there were about 7.0 million job openings per month versus 7.2 million currently. Today there are still 1.0 job openings for every unemployed worker which is just slightly lower than where this was prior to the recession. Employers are nervous but the l labor market is doing OK for now.

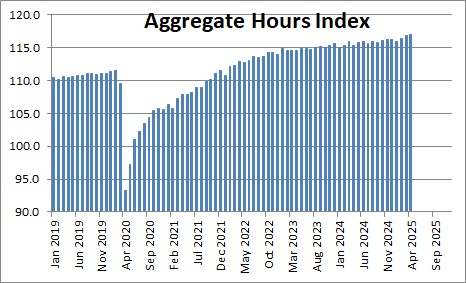

The change in employment and hours worked are reflected in the aggregate hours index rose 0.1% in April to 117.0 after rising 0.4% in March. The aggregate hours index appears to be on track 2.3% in the current quarter. We anticipate a GDP increase of about 2.5% in the second quarter following the 0.3% drop in the first quarter.

Construction employment rose by 11 thousand. Manufacturing employment fell by 1 thousand. Retail trade jobs declined by 2 thousand. Transportation and warehousing rose by 29 thousand. Info tech jobs rose by 2 thousand. Financial sector jobs rose by 14 thousand. Professional and business services rose by 17 thousand.. Health care jobs climbed by 51 thousand. Social assistance gained 8 thousand. Leisure and hospitality jobs gained 24 thousand.(restaurant employment climbed by 17 thousand. Government jobs rose by 10 thousand. Federal government employment declined 9 thousand which puts it 26 thousand below its recent peak level.

We expect GDP to grow about 2.5% in the second quarter and 1.9% for 2025 as a whole.

Stephen Slifer

NumberNomics

Charleston, S.C.

We have seen a change in the way companies are hiring employees. As the owner of the staffing company temp to hire has been a very popular strategy the last several years. Now companies are actually hiring people directly to their payroll and willing to pay fees. That would seem to indicate that they do not expect a downturn in the near future. Good news for all of us.

Thanks for the comment, Neil. From what you said, it certainly suggests that if they do expect a recession it will be short and mild and they will soon need those bodies. But what if rates really do need to go to 6% to slow things down enough to trigger the recession? The outcome may not be quite so mild. We will see.

Hello,

Please add me to your weekly newsletter distribution list. Thank you!

Jon Witherow

Hi Jon. I added you to the list. You should get it tomorrow at 2:00 p.m.