June 1, 2025

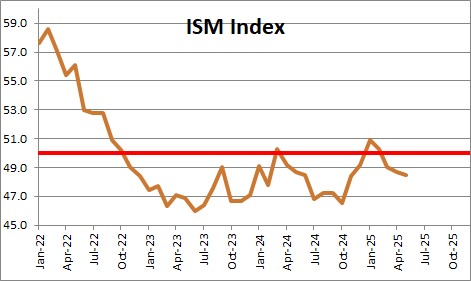

The Institute for Supply Management’s index of conditions in the manufacturing sector declined 0.2 point in May to 48.5 after having fallen 0.3 point in April. This index was above the break-even level of 50.0 in February but it fell below that threshold in March as manufacturers are trying to figure out how to adjust to the tariffs. A level of 48.5 is associated with a GDP increase of 1.7%. While the low readings in recent months are discouraging, the reality is that this index was between 47.0-49.0 for the past two years so one should not get too concerned quite yet.

The ISM organization does a similar survey for the services sector. The ISM index of conditions in the service sector for May will be released on Wednesday, June 4.

The Institute for Supply Management Chair for the Survey Committee Timothy Fiore said, “In May, U.S. manufacturing activity slipped further into contraction after expanding only marginally in February. Contraction in most of the indexes that measure demand and output have slowed, while inputs have started to weaken:

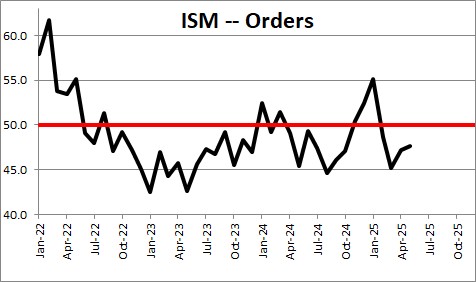

- Demand indicators were mixed, with the New Orders and Backlog of Orders indexes contracting at slower rates, while the Customers’ Inventories and New Export Orders indexes contracted more strongly. However, a ‘too low’ status for the Customers’ Inventories Index is usually considered positive for future production.

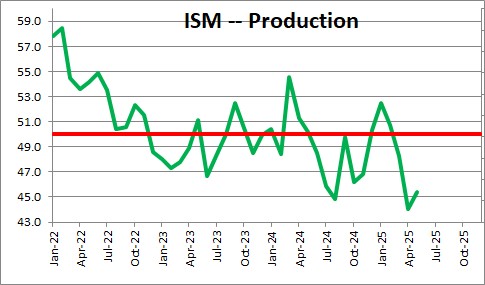

- Regarding output, the Production Index increased from an alarmingly low reading the previous month, but factory output continued to contract in May, indicating that panelists’ companies are still revising production plans downward amid economic uncertainty. The Employment Index ticked up for a second consecutive month but remained in contraction, as head-count reductions continued. Companies generally opted for layoffs because they are quicker to implement than attrition.

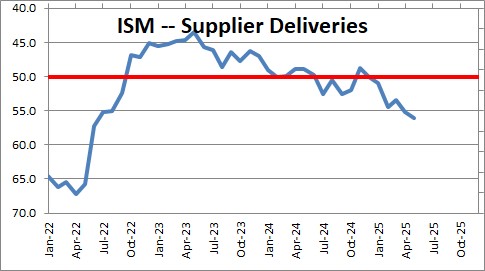

- Finally, inputs are defined as supplier deliveries, inventories, prices and imports. The Inventories Index, as expected, entered contraction territory after expanding as companies completed pull-forward activity ahead of tariffs, while the Supplier Deliveries Index indicated continuing slow performance, reflecting ongoing delays in clearing goods through ports of entry. Tariffs-induced prices growth slowed slightly, while the Imports Index contracted significantly, down 7.2 percentage points compared to April.

Comments from respondents include the following:

- “There is continued softening of demand in the commercial vehicle market, primarily related to higher prices and economic uncertainty. The impact of ever-changing trade policies of the current administration has wreaked havoc on suppliers’ ability to react and remain profitable. Vehicle manufacturers have already rolled price increases into their products to protect their bottom lines but have not been as cooperative with their supply bases. This has resulted in a high occurrence of suppliers falling into financial distress.” [Transportation Equipment]

- “Tariffs, avian influenza and broader commodity markets continue to impact business conditions. The volatility of all three makes business planning and overall conditions challenging.” [Food, Beverage & Tobacco Products]

- “Government spending cuts or delays, as well as tariffs, are raising hell with businesses. No one is willing to take on inventory risk.” [Computer & Electronic Products]

- “Most suppliers are passing through tariffs at full value to us. The position being communicated is that the supplier considers it a tax, and taxes always get passed through to the customer. Very few are absorbing any portion of the tariffs.” [Chemical Products]

- “Tariff uncertainty is impacting new international orders. Tariffs are also the main reason our Asia customers are requesting delayed shipments.” [Fabricated Metal Products]

- “There is continued uncertainty regarding market reaction to the recently imposed tariffs and resulting actions by other countries. The rare earth restrictions being imposed are of high concern in the near term.” [Machinery]

- “The administration’s tariffs alone have created supply chain disruptions rivaling that of COVID-19.” [Electrical Equipment, Appliances & Components]

- “We have entered the waiting portion of the wait and see, it seems. Business activity is slower and smaller this month. Chaos does not bode well for anyone, especially when it impacts pricing.” [Primary Metals]

- “Tariff whiplash continues while the easing of tariff rates between the U.S. and China in May was welcome news, the question is what happens in 90 days. We are doing extensive work to make contingency plans, which is hugely distracting from strategic work, plus it is also very hard to know what plans we should actually implement. The 10-percent tariff on other countries is impactful as well, and it is unclear if/when deals will be made.” [Miscellaneous Manufacturing]

- “Uncertainty due to the recent tariffs continue to weigh on profitability and service. An unresolved (trade deal with) China will result in empty shelves at retail for many do-it-yourself and professional goods.” [Paper Products]

It is striking to us that all 10 comments included some discussion of tariffs and the impact these manufacturers were seeing in their industry. Everybody is nervous and trying to figure out how to adapt their business to this new environment.

The orders component rose 0.4 point in May to 47.6 after having risen 2.0 points in April. This index hasn’t indicated consistent growth since a 24-month streak of expansion ended in May 2022. ““Of the six largest manufacturing sectors, two (Petroleum & Coal Products; and Machinery) reported increased new orders. Panelists noted weakening demand, with a 1-to-1.5 ratio of positive comments versus those expressing concern about near-term demand. Overall, new orders continue to slow, as which party will pay for potential tariff costs is still the prime topic of negotiations between buyers and sellers. A lack of new orders from overseas customers is also a key factor,” says Fiore

The production component rose 1.4 points in May to 45.4 after having fallen 4.3 points in April. Prior to January’s reading, the index was in contraction territory for eight consecutive months, with the last reading above 50 percent in April 2024, “Production levels in May, while slightly improved, are still fragile as order books remain weak and new orders continue to decline. Food, Beverage & Tobacco Products; Transportation Equipment; and Chemical Products declined strongly, causing head-count reductions at factories. Panelists noted reduced output in production due to business-climate uncertainty, with a 3-to-1 ratio of negative to positive comments,” .” says Fiore.

The delivery performance of suppliers to manufacturing organizations rose 0.9 point in May to 56.1 after having climbed 1.7 points in April. This measure indicates the proportion of companies that are reporting slower delivery times. Hence, a reaching above 50.0 indicates that delivery times actually slowed slightly in February, March, April, and May. Fiori noted that, “The main reasons that deliveries continued to be strained were (1) suppliers struggled to meet accelerated delivery requests from panelists’ companies, (2) materials were delayed in processing at ports of entry and (3) suppliers and panelists’ companies are haggling over who pays for applied tariffs,”

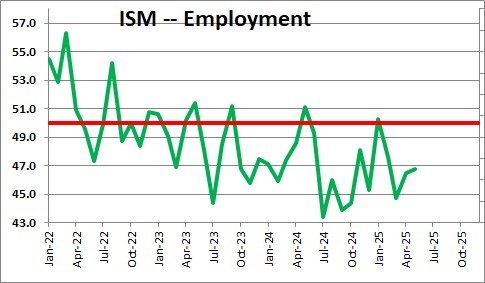

The employment index rose 0.3 point in May to 46.8 after having gained 1.8 points in April. “The index posted its fourth consecutive month of contraction after expanding in January, with seven straight months of contraction before that. Since May 2022, the Employment Index has contracted in 30 of 37 months. Of the six big manufacturing sectors, one (Petroleum & Coal Products) reported expanded employment in May. Respondents’ companies continue to reduce head counts through layoffs, attrition and hiring freezes; an approximate 1-to-1.4 ratio of hiring versus staff-reduction comments reflects an acceleration of head-count reductions due to uncertain near- to mid-term demand. Layoffs were the primary measure, an indication that staff shrinking continues to be urgent,” says Fiore. An employment index above 50.3 is generally consistent with an increase in the BLS data on manufacturing employment.

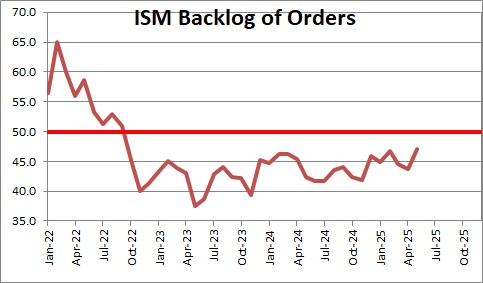

The backlog of orders jumped 3.4 points in May to 47.1 after having declined 0.8 point in April. “Weak new orders and reduced production output in key industries, coupled with the (albeit slower) rate of Backlog of Orders Index contraction in May mean expanding backlogs continue to be delayed until trade issues and other geopolitical tensions recede,” says Fiore.

Customer inventory levels declined 1.7 points in May to 44.5 after having fallen 0.6 point in May. “Customers’ inventory levels in May continued to contract and moved further from ‘about right’ territory. Panelists are reporting that the amounts of their companies’ products in their customers’ inventories continue to suggest a demand level that remains positive for future production,” says Fiore.

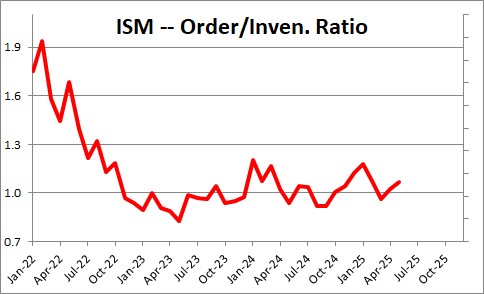

With an increase in the orders index and la decline in customer inventories the ratio of orders to inventories rose 0.1 in May to 1.1 after having been unchanged in April. The 1.1 level for this index suggests that production should be relatively steady in the months ahead.

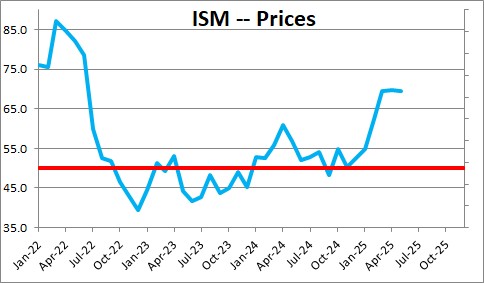

The prices paid component declined 0.4 point May to 69.4 after having risen 0.4 point in April. Fiore noted that, The Prices Index reading was driven by increases in steel and aluminum prices impacting the entire value chain, as well as the general 10-percent tariff applied to many imported goods. Forty-five percent of companies reported higher prices in May, slightly down from 49 percent in April. This share has consistently increased over the prior six months, from a low of 12.2 percent in November to 49.2 percent in April with a slightly slower increase in May,” says Fiore.

After declining 0.2 point in the fourth quarter we expect GDP to expand at a 5.0% pace in the second quarter and climb 2.5% in 2025. The economy is showing numerous signs of uncertainty and rising prices but, thus far, few signs of slowing down.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me