April 26, 2024

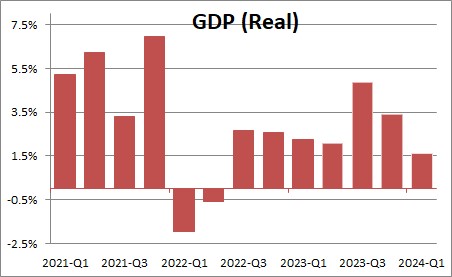

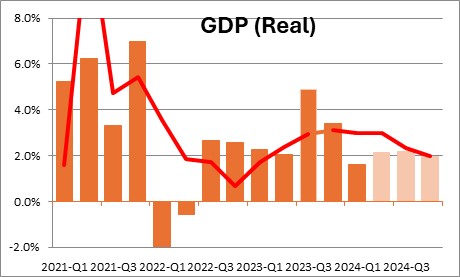

The slower-than-expected 1.6% GDP growth rate in the first quarter and the faster-than-expected increase in the core personal consumption expenditures deflator of 3.7% was generally regarded as the worst of both worlds. That is not quite true. Economists were disappointed with the 1.6% growth rate for the first quarter, but they quickly forgot that they were astonished when fourth quarter growth registered a steamy 3.4%. During the Christmas holiday season sales and inventories fluctuate wildly from month to month. If sales in the holiday season are stronger than usual, fourth quarter growth will be inflated. When sales return to normal early in the new year first quarter sales will be depressed. In our opinion, the only fair way to gauge economic activity around yearend is to average growth for the two quarters which in this case turns out to be 2.5%. Also, most of the first quarter softness came from the change in business inventories and trade which can be extremely volatile from one quarter to the next. In the absence of those two categories growth would have been an impressive 2.8%. Consumer spending, nonresidential and residential investment all climbed at respectable growth rates in the first quarter. Hence, we conclude that the economy is not nearly as soft as the first quarter gain of 1.6% suggests. It still seems to be chugging along at a 2.0-2.5% pace.

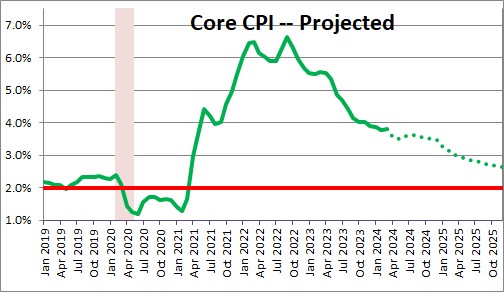

With respect to the inflation rate, the 3.7% increase in the core PCE was far larger than the 3.0% gain that had been anticipated and reflects stickiness in the inflation rate. Make no mistake, the firsts quarter increase was disturbing. Undaunted, we still expect the various inflation measures to slow gradually in the months ahead for reasons that we outline below.

Any notion of Fed easing is off the table for now, but if the inflation rate begins to moderate in the months ahead – which we expect — the initial Fed easing move may still occur in December.

Fourth quarter GDP growth of 1.6% was clearly disappointing, but because so much of the unanticipated weakness comes from inventories and trade, the slower-than-expected GDP growth rate should be discounted considerably.

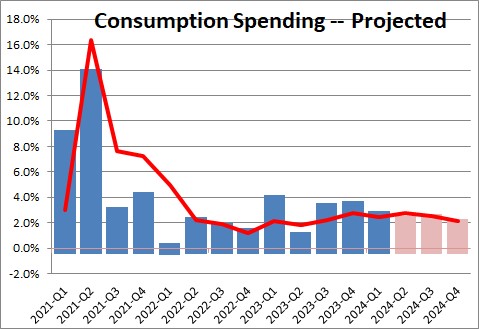

Consumer spending, which accounts for about two-thirds of GDP rose 2.5% in the first quarter which is just a shade slower than the third and fourth quarter growth rates. As long as the economy continues to crank out 200 thousand jobs a month and wages continue to climb, consumer income will rise and consumer spending should grow at roughly its first quarter pace for the foreseeable future

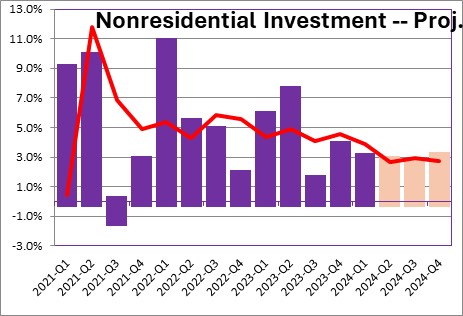

Nonresidential investment climbed 2.9% in the first quarter fueled by a 5.4% increase in intellectual property – computer hardware and software. Given that the economy continues to grow, firms need to boost output. Because they are having considerable difficulty finding an adequate supply of workers, firms are willing to spend money on technology in an effort to boost output by making their existing employees more efficient. Given that the labor market is expected to remain tight for the foreseeable future, our sense is that spending on technology — and the nonresidential investment portion of GDP — will continue to climb at a moderate pace in the quarters ahead.

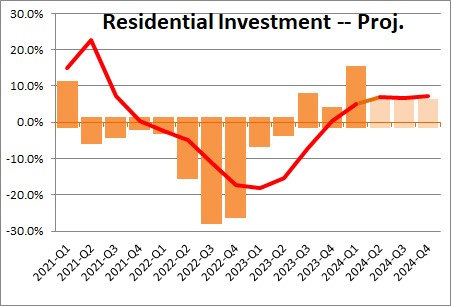

Residential spending jumped 13.9% in the first quarter. Because the inventory of existing homes available for sale is near a record low level, home buyers have turned to new homes as an alternative. The supply of new homes available for sale is much larger and potential buyers have a reasonable chance of finding a new home that suits their requirements. As new home sales climb there is an incentive for builders to boost output, and that is reflected in the impressive first quarter gain. However, builders are facing the same difficulty finding workers as everybody else. At the same time there are few available, affordable lots on which to build. Those two factors are going to curtail growth in the residential investment portion of GDP in the final three quarters of the year.

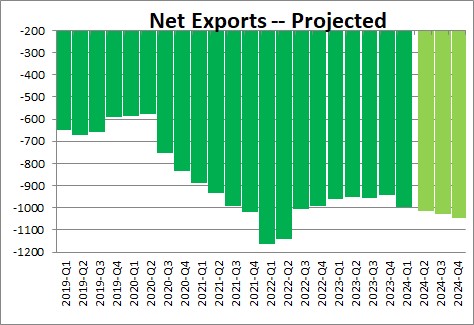

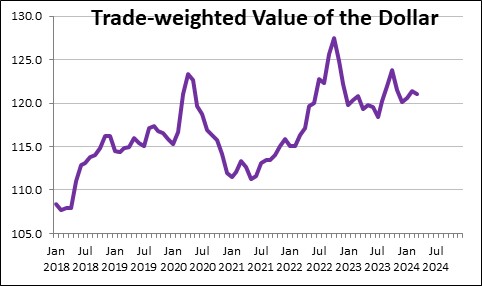

The trade gap widened in the first quarter and net exports subtracted 0.8% from GDP growth.

But the trade-weighted value of the dollar has not risen much since the end of last year, so we suspect that the impressive widening of net exports in the first quarter and the corresponding drag on GDP growth is unlikely to continue in the months and quarters ahead.

Putting all these components together suggests that GDP will expand at a 2.0-2.5% pace for the final three quarters of the year.

The larger-than-expected increase in the core personal consumption expenditure deflator is more troublesome. There were upward revisions to the January and February data as well as a sizeable increase in March. Thus, the core PCE rose 3.7% in the first quarter compared to growth rates of 2.0% in both the third and fourth quarters. But just be aware that the PCE deflator reflects changes in consumer spending patterns as well as actual changes in prices.

For that reason we find that the core CPI is easier to predict. The core CPI has risen 3.8% in the past year. We expect it to increase 3.0% for the year as a whole. Still slowing, but not quickly.

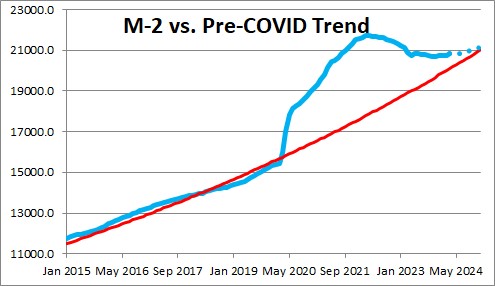

Our belief in a slow but steady drop in the inflation rate comes largely from the money supply and the Fed’s removal of considerable excess liquidity in the economy. Right now there is still about $0.8 trillion of surplus liquidity remaining (versus $4.0 trillion two years ago). If the Fed continues to shrink the money supply the remaining surplus liquidity should disappear during the summer and the inflation rate can resume its descent.

If the core CPI continues to slide from 3.8% currently to 3.0% by yearend and is headed in the right direction, the core PCE deflator should rise about 0.5% slower than that or 2.5%. In that situation we believe there is still an opportunity for the Fed to cut rates in December and continue to reduce them slowly throughout 2025. Rate cuts are still on the horizon, but perhaps not as imminent as had been expected.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me