May 15, 2025

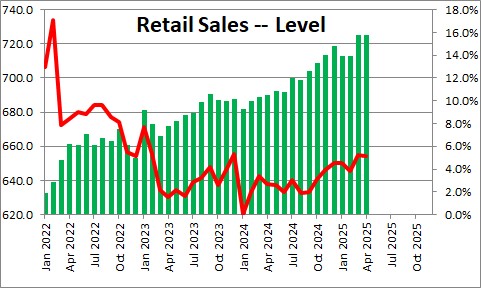

Retail sales rose 0.1% in April after having jumped 1.7% in March. In the past year retail sales have risen 5.2% Some of the dramatic increase in sales in March and continuing into April could be a rebound from the particularly cold/snowy weather that existed in much of the country in January and a snapback in car sales following the California wildfires in the same month. Some of the big jump in March may also represent consumers stocking up on goods prior to the implementation of tariffs. But at the same time restaurant sales jumped in March and April. You obviously cannot stock up on dining out. Our conclusion is that sales remain relatively solid. Despite being depressed, the consumer remains willing to spend.

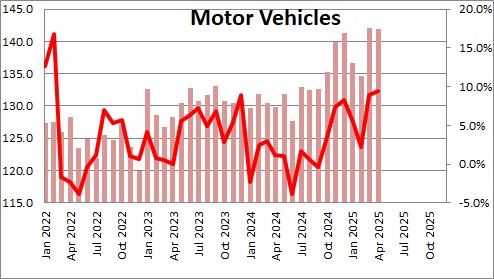

Motor vehicle sales declined 0.1% in April after having jumped 5.5% in March. Car sales have risen 9.4% in the past year.

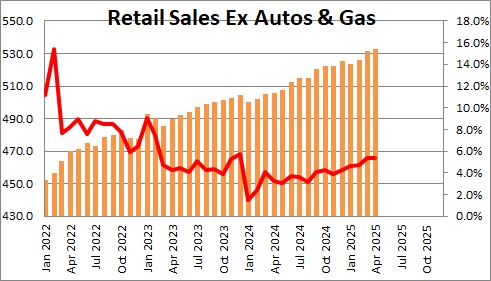

Retail sales ex autos and gas, which eliminates the two most volatile components and is a better gauge of the trend pace of sales rose 0.2% in April after having risen 0.5% February and 1.1% March. In the past year this so-called core spending pace has risen 5.4%.

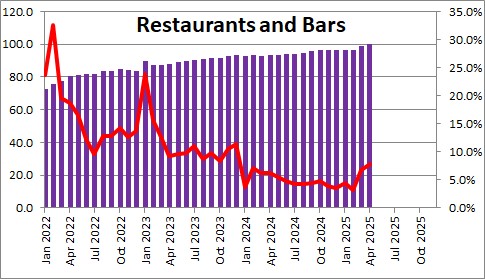

Restaurant sales rose 1.2% in April after having jumped 3.0% in March. In the past year restaurant sales have risen 7.8%. Consumers continue to dine out, and are showing no inclination to slow their pace of restaurant dining.

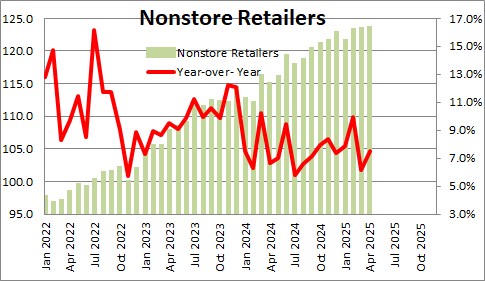

Sales at nonstore retailers rose 0.2% in April after gaining 0.1% in March. In the past year nonstore sales have risen 7.5%.

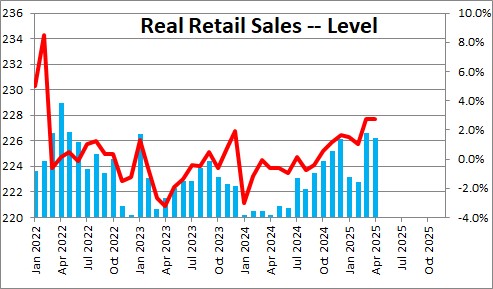

The combination of a 0.1% increase in sales with a 0.2% increase in the CPI caused real retail sales to decline 0.2% in April after having jumped 1.7% in March Real sales have risen 2.8% in the past year. It is hard to see any slowdown in the pace of consumer spending from the recent sales data.

Stephen Slifer

NumberNomics

Charleston, SC

Hi Steve,

How much of the $2T is going to large corporations vs small business?

Hi Brian,

There are tons of different pieces to that program. But it appears to me that the only “big business” that is getting money is the airline industry. Here are some of the highlights:

1. Every taxpayer receives $1,200 check. $500 extra per kid.

2. Unemployed workers get extgra $600/ week for up to 4 months. When couple with state benefits, some will be making more on unemployment than on their day job.

3. Hospitals get $100. Losing money because they are forced to postpone elective surgeries which is wher they make their money. I think they also get a bigger reimbursement from Social Security for treating COVID19 patients.

4. Airlines get $29 billion in grants, $29 billion in loans.

5. Small businesses get tax credit if they keep workers on the payroll.

6. State and local governments get $150 billion. They are losing sales tax and corporate profits + they have expenses involved with the corona virus like police, fire, EMT.

7. Defense Dept. gets $10.5 billion for deploying National Guard to distribute medical supplies, food, etc.

8 Employers get to defer the 6.25% payroll tax which is their portion of funding Social Security.

9. Payments in there for telemedicine, food stamps, farmers.

A little something for everybody.

Steve

Hello Steve,

I pray for a weak covid episode and a quick recovery!

I had some time to kill yesterday before a dentist appointment so I went by an outdoor store in North Charleston and Tanger mall. In both cases, I could’ve rolled the bowling ball down the aisles and never hit a person. This was around 11 o’clock in the morning yesterday not a very good gauge on retail activity, but still these are gathering points for customers. My guess is a lot of the Retail sales growth is online sales.

Hi Neil,

Mary and I went to the Tanger outlet in Bluffton a few weeks ago. It seemed fairly busy, but not like what it used to be a decade or so ago. And you are right that the bulk of recent sales are on-line. For example in March total retail sales rose $5.l billion of which $3.3 billion came from on-line sales. Thus two-thirds of the growth in sales came from on-line retailers which account for just 17.3% of total sales. For what it is worth, just prior to the recession (December 2019) on-line sales were 12.3% of the total. They have increased market share by about 1.0% per year in each of the past four years. Impressive.