October 17, 2024

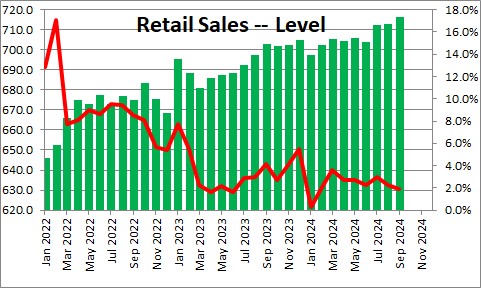

Retail sales rose 0.4% in September after gaining 0.1% in August and having jumped 1.2% in July. In the past year retail sales have risen 1.9%.

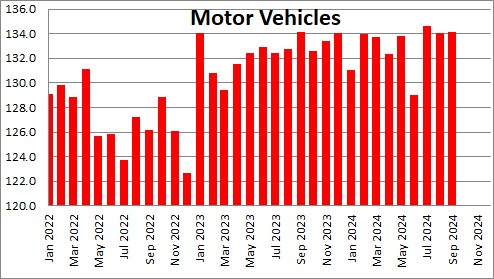

Motor vehicle sales were unchanged in September after having declined 0.4% in August but jumping 4.4% in July Car sales have been bouncing around in recent months which is not unusual. In the past year car sales have been unchanged.

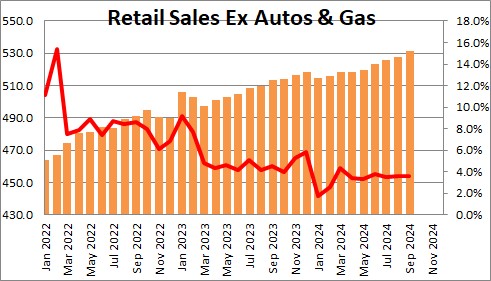

Retail sales ex autos and gas, which eliminates the two most volatile components and is a better gauge of the trend pace of sales, rose 0.7% in September after rising 0.3% in August after gaining 0.5% in July, In the past year this so-called core spending pace has risen 3.6%, but in the last three months it has climbed at a 6.2% pace. While everybody thinks the pace of consumer spending should slow as higher inflation and falling real income finally begins to take its toll, it is hard to see in the retail sales data..

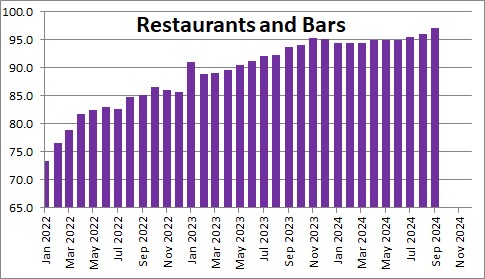

Restaurant sales rose 1.0% in September after climbing 0.5% in August and 0.6% in July. In the past year restaurant sales have risen 3.7%. But in the past 3 months restaurant sales have quickened to an 8.6% pace. Diners seem unphased and are happily going out to eat.

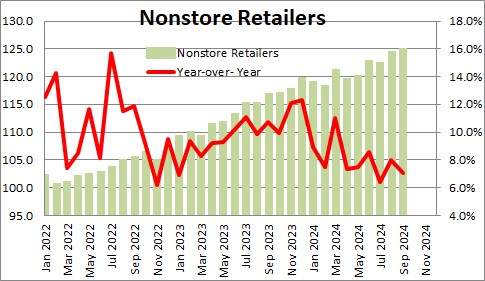

Sales at nonstore retailers rose 1.4% in September after having jumped 1.6% in August after having declined 0.3% in July. In the past year nonstore sales have risen 7.0%. In the past three months the pace of sales has been 6.9%. Consumers continue to shop online.

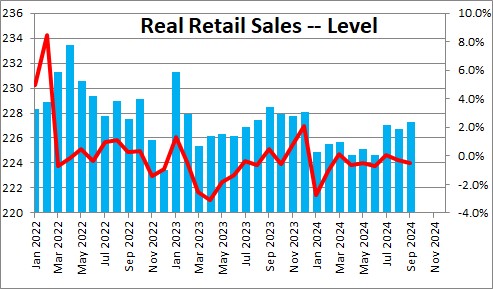

The problem is that inflation was rising more quickly than sales and, as a result, real retail sales had been declining in real terms. Our income had been rising and we kept spending, but the amount of goods and services we were able to purchase with our fatter paycheck was somewhat less than it was a year ago. Real retail sales rose 0.3% in September after having declined 0.1% in August after having jumped 1.1% in July. Real sales have declined 0.5% in the past year. But they have quickened to a 4.7% pace in the past three months as the negative impact from inflation boosts the real increase in sales.

GDP is expected to slow in the months ahead because consumers are running up their credit card bills in an effort to maintain their style of living. Unfortunately, credit cards are a very expensive way to add debt. At some point consumer spending should slow. but it is hard to see in the data available thus far. We expect 2.5% GDP growth in both the third and fourth quarters.

Stephen Slifer

NumberNomics

Charleston, SC

Hi Steve,

How much of the $2T is going to large corporations vs small business?

Hi Brian,

There are tons of different pieces to that program. But it appears to me that the only “big business” that is getting money is the airline industry. Here are some of the highlights:

1. Every taxpayer receives $1,200 check. $500 extra per kid.

2. Unemployed workers get extgra $600/ week for up to 4 months. When couple with state benefits, some will be making more on unemployment than on their day job.

3. Hospitals get $100. Losing money because they are forced to postpone elective surgeries which is wher they make their money. I think they also get a bigger reimbursement from Social Security for treating COVID19 patients.

4. Airlines get $29 billion in grants, $29 billion in loans.

5. Small businesses get tax credit if they keep workers on the payroll.

6. State and local governments get $150 billion. They are losing sales tax and corporate profits + they have expenses involved with the corona virus like police, fire, EMT.

7. Defense Dept. gets $10.5 billion for deploying National Guard to distribute medical supplies, food, etc.

8 Employers get to defer the 6.25% payroll tax which is their portion of funding Social Security.

9. Payments in there for telemedicine, food stamps, farmers.

A little something for everybody.

Steve

Hello Steve,

I pray for a weak covid episode and a quick recovery!

I had some time to kill yesterday before a dentist appointment so I went by an outdoor store in North Charleston and Tanger mall. In both cases, I could’ve rolled the bowling ball down the aisles and never hit a person. This was around 11 o’clock in the morning yesterday not a very good gauge on retail activity, but still these are gathering points for customers. My guess is a lot of the Retail sales growth is online sales.

Hi Neil,

Mary and I went to the Tanger outlet in Bluffton a few weeks ago. It seemed fairly busy, but not like what it used to be a decade or so ago. And you are right that the bulk of recent sales are on-line. For example in March total retail sales rose $5.l billion of which $3.3 billion came from on-line sales. Thus two-thirds of the growth in sales came from on-line retailers which account for just 17.3% of total sales. For what it is worth, just prior to the recession (December 2019) on-line sales were 12.3% of the total. They have increased market share by about 1.0% per year in each of the past four years. Impressive.