February 23, 2024

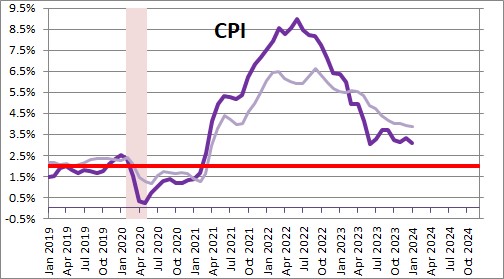

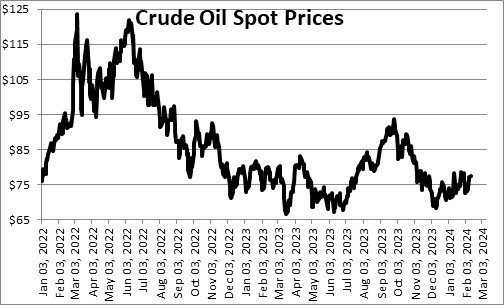

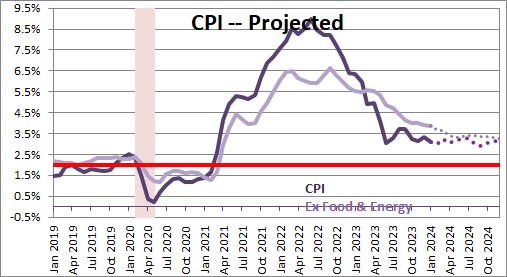

After peaking at 9.0% in mid-2022 the CPI inflation rate has fallen rapidly to 3.1%. A significant portion of this faster-then-expected slowdown has been attributable to falling oil prices. A couple of factors combined to make that happen. First, the outbreak of war between Ukraine and Russia boosted oil prices to $120 per barrel which provided an enormous incentive for U.S. oil producers to increase production. At the same time the U.S. dipped into the Strategic Petroleum Reserve which injected even more oil into the market and further reduced prices. But at $78 per barrel currently oil prices have fallen enough to eliminate the incentive for any further increase in production, And the Strategic Petroleum Reserve has declined to a level last seen in 1983. The country would be ill-advised to dip into it further. Hence, two of the tailwinds that lowered oil prices have disappeared. As a result, oil prices are likely to rise from $78 per barrel currently to $88 per barrel by yearend. But this should neither prevent the core inflation rate from continuing its downtrend, nor prevent the Fed from beginning a series of rate cuts sometime during the summer. What it will do is ensure that the rate cuts proceed at an orderly pace for the next couple of years.

When Russia invaded Ukraine in February 2022 oil prices spiked from $75 per barrel at the end of 2021 to $120 by the spring of 2022.

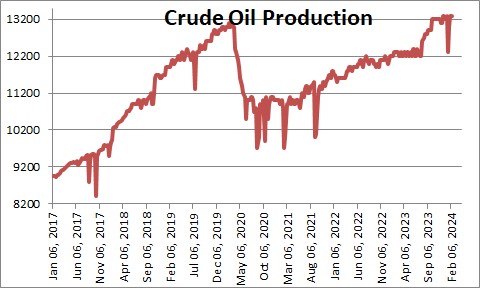

The higher prices encouraged U.S. oil producers to re-open previously drilled wells. As a result, production climbed from 12.3 million barrels per day to 13.3 mbpd in a matter of months. The additional supply of domestically produced oil initiated the price drop.

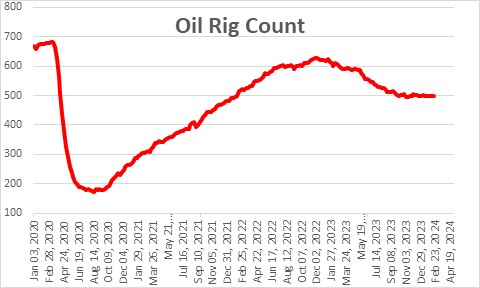

Surprisingly, oil companies were able to boost output without drilling new wells. In fact, the number of rigs in production declined from 600 at the end of 2022 to 500 currently.

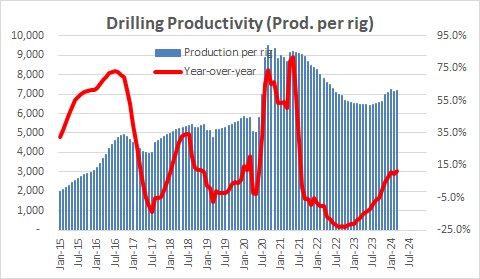

The only way output can increase with a reduced number of wells is with an increase in productivity. As shown below, output per rig has been steadily rising and is now about 10% higher than it was at this time last year.

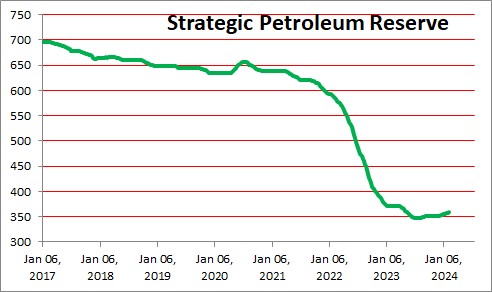

At the same time President Biden chose to dip into the rainy day supply of oil known as the Strategic Petroleum Reserve. The SPR was established in 1975 to mitigate supply disruptions resulting from a war or natural catastrophe. The additional supply of oil from this source contributed to the rapid decline in oil prices. However, the SPR has fallen to 360 million barrels which is the lowest level since 1983. Dipping into it further would, in our opinion, be both ill-advised and dangerous.

The Department of Energy expects U.S. oil production to remain at roughly its current level of 13.3 million barrels per day through the end of this year. At the same time the SPR is expected to be unchanged at its current level for the foreseeable future. Without the steady addition to the supply of oil from those two sources, it is likely that oil prices will climb from $78 per barrel currently to $88 by the end of the year. The tailwind to falling oil prices has disappeared.

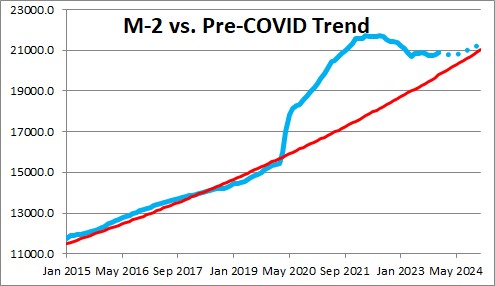

With higher oil prices we expect the overall CPI to be steady at 3.1% in 2024. But the so-called “core” rate of inflation, which excludes both food and energy prices, should slow from 3.9% currently to 3.0% by yearend. Why? Because the $4.0 trillion of surplus liquidity provided by massive Fed purchases of U.S. government and mortgage-backed securities in 2020 and 2021 has largely disappeared and should be completely eliminated by spring. By bringing the supply of liquidity into close alignment with the needs of the economy, the core inflation rate should continue its slide.

As long as the economy expands at roughly a 2.0% pace and the core inflation rate continues its descent, the Fed should be able to initiate a series of funds rate cuts during the summer. Rising oil prices will not prevent the Fed from beginning this process, but it will ensure that the Fed proceeds at a relatively slow pace. That is not a bad thing. If the Fed can begin to lower rates this summer and slowly but steadily continue that process through the end of 2026, the current business cycle will endure for years to come.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me