August 10, 2018

There seems to be an emerging consensus that the combination of tax cuts passed last year, and Trump’s deregulation initiative might boost investment spending and GDP growth for an extended period. That has been our position since the tax cuts were adopted and we are happy to see others shift into our camp. A protracted period of robust business investment will boost the economy’s potential growth rate which has already begun to climb.

Potential GDP growth can be estimated by adding the growth rate in the labor force to the growth rate in productivity. It is a measure of how quickly the economy can grow when it is at full employment.

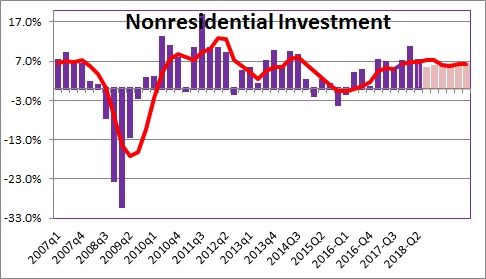

From 2014 through 2016, investment spending slumped as the combination of a high corporate tax rate and a stifling regulatory environment choked off any desire by businesses to invest. But in the wake of the November 2016 election, the expectation of a lower corporate tax rate and deregulation lifted investment spending out of its slump. After three years of essentially no growth, nonresidential investment has surged to a 7.0% pace. It has been growing steadily at that rate for the past six quarters and is showing no sign of slowing down. Why? In an extremely tight labor market where skilled workers are in short supply, what do you as a business person do? You boost investment spending. You spend money on technology to help boost output to satisfy the elevated demand. Meanwhile, the surging U.S. stock market is attracting additional investment from overseas. Foreign firms are starting new businesses and hiring American workers. We anticipate 7.0% growth in investment spending to continue for the foreseeable future.

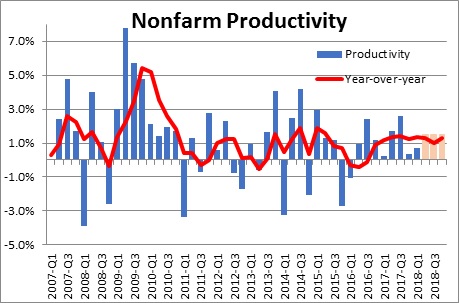

As investment spending surges it should be no surprise that productivity growth is picking up as well. If firms give their workers better technology and additional capital to do their jobs, they will produce more goods and services. The year-over-year increases in productivity have risen from essentially no growth a couple of years ago to steady gains of 1.3% since the beginning of last year. If investment spending continues to climb productivity growth will remain robust.

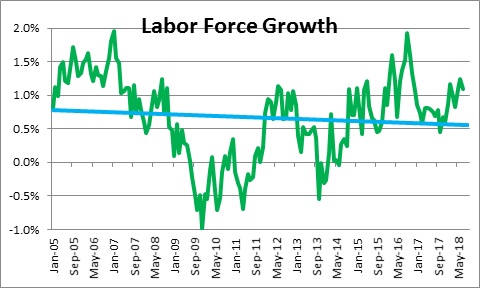

So, what does all this mean for the economy’s potential growth rate? It is climbing. Prior to the 2016 election potential growth was widely estimated to be 1.8% which consisted of 0.8% growth in the labor force plus 1.0% growth in productivity. We believe that with a faster pace of investment spending productivity growth will eventually climb from 1.0% to 2.0%, which when combined with 0.8% growth in labor force, should boost potential growth to 2.8% by the end of the decade. So how are we doing?

The labor force part of the equation seems to be picking up. After rising at an 0.8% rate for an extended period, labor force growth has quickened to 1.1% since the beginning of this year. Why? Faster growth in the economy has almost certainly encouraged some discouraged workers to re-join the labor force, and with enhanced opportunities from specific job-oriented programs offered by many technical colleges, and apprenticeship programs at a wide variety of manufacturing firms, those new labor force entrants have found jobs. As new educational opportunities continue to expand, it is not unreasonable to expect labor force growth of 1.1% to continue for several years.

Productivity growth has averaged 1.3% for the past two years. Given that we have already seen labor force growth pick up to 1.1% and productivity climb to 1.3%, potential GDP growth may have already picked up from 1.8% a couple of years ago to 2.4%.

Having said that, potential growth is a longer-term concept and what we have been talking about thus far is relatively short-term improvement. But the upswing in both labor force growth and productivity clearly suggest that potential growth is on the rise. At this juncture we have no reason to alter our view that potential growth will pick up to 2.8% by the end of this decade consisting of 1.0% growth in the labor force and 1.8% growth in productivity. It appears that we are already well on the way.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me