April 30, 2010

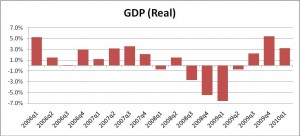

This morning the Commerce Department released first quarter GDP growth of 3.2% which was about as advertised. That compares to a 5.6% pace in the final quarter of 2009. While those figures are accurate, they tend to overstate the actual pace of economic activity.

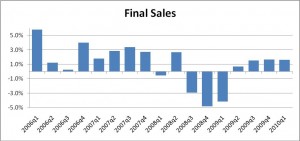

In the world of GDP accounting, inventory swings can exaggerate the changes in both directions. Remember that GDP is supposed to measure production. But what the Commerce Department collects are sales data. The two are different. Here’s a quick example. If G.E. produces 100 refrigerators, but sells only 90, 10 of them obviously end up in inventory. Commerce will include in GDP the value of the 90 refrigerators that were sold. But to arrive at the correct figure of 100 refrigerators produced, they need to add the value of the remaining 10 that are still unsold. And they do that. So when we see a GDP growth rate of 3.2% for the first quarter, that is an accurate assessment of production. But wait a minute! If firms keep producing refrigerators and they just sit in somebody’s warehouse, that published growth rate is overstating the true strength of the economy. So what most economists do is focus on GDP excluding the change in inventories. That figure is known as “final sales”.

So back to this morning’s data. Final sales growth in the fourth quarter was much slower than GDP growth, at a 1.6% rate versus an equally modest 1.7% pace in Q4. Those growth rates hardly seem consistent with the notion of a vigorous recovery. In the first year of expansion, growth is typically in a range from 4.0-5.0%. Thus, the economy continues to grow and heal itself, but the progress is exceedingly slow and painful.

Also this morning we learned that inflation in the first quarter remained subdued at 1.7% compared to a 2.0% rate in the previous quarter. Further a portion of that inflation was caused by rising prices of gasoline. The so-called “core” rate of inflation – or the overall index excluding the volatile food and energy categories, came in at an even lower 1.1% pace in Q1 versus 1.5% late last year. Any way you slice it, the inflation rate seems very much in control. That result is not at all surprising.

Given the slack in the labor market, with the unemployment rate at a very high level of 9.7% and 15 million workers out of work, there has been downward pressure on wages in recent quarters. This is an important factor in determining inflation because labor costs represent about two-thirds of the price of a product. If they continue to rise slowly, inflation will remain under control. It should be noted that the Bureau of Labor Statistics reported this morning that labor costs in the first quarter climbed at an annual rate of 2.5%. As shown in the chart below, that was somewhat faster than wage gains reported in other previous quarters but, given the slack in the labor market, it is hard to imagine that it represents the beginning of a new trend. Nevertheless, we should stay tuned.

If you are the Fed how do you feel about now? They met earlier this week on Tuesday and Wednesday, and almost certainly had in hand an early version of the GDP statistiscs. Knowing that the economy is still growing at a modest rate (as evidenced by the final sales data), recognizing that inflation remains very much in check (i.e., gross domestic purchases deflator), and aware that wage pressures are showing no clear sign of accelerating, the Fed obviously felt comfortable leaving its current directive in place. They released the following:

“The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period.”

Before they ever think of tightening, they will first start to soften that statement. The next FOMC meeting – and hence their next opportunity to change that wording — is on June 22. Once they do change the wording a tightening move is probably still six months away. Thus, the chances of a Fed tightening move by yearend get smaller and smaller.

Follow Me