April 1, 2022

The March employment report indicates that the economy continued to expand at a moderate pace in March. GDP growth in the first quarter was hit early by COVID difficulties and later by the outbreak of war. But yet jobs climbed by 431 thousand in March and rose, on average, 562 thousand per month throughout the first quarter. The unemployment rate fell 0.2% in March to 3.6%. Economists thought that the pace of economic activity would slow in 2022 as the various stimulus packages came to an end. But month after month the long-awaited slowdown gets pushed farther into the future. The aggregate hours index (which is essentially payroll employment multiplied by the nonfarm workweek) rose 4.7% in the first quarter. Presumably, business people have been able to find enough workers and work them long enough hours to produce an impressive amount of goods and services. We are officially expecting 2.5% GDP growth in the first quarter but believe the risk is for a larger-then-expected increase. The downside of still robust GDP growth is that the inflation situation is not improving at all. The monthly purchasing managers’ price index of commodity prices surged in March and is close to a record high level. The 3.6% unemployment rate is pushing wages higher, but they continue to decline in real terms which is encouraging workers to seek even bigger gains. And the rental housing market is the tightest it has been in 40 years which will cause rents to continue to climb. All of that suggests that the pace of tightening proposed by the Fed just a couple of weeks ago will be woefully inadequate. It needs to generate positive real rates of interest but that does not seem to be in the cards any time soon.

We keep hearing about how difficult it is for firms to find workers, but yet employment continues to climb at a brisk pace. Payroll employment rose by a steamy 562 thousand per month in the first quarter. Civilian employment, which includes self-employed workers, rose on average by an even more impressive 828 thousand per month. Nothing in these data suggest the pace of economic activity is moderating. We might see a GDP increase of 2.5% or so in the first quarter, but only because the pace of inventory accumulation will be slower in the first quarter than the fourth, and because supply constraints of both materials and labor are limiting the rate of growth. Final sales, which is a better barometer of spending, is expected to climb at a robust 4.3% pace in the first quarter.

As growth continues to surprise on the upside the inflation situation is certainly not improving. The purchasing managers price index surged in March to a near record-high level. Price pressures on commodities had shown some sign of abating in the final few months of last year. But the war has pushed prices higher for virtually everything. It is not just oil.

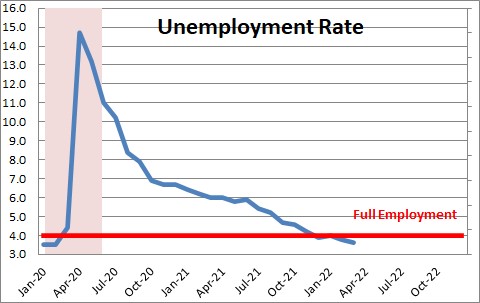

At the same time the unemployment rate keeps falling rapidly. In March 2021 it stood at 6.0%. Today it is at 3.6%. This means that it has declined on average 0.2% per month for the past year. Once the unemployment rate crossed the 4.0% full employment threshold one might have thought that the pace of decline would slow. It has not..

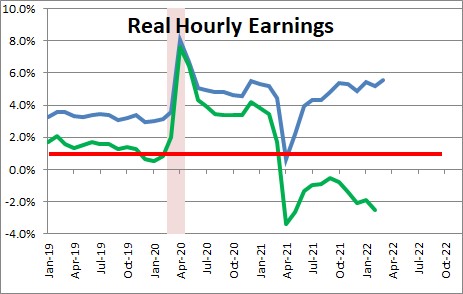

As the number of unemployed bodies continues to shrink, firms will have to work even harder to find the workers they need. This means that workers are in the drivers seat and are able to dictate the terms of their employment. As a result, hourly wages are on the rise. They have risen 5.6% in the past year. As impressive as those wage hikes appear to be in nominal terms inflation has risen even faster and, as a result, real earnings in the past year have fallen 2.5%, This will boost the incentive for workers in all industries to push hard for even bigger wage gains in the months ahead. A wage/price spiral is well underway.

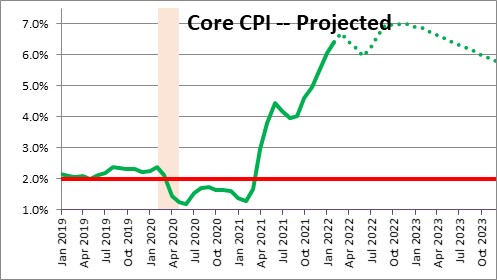

As a result, the inflation outlook does not look pretty. The core CPI has climbed from 1.6% in 2020 to 5.5% last year, and it now stands at 6.4%. By the end of the year we believe it will have accelerated to the 7.0% mark.

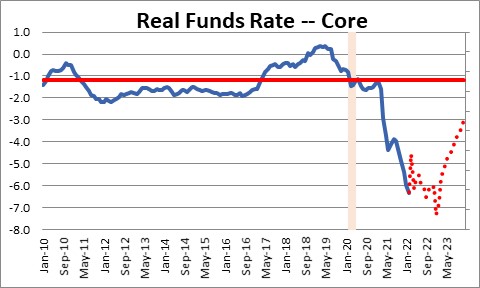

If that is the case, the path towards higher rates that the Fed described just two weeks ago will not even come close to slowing the pace of economic activity. If the funds rate at yearend stands at 1.75% but the core CPI is 7.0%, the real funds rate would be negative by 5.25%. At some point the Fed is going to have to get serious about fighting inflation. It talks a good story, but its proposed course of action is not in the ballpark with what is required. With a mid-term election coming in November it is inconceivable to us that the Fed would choose to pursue aggressive rate hikes between now and then. Once it does become serious about fighting inflation and plans to sharply boost rates, then we have to worry about the Fed overdoing it and potentially dumping the economy into a recession. This is not that time.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me