May 13, 2025

.

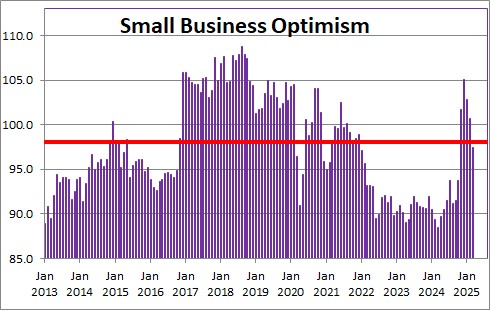

Small business optimism fell 1.6 points in April to 95.8 after having declined 3.3 points in March to 97.4 after falling 2.1 points in February to 100.7 after having declined 2.3 points in January. The media focus seems to be on the fact that the index has declined in each of the past four months. That is true, But the index level also remains close to the 40-year average so-called breakeven point for this series which is 98.0. Note also that small business optimism was below that breakeven level for the previous three years and yet the economy performed well.

NFIB Chief Economist William Dunkelberg said, “Uncertainty continues to be a major impediment for small business owners in operating their business in April, affecting everything from hiring plans to investment decisions, While owners are still trying to fill a high number of current job openings, their outlook on business conditions is less supportive of future business investments” Fourteen percent of owners reported that inflation was their single most important problem in operation this business.

Following a 0.3% decline in GDP in the first quarter we expect to see 2.5% GDP growth in the second quarter and 1.9% GDP growth in 2025. . The economy still seems to be growing at respectable pace despite the policy gyrations coming out of Washington.

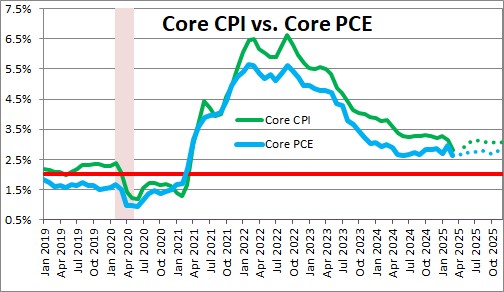

The core CPI is expected to rise 3.1% by yearend which means that the core personal consumption expenditures deflator should rise about 2.8% in 2025. This is the inflation measure that the Fed targets at 2.0%.

The funds rate currently is 4.3%. The so-called “neutral” funds rate used to be about 2.8% but it now appears to be higher, perhaps around the 3.5% mark. Thus, Fed policy remains slightly restrictive. But the Fed has two problems if it chooses to ease. First, GDP growth has yet to slow significantly. Most economists are concerned that a slowdown will occur in the months ahead. But Trump seems to be changing his trade positions and much of the stock market drop has been quickly reversed. At the same time the core inflation rate is quickening, not edging closer to the desired 2.0% target. Misguided Fed policy is not the source of the problem. Trump’s trade policies are. The solution to the problem will come from Trump, not the Federal Reserve.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me