October 8, 2024

.

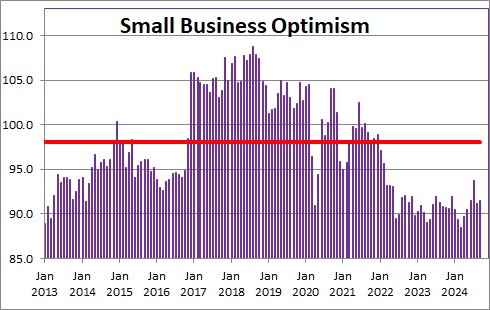

Small business optimism rose 0.3 point in September to 91.5 after declining 2.5 points in August. The level is well below the 40-year average so-called breakeven point for this series which is 98.0.

NFIB Chief Economist William Dunkelberg said, “Small business owners are feeling more uncertain than ever. Uncertainty makes owners hesitant to invest in capital spending and inventory, especially as inflation and financing costs continue to put pressure on their bottom lines. Although some hope lies ahead in the holiday sales season, many Main Street owners are left questioning whether future business conditions will improve.”

We expect to see GDP growth of 2.0% in the third quarter of this year followed by 2.5% growth in the fourth quarter. However, the GDP forecast includes a slower pace of inventory accumulation. Final sales, which excludes the change in business inventories, is expected to grow at 2.8% and 2.6% in those two quarters. Thus, the economy still seems to be growing at respectable pace with no hint of a recession in sight.

The core CPI is expected to slow to 3.0% by yearend which is still well above the Fed’s 2.0% target pace. It should continue to moderate to 2.5% by the end of 2025. The Fed does not expect the core rate of inflation to return to 2.0% until 2026. The Fed will continue to lower rates gradually through the end of next year.

With GDP growth continuing at a respectable pacem inflation very gradually slowing, and the Fed having begun to reduce interest rates, it is surprising that small business owners are as pessimistic as they are. Our sense is that they are overly worried.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me