August 5, 2016

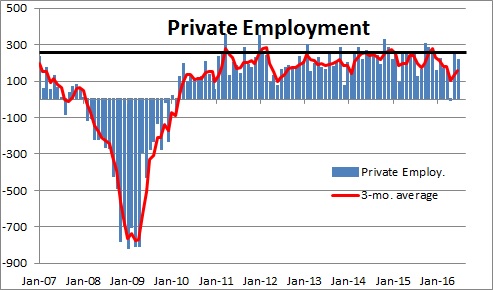

In the wake of a surprisingly small 1.2% increase in second quarter GDP, payroll employment rose a reassuring 255 thousand in July on top of a 292 thousand increase in June. While employment has expanded rapidly in the past two months and third quarter GDP may be 3.5%, the trend rate of growth in the economy continues to chug along at about 2.0%. We can do better.

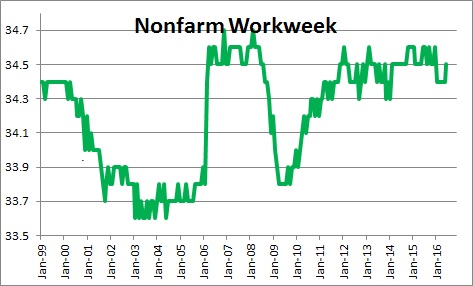

Every month employers have a choice of hiring more workers or working existing employees longer hours. In addition to hiring 255 thousand workers in July firms extended the workweek by 0.1 hour. That represents a gain of 0.3% which has the equivalent impact of an additional 419 thousand jobs. The effect on the economy is the same as if employers had hired 674 thousand new workers in July with no increase in the workweek. Those back-to-back gains create an impression that the economy is on a roll. It is not.

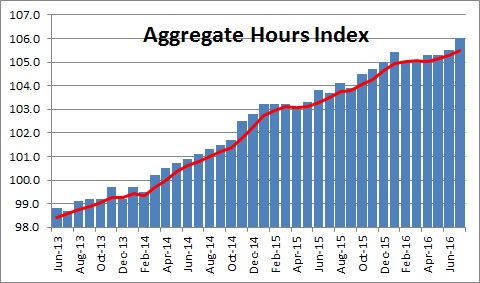

If one knows how many people are working and how many hours they were on the job, we can make an educated guess about how many goods they produced. The combination of employment and hours worked is captured in something called the aggregate hours index. It is essentially a monthly proxy for GDP. This index rose sharply in July and based on this index GDP seems likely to surge by 3.5% in the third quarter.

But make no mistake, 3.5% GDP growth in the third quarter is no more representative of the trend than the 0.8% and 1.2% growth rates reported in the first two quarters of the year. We continue to believe that the economy is chugging along at a 2.0% pace which is roughly in line with its speed limit. In the 1990’s that speed limit was about 3.5%. The drop-off from 3.5% to 2.0% reflects the combination of far slower growth in the labor force as the baby boomers retire, and almost three years of virtually no growth in productivity. The economy simply cannot grow as quickly today as it once did.

But that does not have to be the case forever. There are two ways to boost the speed limit.

- Immigration. Baby boomers will be retiring for another 15 years which will act as a steady brake on growth in the labor force. But with the economy at full employment many industries already are unable to find an adequate supply of workers. Farmers cannot find enough workers to harvest their crops. Builders cannot produce new homes fast enough to keep pace with demand. The hospitality industry cannot find enough workers to adequately staff a new restaurant or hotel. Immigration has been a hot button in Washington for years and continues to be so in the upcoming election. A responsible immigration solution would boost the rate of growth of the labor force and raise our economic speed limit. Building a wall between the U.S. and Mexico is not the answer.

- Tax code overall and regulatory relief. The one piece missing from the current expansion is investment spending which is what produces growth in productivity. Consumers continue to spend freely; businesses do not. Why should they if they cannot be certain how much tax they will owe next year and in the years beyond or what current exemptions might be disallowed? Why should they if they have no idea what their health care costs are likely to be in the years ahead? Not only that, businesses large and small are swamped by an avalanche of confusing and often conflicting regulations.

We would enthusiastically support any simplification of the tax code. For both individuals and corporations broaden the base, and lower the rate. With respect to businesses in particular, cut the corporate tax rate from 39% to 20%. Allow companies to repatriate overseas earnings to the U.S. without penalty.

With respect to health care, give up on the notion of abandoning Obamacare despite its obvious flaws. Businesses have no idea what their health care costs will be in the years ahead if there is the possibility of a wholesale revamping of the industry Similarly, give up on the notion of a dramatic expansion of health care benefits. Consumers and businesses cannot afford what we have at the moment.

If our future leaders can bolster business confidence, firms are more likely to put some of their ample cash to work which would stimulate investment and boost the current anemic pace of productivity growth.

The bottom line is that the economy continues to chug along at about a 2.0% trend rate despite dramatic swings in growth in the first three quarters of the year. Responsible economic policy could boost that speed limit.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me