August 1, 2010

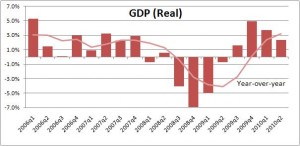

Second quarter GDP growth came in at 2.4% which was somewhat less than anticipated. At the same time, first quarter growth was revised upward by about a percentage point to 3.7%. This means that during this first year of expansion the economy has grown at a lackluster 3.2% rate. Typically in the first year of expansion the economy will climb by 5.0-6.0%. Thus, the economy continues to expand, but at a moderate pace.

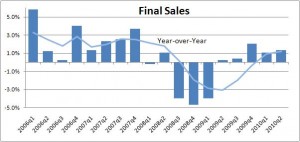

Much of the expansion over the course of the past year has reflected inventory restocking by businesses. Indeed, this intentional inventory buildup has accounted for 2.0% of the 3.2% growth reported. Thus, final sales — which stripsout the change in inventories — has grown at a significantly more subdued 1.2% pace in these first four quarters of recovery. Because inventory rebuilding appears to have slowed in the second quarter, some economists are worried about slower GDP growth in the second half of this year and many have revised downward their GDP projections. Is this a legitimate concern? Probably not for a couple of reasons.

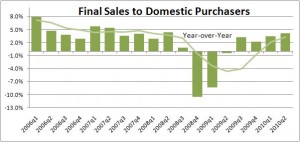

First, it is important to remember that final sales measure sales of U.S. goods. Some of them are bought by foreigners (exports). At the same time some goods purchased by U.S. consumers are purchased overseas (imports). If we were to strip out both exports and imports from the final sales data, we could determine sales to domestic purchasers. That series looks quite different.

In the second quarter, sales to domestic purchasers grew at a relatively robust 4.4% pace, and over the last year at a 3.3% clip. What this means is that American consumers and businesses have been purchasing goods and services at an acceptable – and perhaps even accelerating — pace, but a considerable portion of those products are manufactured elsewhere. It is hard to square this willingness of consumers and corporations to purchase products with an economy that is — in the view of many economists — on the verge of a significant slowdown.

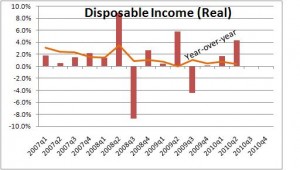

Second, consumer spending represents about two-thirds of GDP. Thus, it is likely that – as always – the outlook for GDP growth going forward is going to be determined largely by the consumer’s willingness to spend. Consumer spending thus far in the expansion has been moderate — 1.6% for the second quarter, and 1.6% for the first four quarters of expansion as well. However, real disposable income has accelerated to 1.7% in Q1 and 4.4% in Q2. And now that the economy has shifted from significant job losses to at least a moderate amount of job creation, disposable income is likely to keep growing, which should provide the fuel for a somewhat faster pace of consumer spending in the months ahead

In the second quarter the gain in disposable income helped push the savings rate to 6.2%. It has been relatively steady in a range from 5.0-6.0% since the middle of 2008. Thus, the consumer seems to be happy with a savings rate in this range. If that is true, then in the months ahead if disposable income grows by 2.0-3.0%, then consumption spending should grow at roughly that same pace. That would leave the savings rate at its current level of about 6.0%. As noted earlier, consumption spending in the past year has risen at a 1.6% rate, so a quickening to 2.0-3.0% would almost certainly ensure that GDP growth does not slow down between now and yearend.

Please do not misunderstand, we are not trying to argue that GDP growth going forward is going to accelerate or be robust in any sense of the word. Jobs creation may pick up somewhat, but will hardly be steamy. Consumers and firms are still trying to pay down debt. And for those that want credit and have the lofty credit levels that banks desire, loans will still be difficult to attain. The economy continues to face significant headwinds. All we are trying to do is counter the notion that the economy is on the verge of a significant slowdown. In our opinion, that view is misplaced.

For what it is worth we anticipate second half GDP growth of 3.0-3.25%, which is roughly the same as what it has been.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me