November 13, 2020

Economists invariably cite a long laundry list of potential problems – the fiscal stimulus is wearing off, renewed shutdowns as the virus spreads more quickly, a delay in the development of a vaccine, an inability to distribute large quantities of it quickly, an unwillingness of the American public to accept it once it does become available. Those are certainly legitimate concerns. But economists are almost invariably too pessimistic and, in this case, underestimate the ability of American consumers and business leaders to adapt to adversity. For the past six months they have grossly underestimated the speed and magnitude of the rebound in GDP growth, and the speed and magnitude of the rebound in the stock market. They remain skeptical that a vaccine will be available by the end of this year. It is the usual wall of worry. We believe that they are seriously underestimating the degree of GDP strength in the fourth quarter of this year and 2021, and the speed with which the economy will regain full employment.

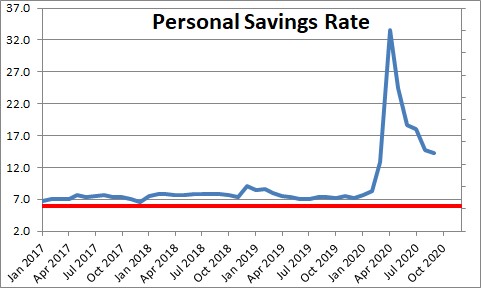

The fiscal stimulus checks were distributed in April and May. When Americans received those checks in the spring the savings rate soared to 33%. It has since declined to 14.3%. But it typically averages 6.0%. Thus, consumers have plenty of ammo to sustain their spending at a vibrant pace through the early part of next year.

The corona virus is spreading more rapidly and many worry that a widespread government-imposed shutdown is coming. We do not believe that is going to happen. The spring quarantine produced the deepest recession in our history. Twenty-two million people lost their jobs in a two-month period of time. GDP declined at a record shattering 31% annual rate. That policy may have been warranted in March when the economy and the stock market were in freefall, but that is not the case now. Re-imposing a nationwide quarantine today would be a disaster. It would produce a second recession within a year, send the unemployment rate soaring, and push the stock market over the edge. Worst of all, as we learned from the spring, it would only briefly curtail the spread of the virus. That is not the answer.

We fully expect and encourage some cities or states to shut those restaurants and bars that are not complying with mask-wearing and social-distancing requirements, and discourage large social gatherings. That action would likely have a relatively minor impact on the economy.

Keep in mind that one vaccine has been announced and more are coming. They will provide considerable economic stimulus by mid-year. As a result, we expect GDP growth of 5.5% in 2021. The consensus expects GDP growth of just 3.0%. We think their forecasts are too low.

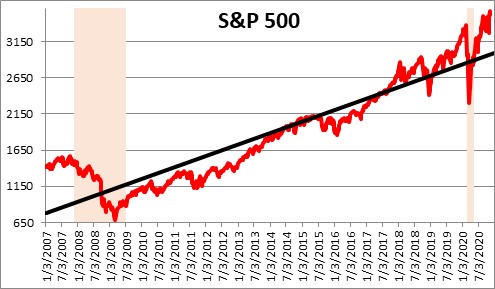

Once the fiscal stimulus was approved in March every economist has marveled at the speed and magnitude of the stock market rebound. Following the “Great Recession” in 2008-2009 the stock market took five years to regain its pre-recession level. In 2020 it took five months for that to occur.

Similarly, we have been struck by how pessimistic economists’ GDP forecasts have been. In June Fed economists expected GDP to decline 6.5% this year. In September they revised that to a drop of 3.7%. If we are right and GDP climbs 10.0% in the fourth quarter the drop for the year will be 1.1%. The economy has come roaring back faster than anyone expected. Following the 2008-2009 recession it took 3-1/2 years for GDP to return to its pre-recession level. If our fourth and first quarter GDP forecasts are correct, GDP will have re-achieved its pre-recession level in one year.

Even more important than how quickly GDP erases its recession losses is how quickly the economy returns to full employment. The economy lost 22 million jobs in March and April. In the past six months 12 million workers are back on the job, but 10 million workers remain unemployed. Furthermore, the impact of the job loss has been most severe on lower-wage workers in the service sector, women, blacks, and Hispanics. The goal should be to get these workers back to work as quickly as possible. As we see it, economists continue to be far too pessimistic about when the labor market might re-achieve full employment.

For example, in June the Fed thought the unemployment rate at the end of this year would be 9.3%. In September it lowered its estimate to 7.6%. The unemployment rate for October is already 6.9% and we expect it to be 5.9% by the end of this year. Nobody expected the unemployment rate to fall this quickly.

In mid-September, the Fed thought the unemployment rate would not drop to its 4.0% full employment threshold until the end of 2023. We expect it to reach 4.0% by September of next year. That is more than two years ahead of schedule. Having said that, September is still 10 months away.

How can we get the unemployment rate to fall faster? A vaccine. One is already in sight and other announcements are expected in coming weeks. Make sure the drug companies have whatever they need to expedite its production. Keep the pressure on the FDA to approve any vaccine that has a reasonable degree of safety. Have President Biden, every member of his cabinet, all governors, Dr. Fauci and their wives be the first in line for their shots to boost confidence in the drug’s safety. If consumer and business confidence surges the economy will do likewise, and the timetable for full employment will come even sooner.

The jobs will keep on coming. Full employment is not that far off. A sustainable recovery is on the horizon.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me