July 9, 2021

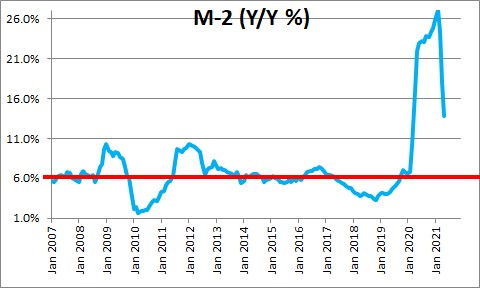

The Fed believes that the recent acceleration in inflation reflects temporary factors such as hiring bonuses, disruptions in the supply chain, and a rebound from prices that were depressed during the recession. That story is beginning to wear thin. Its forecasts of inflation have consistently undershot reality for the past year and they are not getting any better. It currently anticipates that its targeted inflation measure, the core personal consumption expenditures deflator, will rise 3.0% this year. Good luck with that! Inflation in the first five months of this year has been steadily accelerating and is showing no sign of slowing down. We expect the core PCE to rise 4.2% this year. The driver of this unanticipated pickup in inflation is money supply growth. Its growth rate has soared since the recession began in March of last year and, as Milton Friedman taught us back in the 1970’s, “Inflation is always and everywhere a monetary phenomenon.” When countries rapidly expand growth in their money supply, they experience high inflation for a sustained period of time. But yet our Fed Chairman dismisses that notion and tells us that we need to “unlearn” that relationship. We do not buy it.

The Fed’s inflation forecasts have been way off the mark since the recession started in March of last year. In June of last year it expected the core PCE deflator to rise 1.5% in 2021. They have raised it every quarter since. In September it became 1.7%. In December it was 1.8%. By March it climbed to 2.2%, and in June to 3.0%.. But even 3.0% is still too low. We know what happened to this inflation measure every month through May. They only way its 3.0% forecast for the year can be correct is if the core PCE rises 0.15% per month for the final seven months of the year. But in the first five months of the year the monthly increases averaged 0.43% or three times as fast as the Fed envisions for later this year.

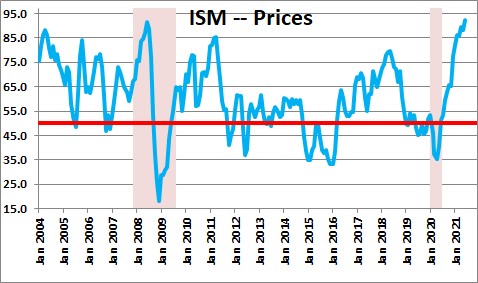

The price component of the monthly purchasing managers’ report has climbed to 92.1. An index of 50.0 indicates that prices were unchanged in that month. It has risen steadily since April of last year to its current level of 92.1 which is its highest level since 1979. Timothy Fiore, Chair of the Institute for Supply Management’s Business Survey Committee said: “Virtually all basic and intermediate manufacturing materials are experiencing price increases as a result of product scarcity and the dynamics of supply and demand, with an increasing number of panelists reporting higher prices compared to May.” No sign of any softening of prices for manufacturers through the middle of 2021. Ditto for service sector firms.

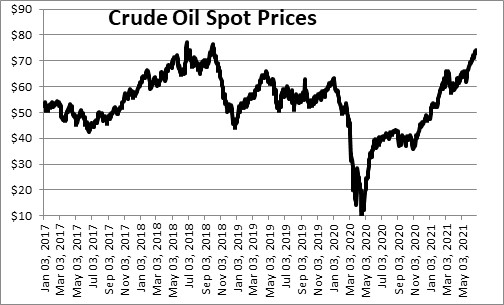

We can see this phenomenon in virtually all commodity prices. Crude prices have climbed to $75 per barrel. Gas prices have risen to $3.12 per gallon. These are the highest prices in several years.

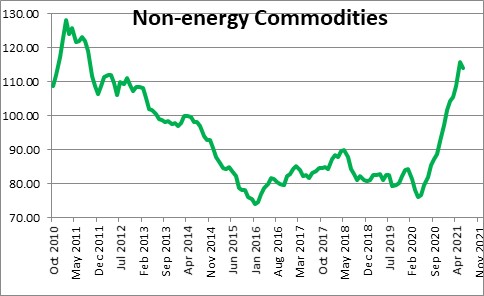

Non-energy prices have continued to surge through June and are their highest level in a decade.

At the same time the extreme labor shortage is forcing firms of all types – but particularly those firms in low-paying industries such as leisure/hospitality and retail to offer one-time sign-on bonuses and, in many cases, boost the hourly wage to or above $15 per hour. In the past year firms such as Target, Starbucks, Wayfair, Costco, Walmart, and McDonalds, have all boosted wages. Their CEO’s see the handwriting on the wall. Prior wage rates were too low. As these large firms raise their wages, smaller ones will follow. This is not a one-off event that will run its course in a matter of months. At a time when qualified willing workers are hard to come by, workers are exercising their newfound power and demanding both higher wages and improved working conditions. The pandemic and recession are triggering profound changes in the labor market which are still in their infancy.

Those firms who do raise wages say they are able to find the workers they need to keep pace with surging demand. With corporate earnings and stock prices at record high levels, firms generally are well-positioned to withstand higher wages.

All of this suggests that the inflation increases we are seeing are not going to be temporary. Yes, shortages of materials are contributing to the current run-up. Yes, a catch-up from prices that were depressed during the recession (like airfares and hotel room rates), is also factor. But we are convinced that a major cause of higher inflation is rapid growth in the money supply. After a surge in money growth in March, April, and May of last year, the Fed’s monthly purchases of U.S. Treasury securities are causing money growth to climb steadily at a 15% pace. But the trend rate of growth of the money supply historically has been about 6.0%. Faster money growth is going to result in faster inflation for some time to come. Eliminating further purchases of U.S. Treasury and mortgage-backed securities would help, but the Fed is not yet prepared to do so.

We believe that inflation will track much faster than the Fed would like at least through the end of this year. We anticipate a 4.2% increase in the core PCE deflator this year and a 5.0% gain is not out of the question. After missing its inflation forecast for a year and one-half, when will the Fed give up on its belief that the jump is temporary? The higher it climbs, the greater the pressure on the Fed to cut its purchases of Treasury securities, raise reserve requirements or, ultimately, raise the funds rate.

Meanwhile the current 10-year note yield of 1.3% combined with a 2.3% expected inflation rate over the next 10 years provides a negative 1.0% real rate of return. The Fed takes comfort from the fact that inflation expectations remain in check. But if we are right, a faster current rate of inflation will eventually boost the expected inflation rate. If that happens both nominal and real bond yields are headed higher.

Stephen Slifer

NumberNomics

Charleston, S.C.

Stephen, I have been wondering about the inflation rate. I understand that you think it will rise more than expected, but I am not a clear as to why this jump in inflation will be “permanent rather than temporary. I expect temporary to be somewhere between one and two years. Your analysis, which I treasure, sees it differently. I would appreciate an explanation on why you think it will remain higher.

Thank you.

Darrel

Stephen –

The real (inflation adjusted) 30 year bond rate has fallen from 0.2% to -0.3%

since mid-March, a very rapid decrease. Why has this happened, when everything

(nearly) is rising rapidly in price, as you point out. (Lumber is the exception – has

fallen back to near normal.)

Steve

You make a very convincing argument that the inflationary trend is not temporary and inconsequential. I am an investing pragmatist. How should this affect my stock-picking?

If the Fed responds to control inflation, it will raise interest rates. Banks become more profitable with rising interest rates and all capital investing is dampened when money becomes more expensive.

What more should I consider?

Bill Greene

Hi Darrel.

Your question is a hard one to answer. My projections currently extend out only to the end of 2022. I am beginning to think about 2023, but that is challenging because the president still has his infrastructure and American families plans working their way through Congress which will, I presume, provide further stimulus to the economy. I doubt they will be budget neutral in the first few years.

Re: my definition of temporary. If the Fed’s 3.0% core PCE forecast for the year is right, it means that particular inflation indicator must rise 0.15% every month from now through the end of the year (compared to a 0.43% monthly average increase in the first five months). So when Powell said there will be a “temporary” increase in inflation, the Fed’s forecasts suggest that the the end of the “temporary” boost is right now. For all the reasons I indicated — money supply growth, energy prices, non-energy commodity prices, upward pressure emerging on wages which should further boost prices, and purchasing managers indicating that supply shortages are likely to persist through the end of the year — I believe that the “temporary” factors are likely to persist through the end of the year.

Beyond the end of this year, I am bothered by the likely continuation of rapid growth in the money supply. The group at the Fed currently has no interest in what is happening to money. They never mention it at their press conferences other than having Powell tell us that we have to “unlearn” the relationship between money growth and inflation that we all learned in school. Tts current pace of purchases of U.S. government and mortgage-backed securities produce 15% growth in the money supply every month at an annual rate. Powell and his colleagues seem to have bought into modern monetary theory. IF so, in my opinion, that is a serious policy mistake. I would suggest that it halt all of those purchases immediately. But it is not going to do that. They are “discussing” it now which means they won’t even take a baby step until much later this year, and then they will almost slow its purchases gradually. It might take another year or more to eliminate them. They should keep money growth humming throughout 2023.

Meanwhile, GDP and the unemployment rate should be back at their full employment levels by about the end of this year. We expect GDP to grow 4.8% next year. The Fed looks for 3.3%. But if it is right that potential growth is 1.8% and the economy is back at full employment by the end of this year, both growth rates mean that demand will continue to exceed supply. That is a recipe that says the inflation rate should keep growing rapidly through 2022. I have little faith that this group at the Fed is going to take any action to slow the economy until sometime after the November 2022 election.

And if inflation keeps rising more rapidly than the Fed expects for another 1-1/2 years, on top of their persistent undershoot last year, don’t inflation expectations begin to rise during that period of time? Currently the market thinks the 10-year inflation rate will be 2.3%. If this year and next inflation averages 4.0% (4.5% this year and 3.4% in 2021), and the Fed is still generating rapid money growth and refuses to raise rates, don’t we think inflation will continue to climb?

For the Fed, I presume “temporary” factors boosting inflation should end immediately. To me, I think the temporary factors he is talking about will persist through the end of the year. But then a continuation of rapid money growth and letting the economy continue to run hot will make inflation run far higher than the Fed’s 2.0% target rate for as far as the eye can see. If inflation remains elevated for as far out as I am willing to look (the end of 2023?) that is permanent.

Does that help?

Best.

Steve

Hi Frank.

You are much more of a market guy than I am. I do not have a good answer for you other than to suggest that the financial markets have been flooded with liquidity via the governments series of fiscal stimulus bills. All that money is looking for a home. Most of it has gone into the stock market. Some of it seems to have headed to high-yield corporate bonds. And, I suspect, some of it has also found its way into the Treasury market. You mentioned a date of mid-March. Remember, that the last round of stimulus checks was mailed out at about that time. And don’t forget that the Fed continues to purchase $120 billion per month or $460 billion per quarter. Most of the government’s issuance is being gobbled up by the Fed.

Best.

Steve

Hi Bill,

If you buy into my world of 8.0% GDP growth this year, 4.8% in 2022, combined with a core inflation rate of 4.5% this year and 3.4% in 2022, the Fed is unlikely to raise rates between now and the end of next year. That is a dynamite scenario for stocks. Decent GDP growth (rapid growth in revenues), moderate inflation (which gives companies some pricing power), and a continuation of near-0% short-term interest rates, it is hard to write a more positive script for the stock market. The Fed will ultimately be forced to respond, but I doubt they take any action until after the November 2022 election. We’ll see, but this group at the Fed is going to have to be drug kicking and screaming to a higher-rate scenario.

Best.

Steve

I suppose one questions what will happen to the dollar if your scenario plays out!

Hi Tom,

I keep delaying my response to you because I am not sure what is going to happen to the dollar in the months ahead. Ordinarily, I would expect the grossly excessive government spending from what we have already seen, and the additional spending from the upcoming legislation, to weaken the dollar. But the U.S. growth has been outpacing the rest of the world and has been acting as a dollar magnet. At some point growth in Europe will accelerate which could shift some of the financial flows out of the U.S. Covid is making Asia a mess right now. Lots of crosscurrents. I typically have pretty strong views on most everything. But not re: the dollar.

Best.

Steve

Thanks Steve!