July 21, 2023

After a promising start at the beginning of the year, existing home sales have fallen steadily in recent months to the lowest level in years. On the surface it appears that the housing sector is experiencing serious difficulty. While it is true that higher mortgage rates have taken a toll, the bigger problem is a serious shortage of available housing. There is a near-record low level of homes available for realtors to sell. As a result, home prices are once again climbing. The extreme shortage of existing homes available is causing buyers to look at new homes which, at the moment, are in more abundant supply. The heightened demand for new homes has boosted builder confidence and they are trying to rapidly boost the pace of construction, but they are running into difficulties of their own. In addition to the shortage of single-family homes and condos for sale, there is also a shortage of properties for rent. The bottom line is that we need more housing and builders may not be able to keep pace with the demand. That implies higher home prices, higher rent, and higher inflation. The Fed’s path to a 2.0% inflation rate is littered with potholes.

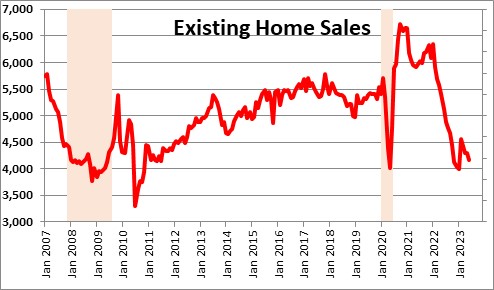

Existing home sales fell 3.3% in June to 4,160 thousand which is roughly the same as the low points reached during both the 2020 recession and the so-called “Great Recession” of 2008-2009. On the surface one might reasonably conclude that the demand for housing has plummeted. But be careful, that might not be the right conclusion.

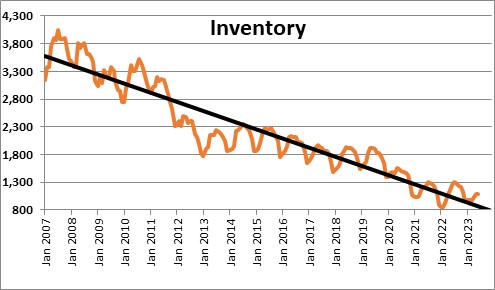

While existing home sales have plunged during the past year, the primary reason is a shortage of homes available for sale. In fact, there are currently 1,080 thousand homes available for sale. That is a near-record low level. Realtors obviously cannot sell what is not on the market. The reason for the shortage is that the current owners are unwilling to sell. They likely have a 3.0-3.5% mortgage rate and would have to trade that for a near-7.0% mortgage rate on their next property. Not an enticing situation. If the supply were to double – an unlikely situation any time soon – existing home sales might be able to climb to the 5,000-5,500 pace that existed prior to the most recent recession.

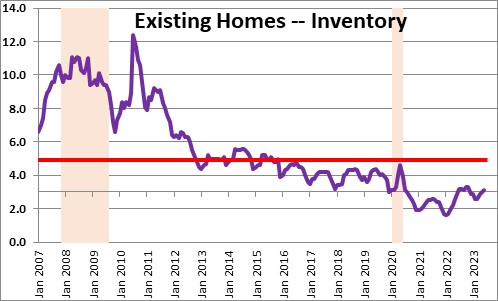

To put this same inventory situation in slightly different terms, there is currently a 3.1-monthj supply of homes available to sell. Compare today’s situation to the 2008-2009 period when there was a 10.0-12.0 month supply of available homes. Everybody was anxious to sell and the abundant supply caused home prices to plunge 15-20%. That is not the situation today.

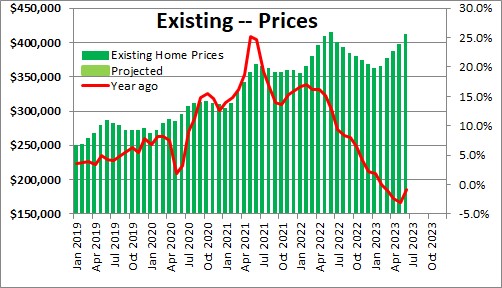

Home sales peaked a year ago at $413,800. As the Fed steadily pushed interest rates higher last year the housing market softened and prices began to fall. After falling for seven straight months, prices have now risen for five consecutive months and at $410,200 are within an eyelash of last year’s record high level. The National Association of Realtors noted that one-third of the homes sold in June were at prices above asking. Bidding wars have once again become common.

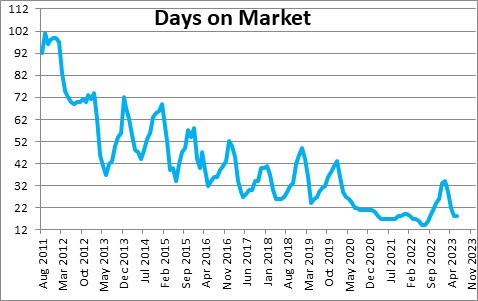

The average home sold in June was on the market for just 18 days. In fact, 76% of the homes sold in June were on the market for less than a month. Compare that to the 3-4 month period that was required to sell a home a decade or so ago. It would be a serious mistake to view the current housing market as weak.

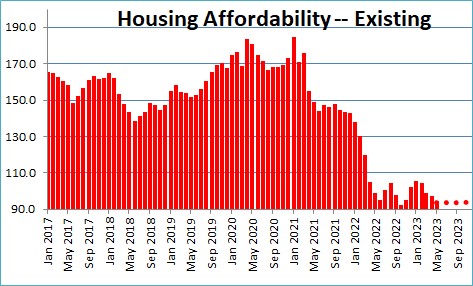

That does not mean that the market has not softened. Housing affordability has dropped from 170 a few years ago – which means that potential buyers of a median-priced home had 70% more income than was required to purchase that home, to 94 which means they had 6% less income than required. Clearly, it has become more difficult for many buyers – particularly first time purchasers — to afford a house today than it was a few years ago. But still, the figures cited above indicate clearly that even with reduced affordability the demand for housing remains solid.

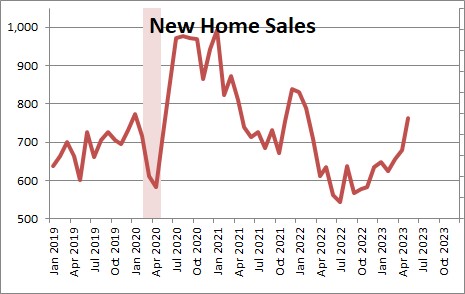

As the population grows and people graduate from school and start jobs, they need a place to live. For those interested in purchasing a home, there are few existing homes available that might suit their needs. For this reason, many are now looking for an affordable new home.

With a 6.7 month supply, those potential purchasers are having more success.But as the pace of new home sales accelerates, the available supply is dwindling and with each passing month the market is becoming progressively tighter.

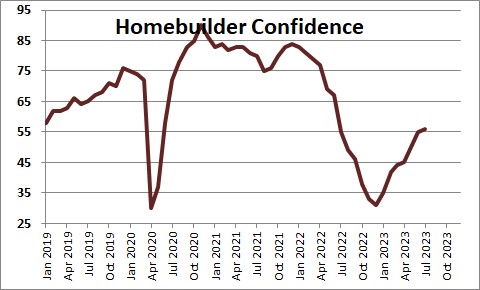

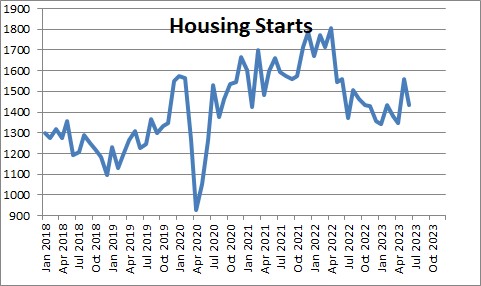

As the demand for new homes increases builders are becoming increasingly more optimistic. Homebuilder confidence has risen for seven straight months but builders are grappling with a shortage of workers, supply-side challenges like an ongoing scarcity of electrical transformer equipment, and increasing difficulty in finding available lots on which to build.

Builders are having difficulty stepping up the pace of construction quickly enough to satisfy demand.

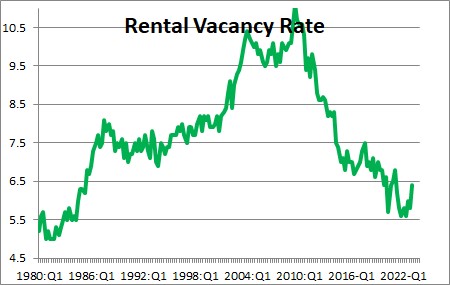

Other people seeking a place to live might look for a place to rent but they, too, are facing challenges. At 6.4% the vacancy rate for rental properties is the lowest it has been since the early 1980’s.

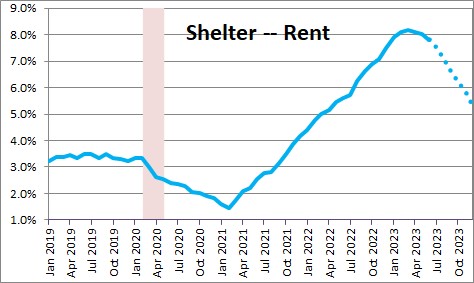

Against this background rents have risen almost 9% in the past year – the fastest on record for a series that stretches back to 2002. This matters because rents represent one-third of the entire CPI index.

The bottom line is that whether you desire to purchase a home or rent, housing is in short supply. Builders seem unable to keep pace given the constraints on their ability to hire workers and lingering supply-side shortages. That seems to suggest a situation where both home prices and rents will continue to climb. If builders cannot quickly boost production, then the Fed will have to reduce demand via rate hikes which may well exceed the additional 0.5% or so that the market expects at the moment.

Stephen Slifer

NumberNomics

Charleston, S.C.

Great piece Steve. Here in the Bay Area, we’ve added many well intentioned road blocks to housing construction that exacerbate the problem. Glad you are well!

HI Granger! A voice from the past! Nice to hear from you.

Everything seems to different today from the world we remember from our days at Lehman. Now if only we could figure out the new rules!

Thanks for sharing your input re: the Bay area.

Steve