January 31, 2020

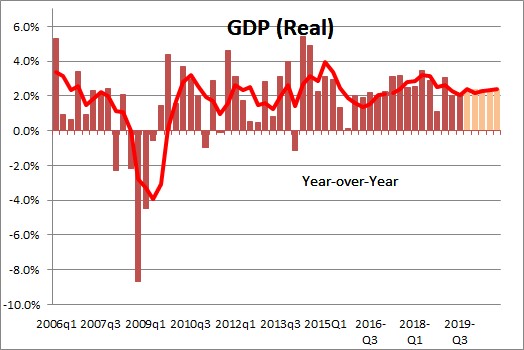

Fourth quarter GDP growth continued onward and upward at a 2.1% pace. This means that GDP came in at 2.3% for 2019. In fact, the annual growth rates for GDP have exceeded the 2.0% mark every year since 2012. While there have been quarterly wiggles, annual growth has been remarkably steady and it is still showing no sign of slowing down. There is also no sign of a pickup in the inflation rate. To us, that is remarkable. Economists continue to believe that the economy’s potential growth rate – also known as its economic speed limit — is 1.8%. We suggest that — with the help of technology — potential growth has already climbed to 2.3%, and with 5-G coming could be even more rapid in the years to come.

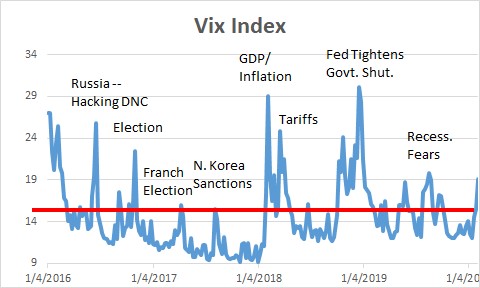

As we look back on the past several years, spikes in volatility reflect a series of fears that t a recession was not far distant Those concerns included everything from Russian hacking of the Democratic Convention prior to the 2016 election, the surprising outcome of the 2016 election, the French election, sanctions on North Korea, the imposition of tariffs, a prolonged government shutdown, Brexit,and fears of slower growth in Europe. Prior to that we had seen numerous European financial crises with government bailouts of Greece, Spain, Portugal, and Ireland. These fears seem to re-surface annually. But the economy marches on. Perhaps it is time to rethink the notion that potential GDP growth is still 1.8%.

The Fed and the Congressional Budget Office both believe potential GDP growth is 1.8%. Potential growth is a longer-term concept so perhaps they are right. But the world is changing rapidly with the help of technology. Big data help companies better understand their customers – who they are, where they are, their sex, age, and education. They can better target their marketing efforts to the people who are most likely to buy their product. This almost certainly boosts top line growth.

By having more targeted advertising, firms can also lower their costs. 3-D printing has lowered the costs of producing machine tools that are more accurate and cost less than ever. With apps this list of cost-saving devices is almost endless.

Faster revenue growth and lower costs generate profits and help to explain the lofty level of the stock market.

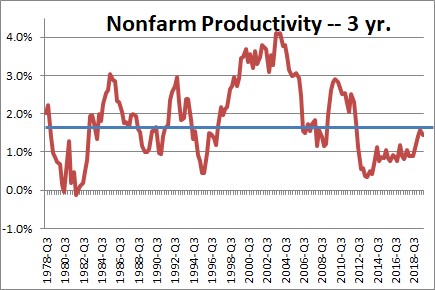

These cost cutting efforts suggest that productivity growth has accelerated. In both the past year and the past three years productivity growth has averaged 1.5%. Thus, faster productivity growth is being sustained. Something different seems to be happening.

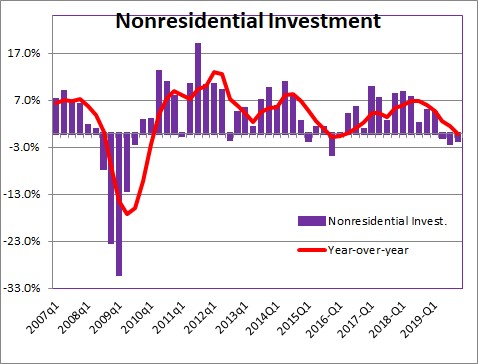

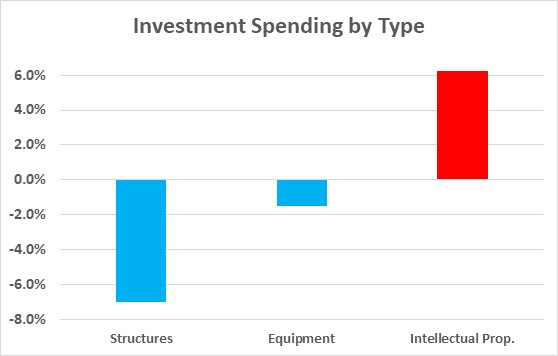

Faster growth in productivity is typically fueled by faster growth in investment spending. But yet, in the past year investment spending has slipped to 0%. While that might suggest that productivity growth will soon slow, perhaps we should not be too quick to reach that conclusion.

It is true, that traditional corporate spending on new factories and new equipment to put on those factory floors have been declining. This obviously reflects the softness in the manufacturing sector this past year caused by the imposition of tariffs by the U.S., China, and other countries. But with global GDP growth likely to re-accelerate in 2020 the drop-off in these two types of investment spending should soon end. In contrast, spending on intellectual property has been rising at a 6.2% pace. This is the category that includes spending on new computer hardware and software. We would suggest that in the face of an extremely tight labor market and an inability to hire qualified workers, firms are choosing to spend money on technology to make their existing workers more efficient – i.e., make them more productive. To us, the pickup in productivity growth is not surprising at all. Furthermore, with 5-G coming, the productivity growth rate might become even more rapid in the years ahead.

The economy’s potential growth rate can be estimated by the sum of the growth rates for the labor force and the growth rate of productivity. Economists who believe potential GDP growth is 1.8% seem to be combining 0.8% growth in the labor force with 1.0% growth in productivity. Our calculation has the same 0.8% growth rate for the labor force. But with long-term productivity currently at 1.5% we conclude that potential GDP growth today is 2.3%. With 5-G coming and, presumably, faster productivity growth down the road, potential growth a couple of years from now could easily be 2.5% or even faster.

If the speed limit is faster than most economists estimate, it is easier to explain the faster-than-expected GDP growth that has persisted despite economists repeated prognostications that the economy was in trouble.

It helps to explain the steady rise in the stock market that has defied virtually everyone’s expectation. While the stock market can experience a correction at any time, the fundamentals of steady, moderate GDP growth, low inflation, and low and steady interest rates suggest strongly that higher stock prices lie ahead.

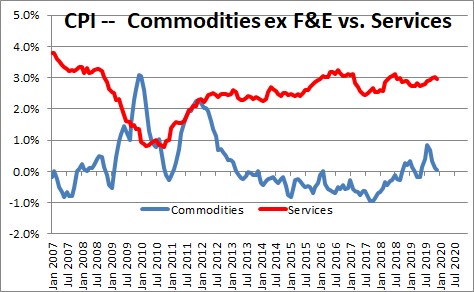

Consumer shopping habits have changed with the rapid growth of on-line shopping triggered in large part by Amazon. The widespread knowledge of the price for any good means that producers of those goods have no pricing power. For the past several years prices of goods have been flat or declining. In contrast, prices of services have been rising at a 3.0% pace. This means that there is absolutely no inflation in roughly 15% of the U.S. economy. No wonder that the inflation rate remains subdued.

Economists have repeatedly been surprised by the resilience of the U.S. economy, the slower-than-expected increase in the inflation rate, the steady drumbeat of higher stock prices. If potential growth were still at 1.8%, we should not be seeing this combination of growth and inflation. GDP growth would be slower, inflation higher, and the Fed would likely be in the process of raising rates. None of that is happening. If one is willing to believe that potential growth has climbed to 2.3%, then GDP growth would obviously be faster, the economy would not be overheating so the low inflation rate would make more sense, the Fed would have no need to raise rates, and the stock market should be doing extremely well.

We are convinced that technology has produced this favorable backdrop and, as we see it, with the introduction of 5G just around the corner, the good news is not about to end any time soon.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me