September 11, 2020

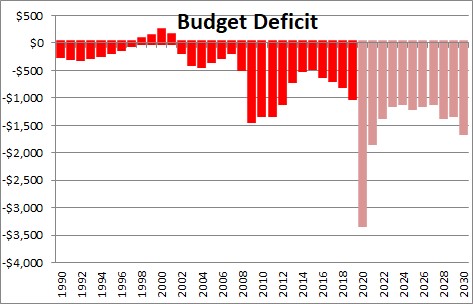

The Congressional Budget Office recently released its updated 10-year budget forecast. The budget deficit for the current fiscal year will be $3.3 trillion. It remains in excess of $1.0 trillion every year between now and 2030. Each year that the country incurs a budget deficit the Treasury must issue an equivalent amount of debt to finance the shortfall. As a result, debt in relation to GDP is now the highest it has been since the end of World War II and is headed higher. But nobody seems to care. In fact, policy makers in Washington are itching to spend more and the odds are there will be another $1.0 trillion stimulus package passed sometime between now and the election.

CBO’s projected budget deficit this year is $3.3 trillion. It shrinks to $1.8 trillion in fiscal 2021 and then averages $1.2 trillion every year thereafter. Not long ago projected deficits of that magnitude would have produced an outcry of alarm. Today – not a peep. In fact, most of our leaders want to spend even more. This is not, in our opinion, a sustainable situation.

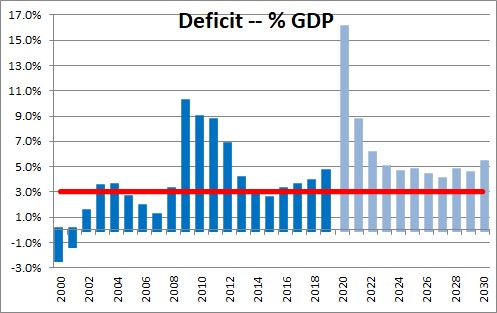

The best way to evaluate budget deficits is as a percent of GDP. On that basis they average 5.0% of GDP for the rest of the decade. Economists believe that a budget deficit that averages 3.0% of GDP is sustainable in the long run. But we are talking about 5.0% of GDP, not 3.0%. So what is the problem? Not enough tax revenue? Too much spending?

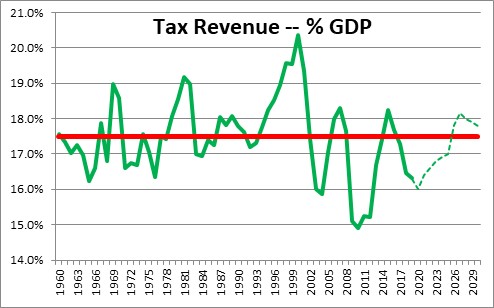

The problem is not too little tax revenue. In the past 50 years tax revenue has averaged 17.5% of GDP. From 2021-2030 the CBO estimates that tax revenue will average 17.4% of GDP. We do not need and should not seek a tax hike to solve the problem.

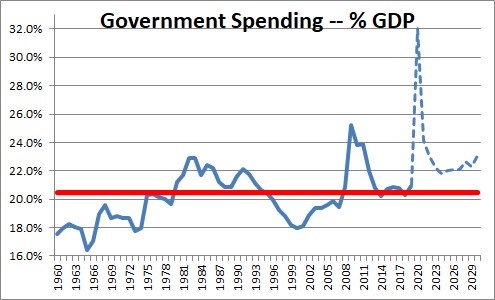

That means the problem is on the spending side. Historically government expenditures average 20.5% of GDP. From 2021-2030 the CBO estimates that such spending will average 22.5% of GDP. Thus, excessive spending is the reason that budget deficits going forward average 5.0% rather than 3.0%. The country is not spending too much on defense, homeland security, or education. This “discretionary spending” will continue to shrink gradually for the next decade. The problem is our aging population and growing entitlements. In the next 10 years more and more adults will reach retirement age. At 62 they can begin to receive Social Security benefits. They can receive full benefits at age 67. At 65 they become eligible for Medicare. Plain old demographics are working to push budget deficits steadily upwards for years to come.

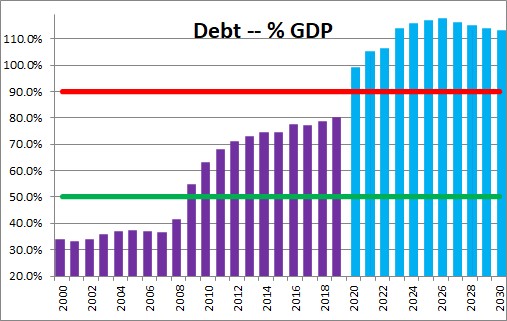

The steady diet of $1.0 trillion deficits will force the Treasury to issue an equivalent amount of debt. As a result, debt in relation to GDP has soared from 79.2% of GDP in 2019 to 98.2% this year. It will continue to climb to 117% of GDP in 2026 before gradually shrinking in the final few years of the decade. Economists have long suggested that a debt to GDP ratio of 50% was sustainable, but have warned that if it climbed to 90% it could be a potential problem. We are there. To put that number in context, in Greece the debt to GDP ratio is 180%. The U.S. is not Greece, but it is certainly moving in that direction.

Is this seemingly excessive debt really a problem? There is something called “Modern Monetary Theory” which says it is not. While it is not widely accepted theory it does have a group of very vocal supporters, primarily the left wing of the Democratic Party which has latched onto the idea as a way to pay for very expensive programs like health care for all, a free college education, or a “Green New Deal” without resorting to middle-class tax increases. We wrote about this back in May. https://numbernomics.com/modern-monetary-theory-is-it-the-answer/

While we do not buy into the theory, the reality is that in a world where interest rates will remain low for the foreseeable future, a moderate increase in debt may not be as problematical as traditional Keynesian economists seem to suggest.

As noted earlier, the outsized deficits are being caused largely by an aging population, Social Security and Medicare expenditures in particular. If we were inclined to shrink these deficits every economist knows how to do that. That part is easy.

For example, with respect to Social Security one could gradually increase the age for full retirement benefits from 67 to 68. Policy makers could reduce benefits for high income individuals. For Medicare they could raise the age for eligibility from 65 to 68. While solutions to the problem are relatively obvious, what is lacking is the will to implement those changes.

It is abundantly clear that none of this is going to happen any time soon – regardless of who wins the election in November. Nobody in Washington seems to care – Republicans, Democrats, the Administration, not even the Fed. We can only conclude that in the past six months they have all become at least semi-believers in modern monetary theory. Our kids are probably going to pay the price for that unfortunate choice.

Stephen Slifer

NumberNomics

Charleston, S.C.

Hi Steve,

A couple comments: Social Security is an entitlement scheme that people have paid into with a commitment backed by the “full faith and credit of the US government” as Newt Gingrich said while coming up with a plan to tap into the proceeds further. That money was spent on then current items, the Treasury now has a bunch of IOU’s. I see no ethical reason that this borrowed money shouldn’t be paid back. Probably we shouldn’t have funded the Iraq war on a credit card, perhaps we should have raised taxes, or spent less and yet here we are. Despite our recent track record, it’s important the U.S. keep it’s commitments, that is certainly one we should keep. And to your point about raising taxes, by lowering benefits and not paying the IOU’s. We have in essence raised taxes. It’s less regressive to just to raise the taxes in a thoughtful way.

Democrats may be more inclined to raise taxes, however Republicans are just as inclined to increase spending while lowering taxes. Neither are great ideas, however on the face of it, one of those is obviously more foolish than the other. There’s a reason that trickle down economics is mocked. It’s an obvious scam to enrich one segment of the economy at the expense of the other.

I’m with you in very much believing that we need to pay down the deficit. At some point it’s going to significantly limit our ability to spend at a moment when we need it, or even worse damage our standing in the world’s financial system. However…. There are a couple things I’ve been pondering:

#1 by borrowing so much money, we become “too big to fail” like it or not, China and other countries HAVE to support the dollar for the time being. Somebody has to support the US debt, otherwise all trading countries would suffer significantly. That gives us more runway than we might otherwise have.

#2 as long as interest rates are held unnaturally low, the US is essentially “borrowing extra” by paying less interest than it otherwise might pay. From that perspective, if we can invest the money wisely we come out ahead of the game. I do think it’s poor fiscal policy but I have to admit it’s not yet been the unmitigated disaster I would have foreseen ten years ago. In short MMT works if the value of the investment is less than the cost of borrowing with the added bonus of having no limits to your borrowing. It’s a very businesslike concept, you might think the Republicans would be more on board with it. It really aligns well with the philosophies behind trickle down economics where you’re investing in sectors where you perceive the best ROI.

I am curious to see how whatever party wins the elections bumbles forward over the next 4 to 8 years. They will have challenges, and unless one party sweeps both houses and the presidency, they’ll continue to be able to point fingers and pass the buck downstream.

Best,

Chris

Sorry I should have said “MMT works if the value of the investment is MORE than the costs of borrowing”

Steve, as always a well reasoned article and viewpoint.

I’m so glad you explicitly defined the category for “Entitlements” being Social Security and Medicare. So often when the term is used people like to point to Welfare, Food Stamps, or other expenditures like Funding for the Arts. They are such a small % of the problem. If those voting to cut entitlements realized it was their Social Security or Medicare, they might vote very differently. It is so surprising that Florida is a “toss-up State”.

Hi Ray,

I guess Social Security and Medicare are the big gorillas, but all those others are on the list as well. I am just so astounded that nobody says anything about these deficits. I certainly seem to be missing something.

Steve

HI Chris,

What astounds me is that nobody — except perhaps you — is paying any attention? What gives? I clearly must be missing something.

Re: Social Security, I don’t think the issue is whether some of that is not going to get re-paid. I think it will be. But I do not have an ethical issue with not giving some wealthy income-earners less than what they are getting now. In theory, I guess, they get back what they paid in. It just takes them longer to do it.

I also would support increasing the maximum contribution amount from $132,900 currently to, say, $200,000.

When SS was first implemented retirement age was 65, life expectancy was 67. It was never meant to be a retirement plan, but somehow that is the way it is being viewed today. If we retire at 65 and live to 85 it really is a retirement plan. I can support raising the retirement age gradually depending upon when you were born. We have that now, it’s just that the retirement age is still way too low.

And if with respect to the deficit we have given up on shrinking it, why not at least issue a big chunk of 50- or 100-year bonds. Why not lock in those rates now?

Another suggestion might include not bailing out any state that is unwilling to convert its defined benefit pension plan to a defined contribution plan? The private sector has already done this. If we are going to provide bailout money for these states, let’s at least make sure they are not going to back again whenever the pension plan is once again depleted. Let’s take the burden off taxpayers.

Steve

Hi Steve,

I think there’s a lot of merit in the ideas you suggest. I’m leery of means testing social security. It’s hard to be fair with cost of living and circumstances varying so widely. I have a feeling, without having done any research, that the effective benefit from means testings is fairly minor against the savings. The bleeding heart side of me likes the idea of increasing the amount of benefit based on need while the pragmatist doesn’t like a idea of potentially rewarding foolish behavior. It’s going to need a lot of thought and consideration. Something in short supply among politicians theses day.

Chris

Do you realize that in 2010 we had something called the Erskine/Bowles Commission? Obama appointed 9 Republicans and 9 Democrats to the Commission and charged them with, basically, fix everything. Figure out the proper number and levels for each tax bracket. Reduce the budget deficit to something that was sustainable. Everything was on the table. Every revenue category, each type of government spending, all entitlements — Social Security, Medicare, welfare benefits, veterans benefits, etc.

Nobody expected them to reach any sort of agreement. But they did. Then Obama says, sorry you cut entitlements too much, I am not supporting your conclusion. But it was HIS commission. He appointed these folks. If I were in charge I would fell duty bound to accept their recommendations. But he didn’t.

The reason I bring this up is that just 10 years ago we were able to get a bipartisan agreement on something really important for our future. The Gold Ring was right in front of our nose. All we had to do was grab it. And Obama — blew it. Too bad.

I don’t think you could every get a panel like that together again in today’s world.

Chris Watson,

Those SS IOU’s over at Treasury are special Interest govt bonds collecting interest. They will be paid back when redeemed to meet SS benefits–just like any other govt bond.

Steve,

I had forgotten about that commission. Obama was not the perfect president. He was too busy being friends with everyone. He should have pushed harder in my opinion. Obamacare only passed because it relatively cruised thru congress in the early days. I only see progress possible if one party or the other ends up with congress and the White House. Then they’ll have less excuses. R.e. the bonds getting paid back, then things should mostly work out? I was reading just now that without adjustment social security can cover 79% of it’s obligations thru 2090. Sounds like a few minor tweaks from politicians with spine could solve this fairly easily. I wouldn’t mind an extra 1% payroll tax on the upper 5% to fix it. I know I wouldn’t notice the difference in my lifestyle. But whatever the solution it needs a congress, Senate and white house working together collaboratively.

Best

Like I said Chris. The fix to SS is easy. Any economist can figure it out. But the will is missing. SS is viewed as the “third rail”. Touch it and your career as a politician is dead.