June 17, 2022

While the Fed believes it can pull off a soft landing, the markets are convinced that a recession is coming. And they are probably right. But when? With core CPI inflation likely to be 5.2% at the end of next year, the 3.8% funds rate that the Fed envisions at that time will not be enough to bring inflation down to the 2.0% mark. The real funds rate would still be -1.4%. That suggests the Fed will continue to tighten into 2024. Eventually it will go too far and the economy will slip into recession. Thus, we believe the recession will not occur until late next year or 2024. The U.S. economy is amazingly resilient.

They key is the real funds rate. Today the funds rate is 1.5%. The core CPI is 6.0%. Thus, the real funds rate is -4.5%. To turn that into a positive real rate the funds rate needs to rise and/or the inflation rate must decline. The Fed expects the funds rate at the end of 2023 to climb to 3.8% and thinks inflation will slow sharply to 2.6%. If so, the real funds rate would be +1.2%. But will inflation decline as rapidly as the Fed expects? We doubt it. We think the core CPI at the end of next year will be 5.2% — double the Fed’s 2.6% expectation. Why won’t inflation fall more quickly?

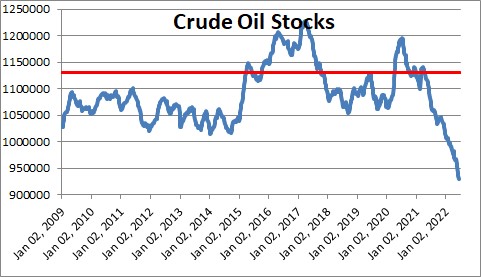

Crude oil prices are currently $115 per barrel. Three factors seem important. First, China is beginning to re-open following its COVID quarantine which will boost the global demand for oil and likely push prices higher. Second, the Biden administration is doing nothing to encourage domestic producers to step up the pace of production. They deny permits for new pipelines. They force companies to comply with strict environmental regulations. Why invest to increase production when the administration wants to eliminate the sale of your product? Finally, crude oil inventories are the lowest they have been in 20 years. Oil companies cannot dip into inventories to boost the supply of oil and help alleviate the upward pressure on prices.

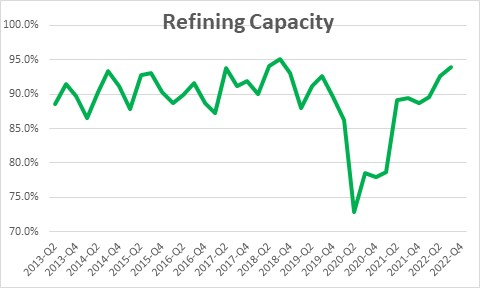

Gasoline refineries are already running flat out There is no spare capacity to boost output. With little incentive to invest it is hard to see how gasoline production can increase enough to lower prices particularly since the production shortfall occurs at the beginning of the summer driving season.

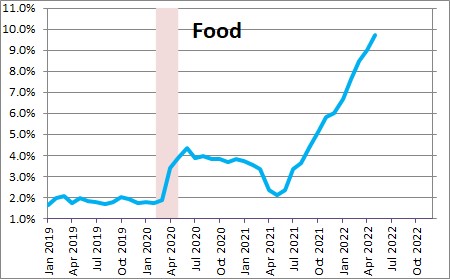

Food prices are also unlikely to decline. Ukraine is a major producer of corn and wheat. The war between Ukraine and Russia seems unlikely to end soon. Once it does end it will take a long time to boost crop production. And if Russia controls the country little if any of those agricultural commodities will be exported. At the same time extreme drought conditions in the West may negatively impact the production of fruit, vegetables, and animal feed crops.

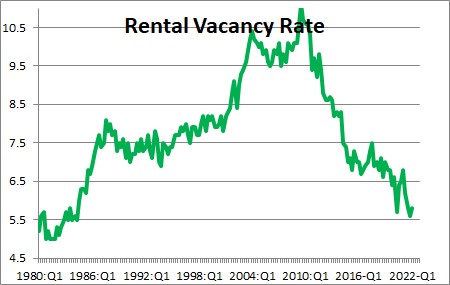

In the housing market the apartment vacancy rate is the lowest it has been since the 1980’s. Demand will continue to exceed supply until such time as builders can increase the production of apartment units. But given the run-up in mortgage rates builders are becoming more cautious and actually slowing the pace of construction. The upward pressure on rents will continue for the foreseeable future. This is critically important because rents account for 1/3 of the entire CPI.

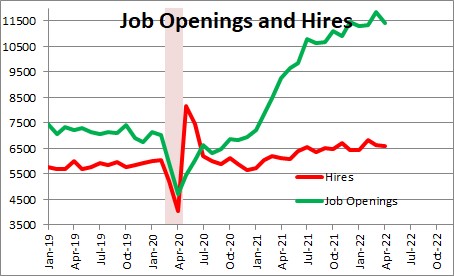

Finally, as evidenced by the number of job openings the demand for labor far still far outstrips supply. As a result, firms are forced to bid aggressively to attract the workers they need. And while wages have been rising, inflation has risen even faster and, as a result, real wages have fallen 2.5% in the past year. As long as that continues to be the case individual workers and the unions will push for sizeable wage gains and businesses will continue to raise prices to counter the higher labor costs.

It is hard to see how the inflation rate can slow to 2.6% by the end of next year. Instead, we believe it will be 5.2% at the end of 2023. If that forecast is correct, the funds rate will need to climb at least to 5.2% (probably higher) to have any chance of slowing the rate of inflation. That is far higher than the 3.8% funds rate the Fed currently expects. The higher the funds rate needs to go, the more likely the end result will be a recession which in our view, is probably a late 2023 or 2024 event.

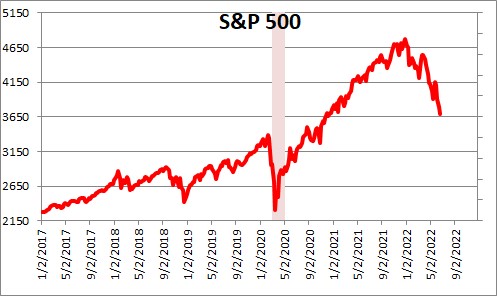

Some argue it will occur sooner. As evidence they point to dramatic 20% drop in stock prices.

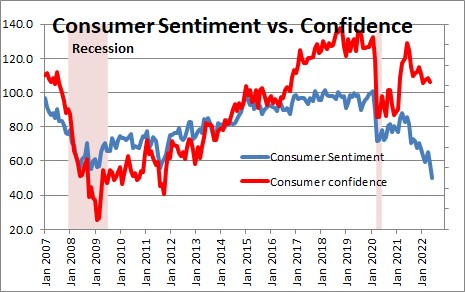

They will also note the precipitous slide in the University of Michigan’s measure of consumer sentiment which has plunged to the lowest level on record. That is scary. But, oddly, the index of consumer confidence published by the Conference Board shows a more modest drop in confidence. Which measure is giving the more accurate barometer of consumer confidence? It is not clear. Thus far, consumer spending has softened, but not by the extreme amount suggested by the University of Michigan series.

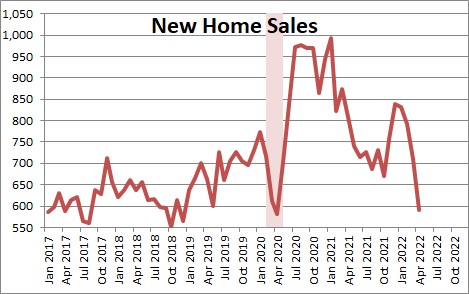

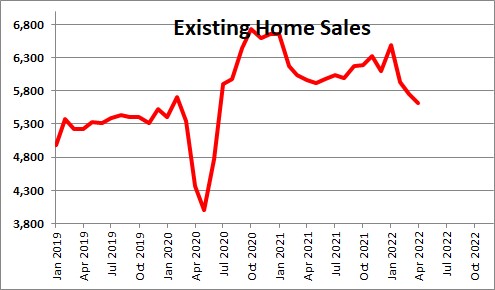

In the housing market there is a similar dilemma. New home sales have plunged in the past several months to a pace in line with the lowest point in 2020. But it is not clear that home sales are as weak as the new home sales data suggest. Existing home sales tell a different story.

Existing home sales have also declined but by a far smaller amount. In addition, the length of time between listing and sale remains the shortest on record which suggests that demand has not fallen precipitously. Which series is the better barometer of the state of the housing market? Once again, it is not clear.

With both the stock and bond markets getting hammered and sharp declines in consumer confidence and home sales having already emerged, we can understand why some believe a recession is imminent. We agree that a recession is coming, but suggest that it may not arrive until late next year or 2024. We are almost invariably surprised by the strength and resilience of the U.S. economy.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me