October 15, 2021

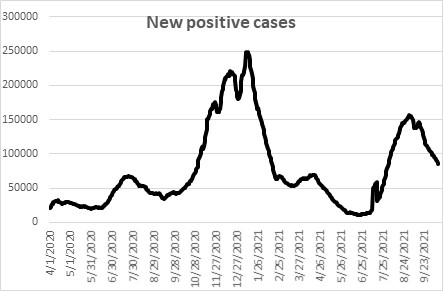

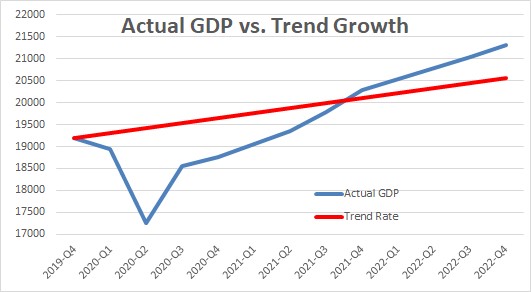

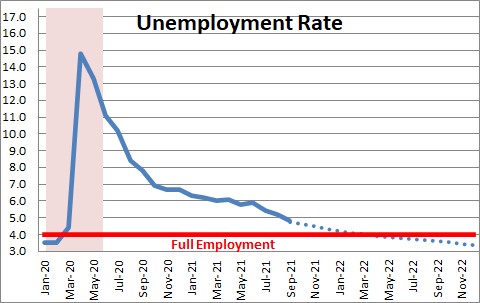

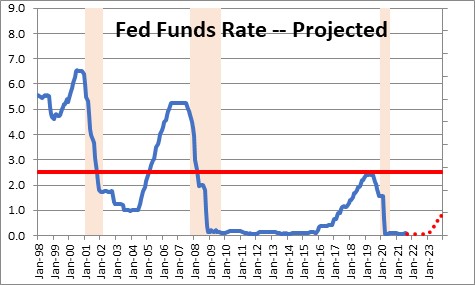

The economy hit a speed bump in the summer as COVID cases began to climb. But now COVID cases are in a tailspin which suggests that the economy is likely to rebound in the fourth quarter. That is reassuring but there is little slack left in the U.S. economy. The current 4.8% unemployment rate is expected to slip to the 4.0% full employment threshold by spring. The level of GDP will return to its potential growth path by the end of this year and continue to grow in 2022. With no remaining slack in the economy and moderate growth next year, that is an almost sure recipe for higher inflation. How will the Fed respond to this? It currently expects to raise rates just once in 2022 to 0.25% and three more times in 2023 to 1.0%. But it believes a neutral funds rate is 2.5%. Thus Fed policy – as currently envisioned – is going to remain extremely stimulative for the foreseeable future. In our opinion, the Fed is far behind the curve. If so, inflation will not return to the Fed’s desired 2.0% pace next year. It will remain elevated until such time as the Fed chooses to adopt a far less accommodative policy stance. That time is not yet in sight.

The economy slowed during the summer as COVID cases began to surge. But now COVID cases are shrinking which is certain to bring with it a resurgence of consumer spending on services like restaurant dining, air travel, hotels, and sporting events. To be sure supply constraints caused by delays at the ports, extensive shortages of required materials, higher commodity prices, and pronounced labor shortages will curtail the production of goods. The much stronger-than-anticipated increase in retail sales in September suggests that the drop in COVID cases is boosting both consumer spirits and their willingness to spend. At the same time layoffs and the number of people receiving unemployment benefits have continued to decline through mid-October which suggests that we could see substantial employment gains in the final three month of this year. The summer slowdown is over and more vigorous sales are on the horizon.

Given all of the above, we anticipate 7.0% GDP growth in the third quarter which we will learn about on October 28. Given an expected rebound in the pace of economic activity we look for 8.0% GDP growth in the fourth quarter. If that is the case, the level of GDP will return to its potential growth path by yearend. Any remaining slack in the economy will have disappeared. Next year we anticipate 5.5% GDP growth but potential growth climbs by just 1.8%. Demand will exceed supply. Inflation will remain elevated.

With rapid GDP growth the unemployment rate should continue to drop. It is currently at 4.8%. The labor market is deemed to be at full employment when it reaches 4.0%. We believe that the full employment threshold will be reached in the spring. At that point wages pressures will accelerate.

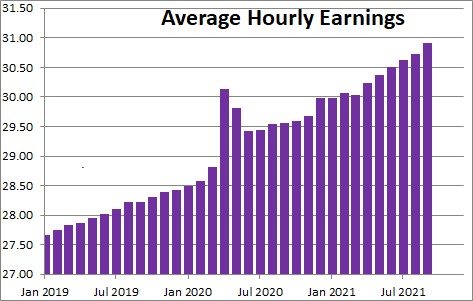

But wage pressures are already climbing. Average hourly earnings have risen 4.6% in the past year but at a 5.9% pace in the past six months. Wage pressures seem to be mounting. The NFIB, which represents small business owners, reported that in September 42% of business owners raised compensation, and 30% plan to raise compensation in the next three months – both record high levels.

By almost any metric, the economy is at, or very near, full employment. Most economists expect GDP growth next year of about 4.0%. We anticipate 5.5% growth. But potential GDP is only 1.8%. With the economy at full employment and demand continuing to exceed supply, inflation is going to rise.

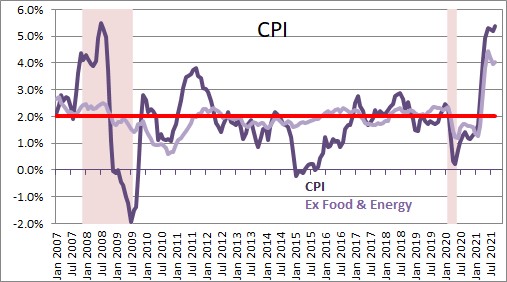

Driven by rising food and energy prices the CPI rose 0.4% in September which brings the year-over-year increase to 5.4%. Because of their volatile nature economists typically exclude food and energy prices. On that basis the core CPI rose 0.2% in September which brings the 12-month increase to 4.0%, but it has risen at a steamy 6.5% pace in the past six months. It is not slowing down.

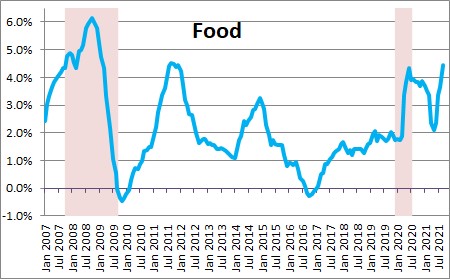

Perhaps we should also not be so willing to dismiss what is happening with food and energy prices. These two categories are notoriously volatile so it generally makes sense to exclude them when trying to estimate the underlying trend in inflation. But food prices have risen 4.5% in the past year which is the biggest increase in a decade. Furthermore, 90% of California is in the highest “exceptional” drought stage. Water restrictions abound and there is no rain relief in sight. It is hard to envision food prices retreating any time soon.

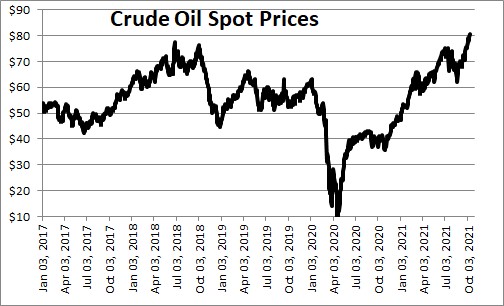

Meanwhile, crude oil prices have climbed to $81 per barrel. The EIA expects oil demand in the U.S. to exceed supply through the end of this year. Meanwhile, crude oil inventories are at a 5-year low. It is hard to see oil prices falling any time soon.

For all of these reasons we see the core CPI climbing 4.8% this year, 3.7% in 2022, and 4.2% in 2023.

With all remaining slack in the economy having disappeared and the economy continuing to run hot, the Fed should be shifting back to a less accommodative policy stance. It will soon begin to “taper” its monthly purchases of U.S. government and mortgage-backed securities, but once that process is complete the funds rate will still be at 0.0%. The Fed believes a “neutral” funds rate is 2.5%. As currently envisioned it expects to raise the funds rate once in 2022 to 0.25% and by the end of 2023 it expects it to still be low at 1.0%.

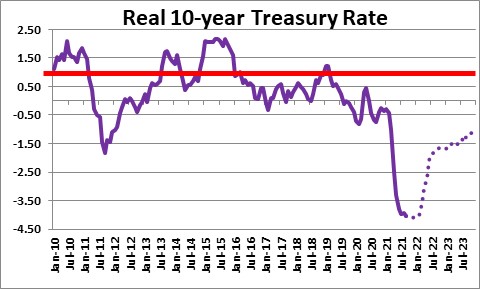

In our opinion, the Fed is far behind the curve. As long as that is the case, the economy will continue to expand rapidly and the inflation rate is going to be remain well above the Fed’s target. If inflation does not soon slow considerably, long-term interest rates are destined to climb. Today’s 1.6% yield on the 10-year note will climb to 1.8% by the end of this year, to 2.1% by the end of next year and 3.25% by the end of 2023 – and that will still be low. In real, inflation-adjusted terms, a 3.25% long-term bond yield combined with a 4.2% inflation rate means produces a negative 1.0% real rate. In the past decade this real rate has averaged positive 1.0%.

The inflation genie is out of the bottle. It will not be easy to get it back in.

Stephen Slifer

NumberNomics

Charleston, S.C.

Hi Steve… Could you share multiple decades of Real 10-year Treasury rates and perhaps give us an estimate as to when you see the ‘real rate’ once again to be on average positive 1% ? Thanks.

I will send you a response via e-mail. Cannot figure out how to do charts in this comments section.

Steve