September 25, 2020

Economists often use the Fed’s forecasts as a benchmark for their own. And why not? The Federal Reserve system has more than 1,000 of the smartest economists in the business. They have the bodies to closely analyze every aspect of the economy. But that does not mean their view is always correct. And never has the Fed been more off the mark than in recent months. It has had, and continues to have, a very pessimistic view of the economy. As a result, the Fed believes the economy will not achieve full employment until 2023 and its first tightening move will not come until 2024 at the earliest. But is its pessimistic view correct? We believe the economy will grow more quickly than the Fed expects and may actually approach full employment by December 2021.

In mid-June the corona virus was spreading rapidly At that time, the Fed expected GDP to decline 6.5% in 2020 and the unemployment rate to end the year at 9.3%. But suddenly employment, retail sales, and housing came roaring back.

For example, roughly half of the 22 million jobs lost in March and April were regained by August with an additional increase of one million workers projected for September. As a result, the unemployment rate has dropped from a peak of 14.7% in April to 8.4% by August and should fall further to 7.8% in September.

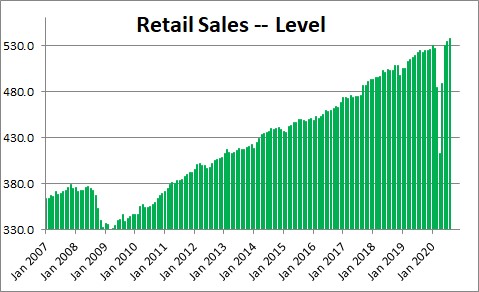

Retail sales plunged in March and April, but they have come roaring back fueled by the $1,200 tax refund checks and expanded unemployment benefits. In fact, the August level of sales surpassed the pace that existed prior to the recession. If employment increases by one million workers in September, income will rise and retail sales will continue to climb.

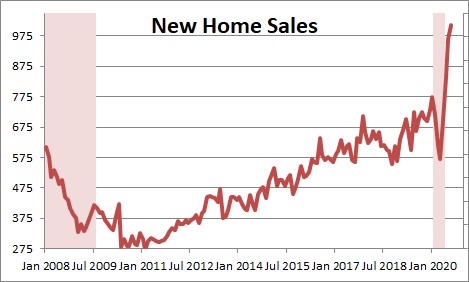

Following sharp declines in March and April both new and existing home sales have taken off. New home sales skyrocketed to 1,011 thousand in August which is the fastest pace of sales since September 2006. This dramatic upswing is attributable to a record low 2.9% mortgage rate, the $1,200 tax refund checks, and pent-up demand from sales postponed during the recession. Sales would be even faster if there were more homes available for sale. There is currently a 4.2 month supply of new homes on the market which is far below the 6.0 million supply that is required to balance supply and demand. Home sales will continue to climb.

Given these robust data the Fed still believes that GDP will decline 3.7% this year and the unemployment rate will fall to 7.6% by December. But remember, three months earlier it thought GDP would decline 6.5% and the unemployment rate at yearend would be 9.3%. This is an astonishing shift in view in a 3-month period of time. Furthermore, we believe its forecasts are still too pessimistic.

The Fed expects GDP to decline 3.7% for the year. That is simply an average of GDP growth rates for each of four quarters. But we know GDP fell 5.0% in the first quarter and an additional 31.7% in the second quarter. For the yearly average to decline 3.7% the Fed must expect GDP growth for the third quarter of perhaps 18% and a fourth quarter GDP growth rate of about 4.0%. It is basic math.

However, we are looking for third quarter GDP growth of 28.0%. The Atlanta Fed is at 32.0%. Furthermore, the economy still has plenty of momentum. Through mid-September both layoffs and the number of people receiving unemployment insurance benefits decline steadily each week. That means that employment is still rising and the unemployment rate declining. That process should continue – but at a slower pace — throughout the fourth quarter.

While the Fed may expect GDP growth in third and fourth quarters of 18% and 4%, we anticipate GDP growth of 28% in the third quarter followed by 7% in the fourth quarter.

Given this more robust pace of economic activity in the second half of the year, we expect the unemployment rate to be 6.6% at yearend versus the Fed’s projected 7.6%.

Looking ahead to 2021, our relatively optimistic view is based on the notion that a vaccine will be available by the end of this year which will allow all of us to feel safer going out to a restaurant, flying, staying in a hotel, going to a concert. If that is the case, the sectors of the economy that have not yet participated in the vigorous upturn will join the pack and GDP growth in 2021 will be 5.3%. The Fed is looking for more modest growth rate of 4.0%. As a result, by the end of next year we believe the unemployment rate will decline to 4.4%. The Fed believes it will end 2021 at 5.5%.

The difference between these projected unemployment rates is important. The Fed currently estimates full employment at 4.1% — which is now its primary goal. But not a single Fed official believes the unemployment rate will reach that level until sometime in 2023. No wonder the Fed does not expect to raise rates until 2024 at the earliest.

But if we are right the economy achieves full employment by the end of 2021 – two years earlier than the Fed expects, which means the Fed’s first move toward higher rates could begin sooner.

The point of all this is that nobody’s forecasts — neither our own, nor the Fed’s– are gospel. The Fed can blow it just as easily as the rest of us and it recently has been struggling with a steady diet of far stronger-than-expected economic indicators that are inconsistent with its pessimistic view of the economy. Having said that, we are all currently trying to anticipate the likely course of the corona virus, how quickly a vaccine can become readily available, and how soon we will all feel comfortable venturing farther from home. These are not the typical factors that economists look at in determining GDP growth. We are all guessing. The Fed today says it is unlikely to tighten before 2024. That may be right, but it could happen sooner. Stay tuned.

Stephen Slifer

NumberNomics

Charleston, S.C.

I wonder if the Federal economists paint a pessimistic viewpoint in order to budget out the tax (govt revenue) for the coming years. Does that have a play in why the Feds data is pessimistic?

Would you take a vaccine in November of 2020 if it was just approved and showing promise? The promise being it is reducing deaths and reliance on ventilators.

The support you gave the dead of COVID-19 and your forward economic look suggest that we will come away stronger even with a change in Government.

We can be comfortable with a new president!

Best,

Ray

I would suggest that many, if not most of these smart economists buy into the belief that Trump will be out, or cut off at the knee, come 2021. This outlook may actually be considered optimistic. If you didn’t like 2020 – things could possibly get much worse. This election will produce more consequences than most in history.

Hi Mike,

Whenever any of us do our forecasts we assume no political changes during the forecast period. That means no changes in fiscal policy. No second round of stimulus. And no new legislation passing Congress. I guess that means that implicitly I am assuming Trump wins, and we end up with a divided Congress.

But then if you ask how my policy would change if Biden wins, my answer would be — it depends. It seems to me that this country is divided about 50/50 between those that love Trump and those that hate him. If Biden wins 50% of the country is very happy, the other 50% is very angry. If Biden wins and Congress remains divided, I would guess that we continue to have very bitter debates over everything but nothing very different happens.

If Biden wins and Democrats retake the Senate, then there will be some huge policy changes. I worry about the extent to which the left wing of the Democratic party dominates the agenda under Biden.

I think you are right that we could see some very dramatic changes, but before I can have a chance of figuring out the implications of that, I need to know the outcome for the Presidential election, the House and the Senate. At this point in time, I have no idea how all that will turn out. Hang on to your hat!

Steve

Hello Steve,

Thank you for your analysis. I have been reading your newsletter for about a year and look forward to reading every one of them.

I agree with your comments. I believe the Fed had to report pessimistically knowing some of the same things you mention in your comments back to me.

I am praying while at the same time holding onto my hat. Maybe 2021 will be the best year ever (my optimitic side speaking).

Thank You,

Mike Husman

Hi Darren. Each of the 12 Federal Reserve Bank presidents as well as the Board staff each present their forecasts for GDP, the unemployment rate, inflation, and the funds rate at each FOMC meeting. What we see are the median forecast for each of these indicators. When Fed economists (as well as economists in general) make their forecasts, they assume no policy changes. No changes in tax rates. No additional fiscal stimulus. We look at all sorts of different variables in coming up with those forecasts — consumer and business confidence, some expectation about the spread of COVID and how quickly a vaccine might become available, how will businesses and consumers respond to the availability of a vaccine, and how the housing, manufacturing, and retail sectors are behaving. The list is endless. But nowhere is there any assumption of what that is going to do to the budget deficit. That comes after the fact. Given the outlook for the economy, inflation, interest rates, etc., what will the budget deficit — revenues and expenditures — become? Basically, the Fed’s forecast is pessimistic, I suppose, because they worry about the date of availability of a vaccine and how quickly you and I and all the rest of the American public will be to take an early version of that vaccine. They worry that once the fiscal stimulus dries up, how many business will fold. Lots of room for different views. They are quite pessimistic. I am less so. Thanks for taking the time to comment.

Hi Ray. Obviously speculation about the election results gets everybody talking and there is a wide range of possible outcomes. But it appears that the American public is split about 50/50. You hate Trump or you love him. My forecast is reasonably optimistic not because I am assuming a change in leadership at the top. I guess that implicitly I am assuming Trump wins and we end up with divided government so not too much is different from what we are experiencing today. But suppose Biden wins. What then? It depends upon the results for the House and then Senate. If Biden wins and the Republicans keep control of the Senate we still end up with divided government and nothing much happens despite a new president. What would worry me is if Biden wins and the Democrats take control of the Senate. To what extent does the left wing of that party begin to control the agenda? The spending associated with free college education, government run health care, the Green New Deal, and the higher corporate taxes and higher taxes on the rich to pay for all of this concerns me. Even if we get a new president, I suspect that the bickering and difficulty getting any sort of legislation passed will remain. It never ends.

Steve