December 1, 2023

The housing sector has suffered the brunt of the slower pace of economic activity during the past year as higher mortgage rates and soaring home prices have taken a toll. But a major factor in the softness in the housing market has been the reduced number of homes available for sale. Real estate agents cannot sell what is not on the market. If the supply of homes were at a more normal level, the pace of sales would be far less anemic. Going forward the outlook for home sales in 2024 should be brighter as mortgage rates decline, home prices edge lower, and consumer income continues to climb. Those three factors will significantly boost housing affordability and thereby boost sales. In the past four quarters the housing sector has subtracted 0.4% from GDP growth. It might boost GDP growth by a roughly comparable amount in 2024.

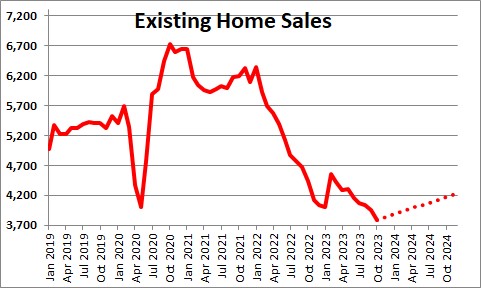

Existing home sales have plunged in the past 20 months as the Fed began to aggressively lift the funds rate. Sales are roughly in line with the low points in both the 2008 and 2020 recessions. But the softness in sales today seems exaggerated.

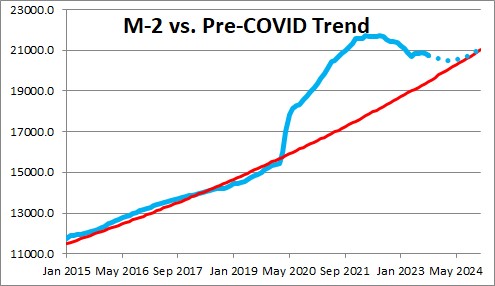

Home prices have been soaring. They began to climb immediately after the end of the 2020 recession. The economy was flooded with unprecedented sums of liquidity provided by the Fed and the various stimulus measures enacted by the government. That excess liquidity can be measured by the dramatic increase in the money supply which at one point was $4.0 trillion higher than it ordinarily would have been.

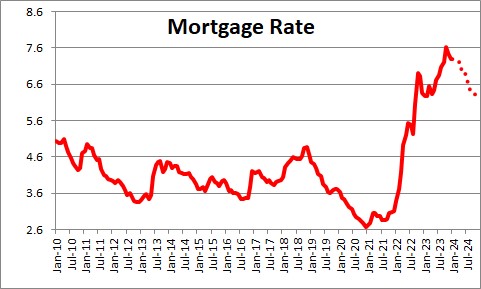

In March 2022 the Fed decided to tame the soaring inflation rate by raising the Federal funds rate. The Fed funds rate climbed from 0.0% to 5.5%. Mortgage rates rose from 3.0% to a peak of 7.8%. Homeowners who wanted to sell would have had to buy another house so, effectively, they would have traded in a 3.0% mortgage rate for a 7.8% rate. Not a good trade!

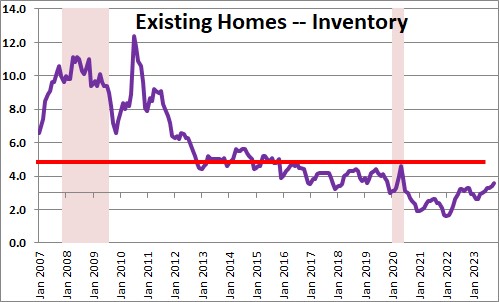

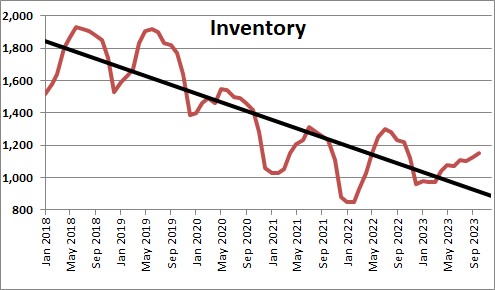

As a result, they chose not to put their homes on the market. The inventory of unsold homes fell to a record low of 1.7 months. Realtors suggest that the housing market is relatively in balance — meaning that demand is in line with supply — when there is roughly a 5.0 month supply of homes available.

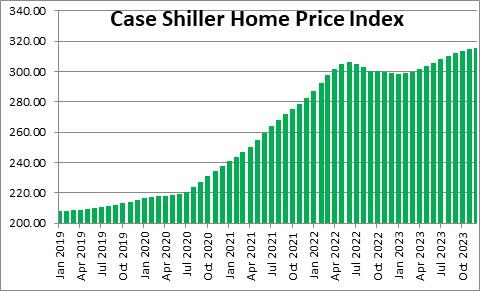

With the limited availability of homes on the market, potential buyers could not find a home that suited their needs. When a suitable home did come on the market bidding wars erupted and home prices soared. In fact, prices climbed 45% from their pre-recession level to a peak that roughly coincided with the beginning of the Fed’s tightening initiative. Every homeowner in the country saw the value of their home appreciate to a level they probably never thought they would see in their lifetime. Many wanted to sell and capitalize on their home’s appreciated value, but were prevented from doing so by the simultaneous increase in mortgage rates and the reduced availability of homes on the market. As a result, existing home sales continued to slump.

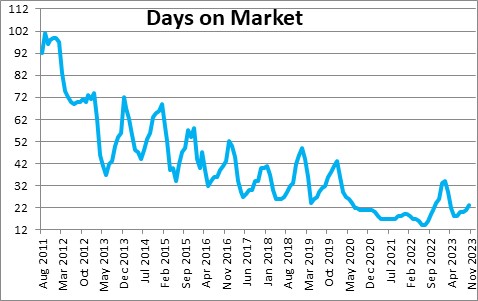

Having said all that, the housing market is not as weak as the decline in existing home sales would suggest. Homes that do come on the market sell quickly. Today the average home sits on the market for just 23 days. Two-thirds of the houses that come to market in any given month sell within a month. It was not that long ago that it would take 3-4 months for a house to sell. Clearly, there is still underlying demand for housing despite higher mortgage rates and elevated home prices.

The National Association of Realtors suggests that the market could easily handle a doubling of the available inventory. The actual number of homes on the market today is 1,100 thousand. Doubling that would take it to 2,200 thousand. If the NAR is right those homes would get sold, which means that existing home sales would climb from 3,790 thousand to about 5,000. Going into the recession home sales were averaging about 5,500 thousand. Unfortunately, it is unlikely that many additional homes will find their way to market in 2024. So what does the housing market look like in 2024?

If the Fed is able to pull off a soft landing, which is what we and many other economists expect, GDP growth will remain moderate with about 0.7% growth in the first half of the year followed by 1.8% growth in the second half. At the same time the Fed should continue to eliminate the remaining surplus liquidity in the economy as the money supply continues to contract. Thus far the surplus liquidity has shrunk from $4.0 trillion to $1.1 trillion. It should be eliminated entirely by the spring. If so, the inflation rate will continue to slide. Our expectation is that the core CPI will slow from 4.0% currently to 3.1% by the end of next year. The slow growth/reduced inflation scenario should allow the Fed to lower the funds rate from 5.5% today to 4.75% by the end of 2024. Putting all that information together suggests that today’s 7.3% mortgage rate could slide to 6.25% by this time next year.

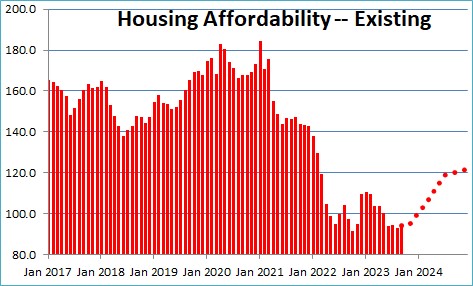

The combination of lower mortgage rates, continued growth in consumer income (caused by further gains in employment and higher wage rates), and a modest drop in home prices should boost housing affordability sharply. Currently, a median income earning family has about 6% less income than required to purchase a median-priced house. By the end of next year that same median income earning family should have 22% more income than required. That is a dramatic turnaround.

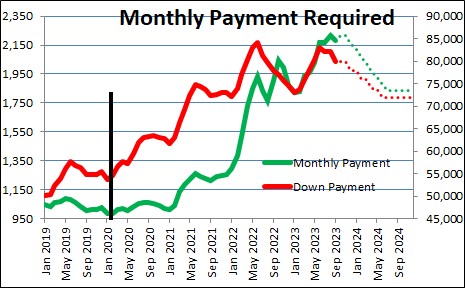

In the world described above, the down payment for a median priced home would drop from $80,000 to $72,000. The monthly payments would decline from $2,200 a month to $1,850. Clearly, some potential first-time homebuyers would now be able to afford a home, and at least some current homeowners will put their houses on the market which would boost supply.

If all of that is reasonably accurate then existing home sales are likely to increase about 10.0% from 3,790 thousand today to 4,250 thousand by December 2024..

The U.S. economy continues to adjust from an extremely low interest rate environment to a more normal rate structure, and the Fed has (amazingly) been able to do that with little weakness in the labor market. Soft landings rarely occur. We have long faulted the Fed for being slow to raise rates and combat the rampant inflation, but it has done a good job of making that happen without pushing the economy over the edge into recession. With each passing more the soft landing scenario seems increasingly likely.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me