June 24, 2022

The markets swing daily as the odds of recession rise or fall. Everybody is trying to figure out how high interest rates might need to go to bring inflation back down to the 2.0% mark. Keep in mind that a recession is characterized by declining employment and a rising unemployment rate. As those two things occur wage pressures diminish which will, in turn, alleviate upward pressure on the inflation rate. Thus far, the labor market has shown few signs of softening and that may not happen for some time to come. So while the markets currently seem convinced that a recession is not far distant, inflation has peaked, and the funds rate may not have to climb higher than the 3.4% the Fed envisioned for yearend, we are unconvinced. Signs of a significant slowdown in either economic growth or inflation are elusive.

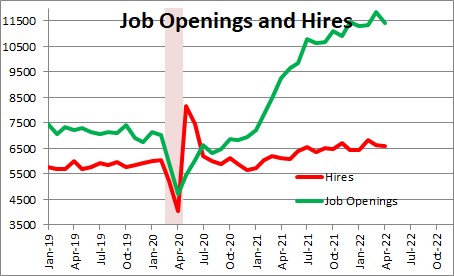

Currently, the difference between job openings and hire indicates clear that there is far greater demand for workers than there is supply. Typically, the first place labor weakness shows up is in the data for layoffs which are released weekly. But that is unlikely to be the case in today’s world. Given the excessive demand for labor, if business leaders fear slower growth ahead their first response will likely be to pull back some of the job openings that they hoped to fill. The latest available data on job openings are for April so they are somewhat stale. But at least through that month there is no evidence of emerging softness. Having said that, openings will almost certainly fall in the months ahead. But then look at what happened to job openings during the March/April 2020 recession. They dropped sharply, but that was also a quarter in which GDP declined 31%. Openings will not fall nearly as rapidly in the months ahead. Job openings will continue to exceed the pace of hires for months to come. The point is that the demand for labor remains so strong that upward pressure on wages and inflation associated with a tight labor market is unlikely to subside any time soon.

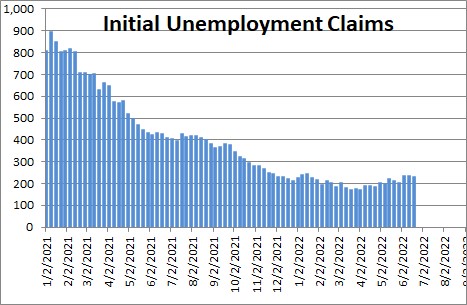

For wage pressures to abate the unemployment rate needs to rise. It is currently 3.6%. The full employment level is believed to be about 4.0%. At that level everyone who wants a job presumably has one. For wage pressures to subside the unemployment rate needs to climb above the 4.0% market to, say, 4.3-4.5%. But that is almost certainly not going to happen this year. The Fed expects the unemployment rate to be 3.7% at yearend. We look for it to be 3.4%. Layoffs for the most recent week of June 18 have barely budged. They were essentially unchanged at 229 thousand. This series hit a 50-year low of 185 thousand back in mid-April. As a result, we expect payroll employment to increase 350 thousand in June and the unemployment rate to be unchanged at 3.6%. Through midyear the labor market is still on a roll.

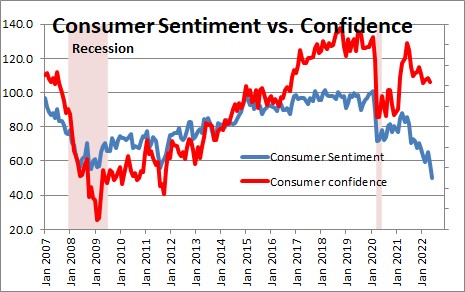

Given what has happened to the stock market since the end of last year and the dramatic rise in interest rates, it is almost certain that slower growth lies ahead. Recent data seem consistent with that theory. One piece of evidence has been the decline in the University of Michigan’s series on consumer sentiment which has plunged to a level below the bottom of the March/April 2020 recession and even lower than the low point in 2008-09. That seems scary, but the Conference Board’s measure of confidence has fallen by a far smaller amount. Only time will tell which series is correct but, thus far, the pullback in consumer spending has been far smaller than one might expect if the Michigan data were the better barometer. While confidence has dropped somewhat, how much of a pullback will we see in consumer spending?

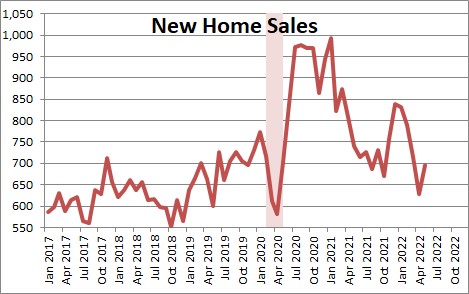

New home sales were another series that appeared to have fallen off the cliff as they initially sank to a 591 thousand pace in April which suggested that the housing market was collapsing. But suddenly the May data were revised upwards to 629 thousand and they then jumped 10.7% in June to 696 thousand. That changes the picture. A 700 thousand pace is roughly where sales were prior to the recession.

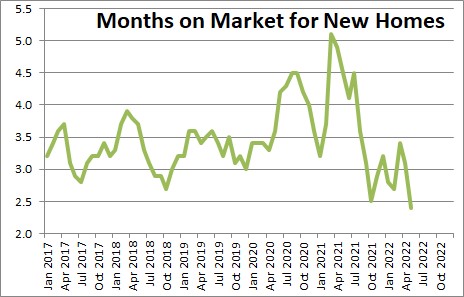

Furthermore, new home sales sat on the market for a record short 2.4 months in May. Demand for homes still seems solid. New homes are flying out the door. We believe that the primary problem with new home sales is a shortage of supply rather than a drop in demand.

So while home sales appear to have slipped somewhat in recent months, they have hardly collapsed. The labor market has shown few signs of softening. In our opinion, the market has prematurely reached a conclusion that growth is slowing sharply and that the Fed may be able to get away with raising the funds rate no higher than 3.4% by the end of this year. In short, the markets appear to be concluding that a soft landing is possible We are not so sure. We believe the economy is still far stronger than what many seem to believe. GDP growth in the second half of the year is likely to surprise on the upside, and inflation rate will remain stubbornly high. If that is the case the funds rate may need to be 5.0% or higher to produce the required slowdown in the pace of economic activity. As always, we will see.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me