March 15, 2024

We have written frequently about how the Fed’s temporary run-up in inflation turned out not to be temporary. Because wages have not kept pace with the jump in prices, consumer purchasing power has been reduced. This has soured consumer attitudes regarding the health of the economy. Consumers have reacted by substituting cheaper goods for some of their higher-priced favorite items. But they can push that string only so far. What happens when they have already made the switch? What then? The Fed is committed to reducing the rate of growth of inflation. It has no intention of reversing the earlier increase in prices. But should the Fed try to induce a little deflation to offset the cumulative increases that have taken place in the past couple of years? That sounds like a desirable income. But doing so would require higher interest rates which would increase the risk of a recession and boost the unemployment rate. If the inflation rate continues to slow, throwing people out of work to counter higher prices would probably result in a worse outcome than allowing consumers to gradually adjust to the overall higher level of prices.

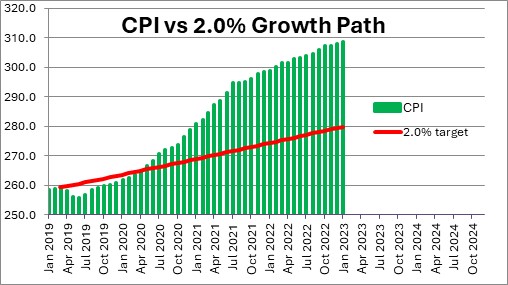

A recent Wall Street Journal article cited a consumer that used to buy Old Spice deodorant for years for less than $4.00 per stick, but suddenly discovered the price had doubled to $7.99. While that may be an extreme example, there is a lengthy list of products that consumers buy every day whose price has risen sharply. For example, beef steaks have risen 37%, milk 24%, eggs 95%, coffee 50%, chicken breasts 21%, gasoline 30%, car insurance 40%, car repairs 44%, and rent 22%. If the CPI had risen at the desired 2.0% pace from December 2019 (just prior to the pandemic) to February 2024, the cumulative increase would have been 7.2% — not 30-50%. All the prices noted above are for necessities – food, gas, and shelter — which cannot be easily avoided. Because lower income families spend about 80% of their take home income on necessities, the burden of higher prices is weighing most heavily on families that can least afford them. No wonder so many Americans are upset!

The level of the overall CPI today is 20.3% higher than it would have been if it had grown at the desired 2.0% pace for the past four years. So much for the idea of a “temporary” increase in inflation.

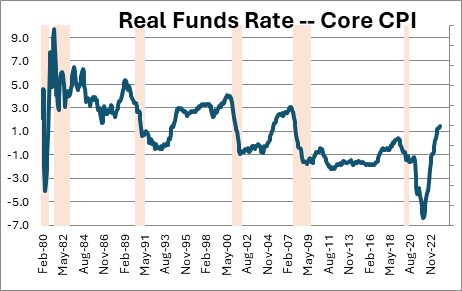

Given the impact of the unexpected run-up in inflation and its impact on the lowest income earning families, consumers would love a little deflation. Why shouldn’t the Fed seek a temporary decline in prices? That sounds nice in theory, but for that to happen significantly slower GDP growth would be required. In the past four quarters GDP growth has averaged 3.1%, To slow it to substantially would require a higher funds rate. The funds rate today is 5.5%, the core CPI is 3.8%, thus the “real” funds rate is 1.7%. Further Fed tightening would quickly push the real funds rate close to the 3.0% mark, which is a level that in the past has triggered a recession. To risk a recession at a time when the inflation rate is widely expected to gradually slide towards 2.0% makes no sense.

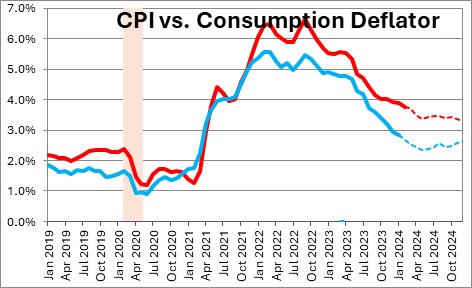

So what do consumers do to counter the sting of higher prices? They substitute lower-priced items for more costly ones like store brands vs. name brands. They shop at discount stores. These changes in behavior are reflected in the difference between the CPI measure of inflation and the personal consumption expenditures (PCE) deflator which is the inflation measure that the Fed targets. The CPI measures month-to-month changes in a fixed basket of goods and services that the consumer purchases every month. The PCE deflator is different. It is a weighted measure of inflation. That means that if a consumer buys the store brand of toilet paper rather than Charmin, the PCE deflator will give a greater weight to the lower-priced good. If the price of the store brand and Charmin are unchanged in a given month the CPI will show no change in prices while the PCE deflator will register a decline because it gives greater weight to the lower-priced product. That is the primary reason why the PCE deflator always rises less than the CPI. In the 10-year period leading up to the recession the difference between the two measures averaged 0.3%. In the past two years the difference has averaged 0.8% and in recent months it has hit the 1.0% mark. Consumers are making a concerted effort to seek lower-priced options. But one wonders how long this can go on. Once they rely solely on store brands and have begun to shop at discount stores, what next?

Our hope is that the CPI inflation rate continues to shrink towards the 2.0% mark which will counter the need to constantly seek lower prices. We think it will.

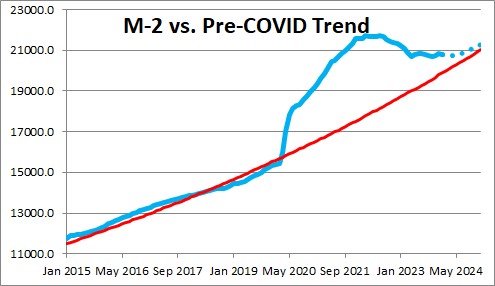

We remain confident that the downtrend in inflation will continue because of steady declines in the money supply which have nearly eliminated the surplus liquidity in the economy that was the cause of the run-up in inflation in the first place. At its peak the economy was awash with $4.0 trillion in surplus liquidity. Today that has shrunk to $0.9 trillion and, if the money supply continues to decline for a couple more months the remaining surplus liquidity should disappear by midyear. That would pave the way for further reductions in the inflation rate and eventual rate cuts by the Fed.

The bottom line is that higher prices are here to stay, but if the Fed can continue to reduce the inflation rate consumers will gradually adjust to the new, higher, level of prices. Unfortunately, that will take a while.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me