September 15, 2023

As data continue to flow in, third quarter GDP growth seems likely to be a solid 3.5%. But in October as student loan borrowers resume payments on their debt the pace of consumer spending is almost certain to slow. At the same time workers at the Big Three automobile manufacturers are on strike. Nobody knows how long the strike might last, but it will have a negative impact on GDP growth in the near-term, but will provide a positive boost to growth once the strike ends. All of these pieces suggest that fourth quarter GDP growth will not be nearly as robust as the third quarter. But we have heard this story before. It was not long ago that virtually every economist was convinced that the U.S. economy would be in recession in the second half of this year. That obviously has not happened. The cardinal rule of economics is to never underestimate the strength and resilience of the U.S. economy. The inflation data continue to be favorable with one notable exception – oil prices. While energy prices are excluded from the calculation of the core rate of inflation, the reality is that they filter into other sectors of the economy — like the cost of jet fuel for airlines and the price of diesel for truckers. It is still unclear to us that the Fed has done enough to reduce inflation to the 2.0% mark any time soon. Somewhat higher rates may still lie ahead. But it seems inappropriate to raise rates in the midst of an auto workers strike and an uncertain economic environment. Expect the Fed to sit tight at its meeting this coming week. What happens beyond that date is anybody’s guess.

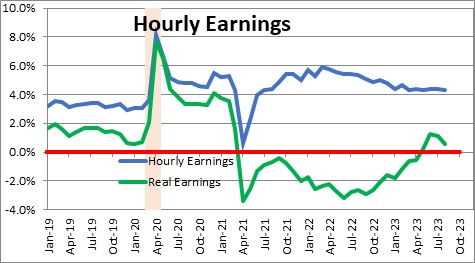

Adding up the tidbits of information available for July and August, GDP growth in the third quarter seems particularly robust at about 3.5%. That burst of growth surprised everyone. But it seems unlikely to last. Real wages have been declining for the past couple of years which means that consumer purchasing power has been eroded by the run-up in inflation.

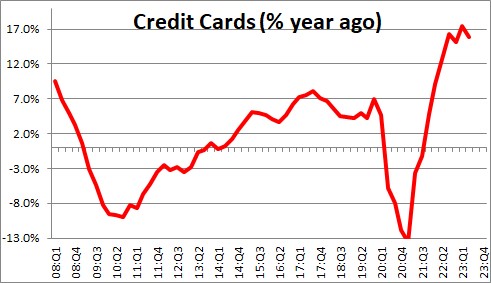

To maintain their pace of spending consumers have pulled out their credit cards. Outstanding credit card debt has risen 17% in the past year. That is not sustainable. Credit card borrowing is super-expensive. While there may be an introductory rate of 0% for a year or so, the regular rate jumps to 20-25% thereafter. Credit card borrowing is not a reliable source of credit over the longer term.

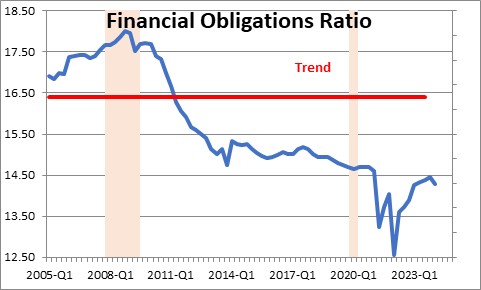

Having said that, credit cards may well be a significant source of funds for consumers for a while longer. Consumers do not have a lot of debt outstanding. Monthly payments on all types of consumer debt – like rent or a mortgage payment, car loans, credit card balances, and student loans – as a percent of income is very low. It appears that in 2020 and 2021 when the government was doling out stimulus checks consumers used much of the proceeds to reduce debt. Monthly payments as a percent of income fell to a record low level. The jump in outstanding credit card balances has caused that ratio to rise, but it started from a record low level and remains far below the 16.4% average over the past 20 years. A 0% introductory rate for a year or so and the fact that consumers still have very little debt outstanding means that they could use their credit cards to fuel spending for some time to come.

Beginning in October student loan borrowers will have to resume monthly payments to the government. They have not had to make payments in over three years. But that longstanding reprieve is coming to an end. Those borrowers may have had an additional $200-300 every month to spend for the past several years. But no longer. Now that $200-300 has to be shipped off the Federal government. Clearly, this will act as a brake on consumer spending in the months ahead.

And now, for the first time in history, the United Auto Workers Union has staged a strike against all of the Big Three automakers simultaneously. Unlike previous strikes all auto workers will not walk off the job at the same time. Instead, the UAW will target specific plants for each company. The idea is to curtail the auto manufacturers ability to produce while reducing the number of UAW workers that are on strike – at least initially. The union estimates that in the first phase only about 13,000 workers out of the UAW’s 145,000 members will walk off the job. If the talks drag on unsuccessfully for some period of time, almost certainly more and more workers will be affected. Clearly, the strike will negatively impact GDP growth as long as the strike lasts. But all strikes eventually end and workers will at some point return to the job. When that happens GDP growth will receive a significant boost. Over the longer-term the impact of the strike on the economy will be temporary, but it certainly muddies the waters about what might be happening to the economy in the absence of the strike.

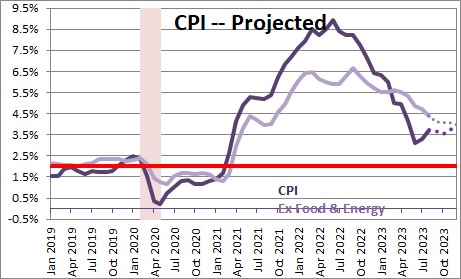

On the inflation front, the core CPI rose 0.3% in August after having gained 0.2% in the previous two months. So far, so good. But energy prices have surged in the past couple of months. At the end of June the price of West Texas Intermediate oil was $70 per barrel. Today it has jumped by 28% to $90 per barrel. In the calculation of the core rate of inflation food and energy prices are excluded because they tend to be very volatile. But be careful. Energy prices filter into many of the so-called core CPI prices. For example, airlines use jet fuel and if the price of jet fuel rises so do airfares. Truckers use diesel fuel and truckers deliver every single good included in the CPI. Do not be too quick to write off completely the increase in energy prices. It will produce an upward tilt to the underlying core rate of inflation.

Against this somewhat murky background, it is not at all clear that the Fed is done tightening. That remains to be seen and depends upon GDP growth for the fourth quarter and the extent to which rising energy prices filter into the CPI. But right now the situation is sufficiently unclear that the Fed will almost certainly leave the funds rate at 5.5% this week. It meets again in late October and mid-December. We expect the Fed to raise the funds rate to 5.75% at one of those meetings, and hike it again in late January to the 6.0% mark. But those two moves should be characterized as fine-tuning. The Fed has already boosted the funds rate from its initial starting point near 0% to 5.5%. The bulk of its work has already been done. Unless the inflation rate does something far different from what is expected, another couple of rate hikes to 6.0% should not be particularly troublesome.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me