September 30, 2022

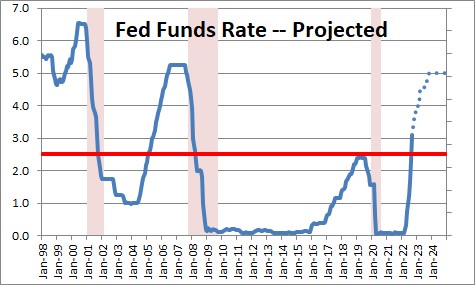

We continue to believe that consumer and business sentiment ratcheted downwards after September 21 when Fed Chair Powell emphasized that the Fed was willing to tolerate a recession as an unfortunate consequence of its effort to reduce inflation. The S&P 500 index has fallen 23% from its record high level in early January. Bond yields have risen almost two percentage points. Stock and bond market investors have come to expect a recession. The likely further decline in consumer and business confidence should soon translate into an even slower pace of economic activity. But will the current near-record level of job openings quickly disappear and be followed by layoffs? Will the housing market see potential buyers disappear in anticipation of lower prices ahead? Will consumers begin to worry about whether they will have a job at the end of the year and slow their pace of spending? Will manufacturers finally see a sharp drop in orders and curtail production? We expect all of these things to happen, but the question is one of degree. A key positive factor for our economic outlook is that real interest rates remain negative and, in the past, a positive real funds rate of several percentage points was required to produce a recession that would then translate into a meaningful drop in inflation. We expect to see slow (and perhaps even slower) GDP growth for the next several quarters, and a modest slowdown in inflation. But those developments will not be enough to deter the Fed from a steady diet of sizable rate hikes until such time as inflation shows clear evidence of slowing rapidly. We are not there.

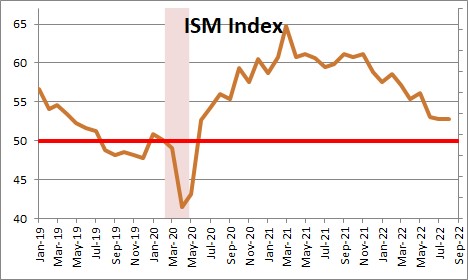

This coming week will bring with it the purchasing managers reports for both the manufacturing and service sectors. For the manufacturing sector the index currently stands at 52.8 in August. Because it remains above the 50.0 level the manufacturing sector was still growing in that month. But what will it do in September? We anticipate a decline to about 51.0.

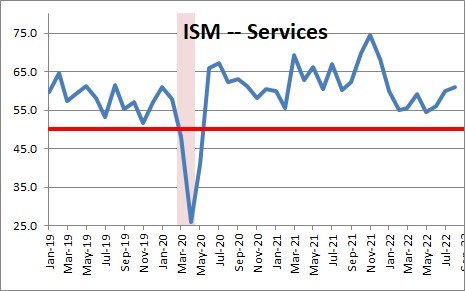

The service sector index is currently at a relatively robust level of 60.9. It should decline, but to only about 57.0 which would mean this important sector of the economy is continuing to expand at a respectable pace.

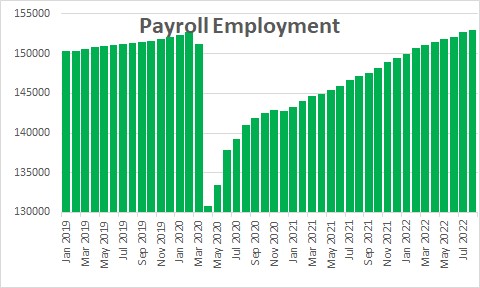

At the end of next week will be the September employment report. Contrary to expectations, layoffs actually declined steadily throughout the month. In the past three months payroll employment has risen on average 375 thousand per month. We expect to see an increase in employment of 300 thousand for September. If that estimate is correct there is still no evidence of any significant weakening in the labor market.

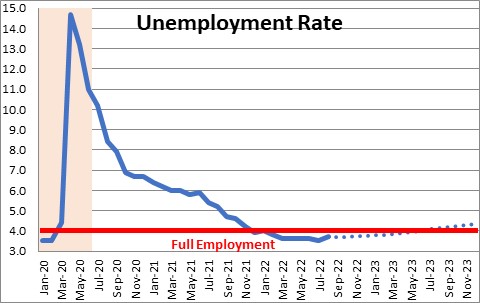

If the economy registers 300 thousand new jobs in September, the unemployment rate should remain at 3.7% which remains below the so-called full employment level of 4.0% at which point everybody who wants a job has one. But that is not what the Fed needs to see. It sounds crass, but it wants to see a few workers without jobs which would boost the unemployment rate to 4.5% or so. If that occurs there will be more workers available for firms to hire which should, in turn, take some of the pressure off wages. But every month economists keep waiting for labor market softness to emerge and it remains elusive.

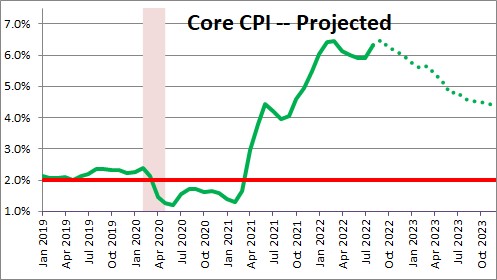

On October 13 we get the all-important CPI data for October. We expect an increase of 0.1% overall as energy prices continue to slide. But we also expect the CPI excluding the volatile food and energy categories (the so-called core CPI) to rise 0.4%. Importantly, that would boost the year-over-year increase from 6.3% to 6.5%. That is obviously inconsistent with the idea that the peak inflation rate has been reached.

On October 27 we get our first look at third quarter GDP. We expect a modest gain of 0.5% after having declined in each of the first two quarters of the year. That would suggest that the economy is expanding at a slow pace, but it is inconsistent with the idea that the economy is in recession.

The Fed meets again on Wednesday, November 2 and we expect another increase in the funds rate of 0.75% from 3.25% to 4.0%. Even with the funds rate at the 4.0% mark, inflation is running higher than that at 6.5%. The real funds rate remains negative at -2.5%. The Fed will still be supporting a monetary policy that is not yet tight enough to bring down the inflation rate.

November 8 will bring the House and Senate elections. The polls suggest that Republicans will be able to capture the House of Representatives while Democrats maintain control of the Senate. If that is the outcome, divided government would probably be viewed as a positive event for the markets. But do the polls have it right?

We are looking for clear evidence that the pace of economic activity is slowing (or even contracting), and that inflation is finally moving in the right direction. But the data available through October seem unlikely to support that notion. November perhaps?

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me