April 1, 2022

The President recently released his 2023 budget. Throughout history, the federal government has boosted spending during the bad times as tax revenues decline and expenditures climb. In good times the government is supposed to take advantage of enhanced tax revenues to reduce spending and shrink the deficit. These are the good times. Government spending should be curtailed. Debt as a percent of GDP is supposed to be declining. But yet the president proposes huge tax increases, an even greater amount of government spending, outsized budget deficits every year for the next ten years and, as a result, debt outstanding climbs to a record high level. In short, President Biden hopes to dramatically increase the role of government in our society. Furthermore, the proposed budget deficits are based on steady GDP growth for the next decade. What happens if the economy slips into recession? Budget deficits exploded during both 2008-09 and 2020-21 recessions. It will happen again. If debt in relation to GDP is at a record high level prior to the recession, it will soar once the recession starts. This is not a sustainable situation.

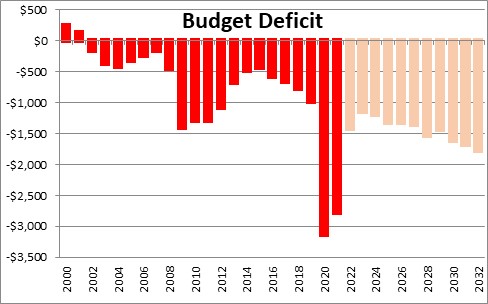

According to the president, budget deficits for the next 10 years average $1.4 trillion. The deficit first to pierce the $1.0 trillion mark occurred in the 2008-09 recession. After four consecutive years in excess of $1.0 trillion deficits shrank to more manageable proportions for the next seven years. Then came 2020 and 2021 and suddenly deficits skyrocketed to $2.5-3.0 trillion. President Biden’s budget never envisions a deficit that is less than $1.0 trillion.

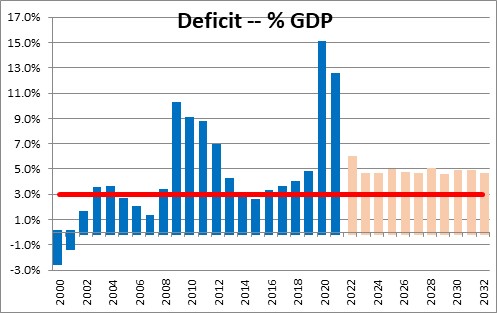

Those are eye-popping numbers, but deficits are most accurately gauged in relation to GDP. Even looked at in this manner the conclusion is the same – these projected deficits are far too big. The economics profession believes that a budget deficit that averages about 3.0% of GDP is sustainable. They can be bigger in the bad times but smaller when the economy is cruising. In fact, in the 50-year period from 1970-2020 the budget deficits averaged exactly 3.0%. But this Administration has no intention of shrinking them – ever. In the next 10 years the budget deficit averages 4.8% of GDP.

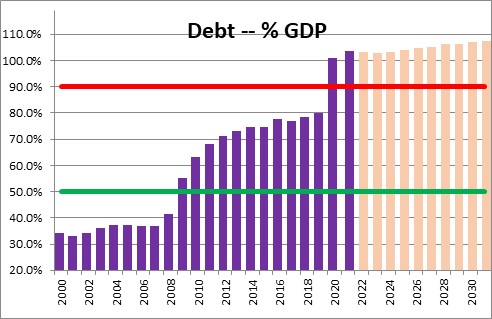

Whenever the government runs a budget deficit it must borrow an equal amount to finance the shortfall. For a deficit of $1.4 trillion, the government must issue $1.4 trillion of debt. Over the next 10 years the government will add, on average, $1.4 trillion to debt every single year. As a result, debt outstanding as a percent of GDP climbs from a near-record 102.7% last year to an unprecedented 106.8% by 2032. Economists generally believe that a debt/GDP ratio of 50% is sustainable over time. They also believe that when it gets to about 90% it can become a problem. We blew through that apparent danger level in 2020. By the time we get to 2032 it will have climbed to 106.8%.

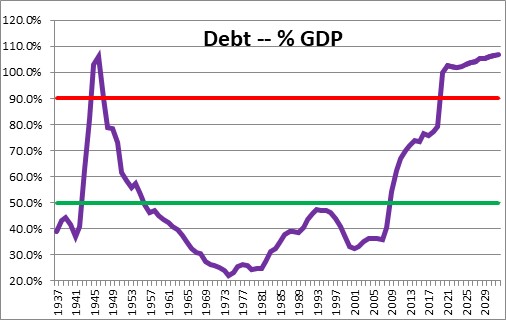

Prior to 2020 the record debt/GDP ratio was 106.2% right after World War II ended in 1946. At that point government spending declined dramatically. The economy regained its footing and tax revenues soared. The deficit quickly shrank and for 50 years stayed below the sustainable 50% level. But it soared when the 2008-09 recession hit and it has been steadily climbing since. The problem today is that government spending today cannot shrink quickly because 70% of all government expenditures are some type of entitlement – Social Security, Medicare, Medicaid, Veterans benefits, or welfare benefits. Without a cut in entitlement spending lawmakers can only cut the remaining 30%. Budget deficits will never shrink unless our policymakers have the courage to reduce entitlements and that is not going to happen any time soon. Each one of those benefits represents income for somebody. For a policy maker a vote to cut any of those benefits is like touching the third rail. They will most likely lose their seat in the next election and their political career will come to an end.

So where is the problem? Too few revenues? Too much spending? Easy. Too much spending.

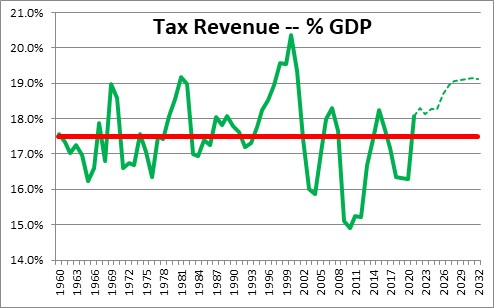

Over the past 50 years tax revenues as a percent of GDP averaged 17.5%. Biden’s budget indicates that revenues will average 18.7% of GDP over the next 10 years. Thus, his budget anticipates tax revenues 1.2% higher than their long-term average. This hardly seems like the time to introduce a new billionaires tax, increase the corporate tax rate from 21% to 28%, and boost the top individual rate from 37.0% to 39.6%. Tax revenues have only been higher one time in the past 60 years – the late 1990’s when the economy was booming. Watch your wallet. The tax man cometh.

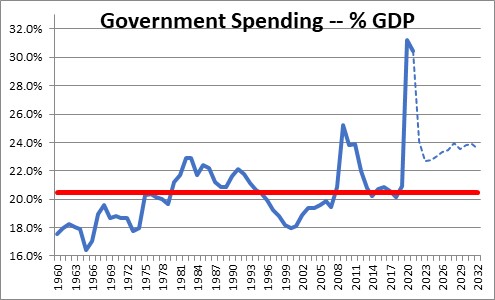

On the expenditure side the White House proposes spending that averages 23.5% of GDP versus a long-term average of 20.5%. Spending has only been higher during World War II when it averaged 41% of GDP, and during the 2020-2021 pandemic when it averaged 31%. Much of this spending is on climate control, veterans benefits, public health, and education. This turbo-charged pace of spending causes the budget deficit to soar and pushes debt outstanding to a record high level.

It seems to us that by significantly raising taxes and using those funds to finance a variety of questionable progressive spending initiatives, President Biden is choosing to expand the role of government in our society. If, as presented, debt climbs to a record-breaking 106.8% of GDP in good times, what might happen if the economy stumbles into a recession some time between now and 2032? These are the good times. Government spending should be curtailed and debt as a percent of GDP should be reduced. This budget does the exact opposite. Does the American public want the size of government in our society to expand far beyond what it has at any time in our history? We hope not.

Stephen Slifer

NumberNomics

Charleston, S.C.

May God save us all. It may well be our prayer for a long time.