October 23, 2020

With every passing week the pace of economic activity remains robust. Signs of the long-awaited slowdown are elusive. While logic suggests that the economy should sputter as fiscal stimulus abates, the incoming data suggest otherwise. The labor market and the housing market, in particular, are on a roll. Following an expected 30.0% rebound in economic activity in the third quarter, we believe that GDP will continue to climb at a 10.0% growth rate in the fourth quarter. American consumers and business people are proving to be amazingly resilient in the face of adversity. Will growth in the 2020’s duplicate the “Roaring Twenties” of a century ago?

Over the next two weeks we will learn a lot. We will get our first look at third quarter GDP growth on Thursday, October 29. Following the 31.4% decline in the second quarter the consensus appears to be for an increase of 30.0%. Most economists will probably attribute the rebound to fiscal stimulus and conclude that growth will slow dramatically in the fourth quarter and beyond. We disagree.

Then comes the election on November 3, we read the polls like everybody else, but we also remember what happened in 2016. If Democrats sweep the presidency and both houses of Congress, their growth initiatives will boost GDP growth, but probably not until 2022. It will take them time to formulate the legislation and then implement the agenda. Republicans will do their best to delay things. The outcome seems likely to affect GDP growth in the years 2022 and beyond rather than 2021. Anything less than a Democratic sweep suggests that a legislative stalemate will continue for the foreseeable future.

On November 6 we get a very important piece of information — the October employment report which will show that the economy remains on a roll as the fourth quarter gets underway. We believe that payroll employment will climb by a solid 1 million workers and the unemployment rate will decline 0.8% to 7.1%. The consensus appears to be for an increase of about 600 thousand and no change in the 7.9% unemployment rate. Those estimates appear to be way off the mark. The weekly data on initial unemployment claims, the number of people receiving unemployment benefits, and the insured unemployment rate, all point to continued strength in the labor market.

Part of the employment story every month is the number of layoffs – how many people lost their jobs. The weekly claims data continue to decline. In the past four weeks initial claims have fallen on average by 20 thousand per week, and this past week dipped below the 800 thousand mark for the first time since March. Prior to the recession claims were averaging about 225 thousand per week. People continue to lose their jobs and the labor market cannot be deemed healthy until they have fallen to their pre-recession level. We have a ways to go.

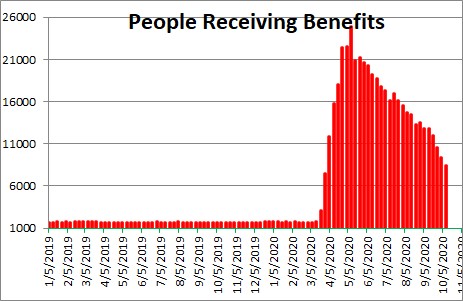

But there is more to the story. While some workers lose their jobs, many more are being hired. If 800 thousand workers lose their job in any given week but the number of people receiving unemployment benefits declines, then employment must have risen dramatically. The number of people receiving unemployment benefits peaked at 25 million in early May. In the most recent week it fell to 8.4 million. In the past four weeks it has declined on average by 1.1 million per week. Prior to the recession this series was fairly steady at 1.7 million. There are 11 weeks to go. Could the benefits data hit the pre-recession 1.7 million mark by the end of this year? Probably not, but it might be close.

The same conclusion can be reached by looking at the insured rate of unemployment. It is the number of people who are receiving unemployment benefits as a percent of the labor force. It is not a completely accurate barometer of what is going to happen to the unemployment rate. People can be unemployed and looking for work, but not receive unemployment benefits. Those people will be counted in the official unemployment rate, but not in the insured unemployment rate. Nevertheless, the two series behave similarly. This series peaked at 17.1% in early May and has fallen steadily to 5.7% in the most recent week. Indeed, in the past four weeks this series has declined 0.7% per week. Prior to the recession this series stood at 1.2%. It, too, could hit its pre-recession level by yearend. For what it is worth, we expect the employment rate for October to decline 0.8% from 7.9% to 7.1%. But the chart below suggests that an unemployment rate somewhere in the 6’s is not out of the question for October. The labor market continues to improve faster than anyone expected.

So how does all this impact our estimate of fourth quarter GDP growth? It boosts it from 7.0% to 10.0%. Most economists expect fourth quarter growth to be 2.0-3.0%. We disagree. Consider the following:

First, if payroll employment rises by 1.0 million workers in October and the weekly data continue to decline in mid-October, it is hard to imagine that employment will come to a screeching halt in November or December. People have been expecting that the happen for months, but there is still no sign of softening in the labor market.

Second, if employment rises and the unemployment rate falls, consumer income will continue to climb which will provide the fuel for consumers to keep spending at a rapid pace in the fourth quarter.

Third, consider the housing market. It is on fire. Existing home sales jumped 9.4% in September to a 6.5 million pace which is the fastest since 2006. Furthermore, there was a 2.7 month supply of homes available for sale. That is less than half of the 6.0 month supply that realtors believe is the point at which demand and supply are in balance. If more homes were available for sale, existing home sales would exceed 7.0 million. The average home remained on the market for 21 days in September – the shortest time from listing to sale ever. Why is all this happening? Clearly, a record low 2.9% mortgage rate is enticing to every potential buyer. Furthermore, with the ability to work from home, sales in summer resort locations like Lake Tahoe, the mid-Atlantic beaches and the Jersey shore are booming. Do we seriously believe that this extraordinary demand for housing is going to abate in the fourth quarter?

While common sense suggests that the labor market and GDP growth should soon slow, the most recent data suggest that the economy is far more robust than even the optimists expected. American consumers and business people are proving, once again, to be remarkably resilient in the face of adversity. The 1917-1918 pandemic was followed by the “Roaring Twenties” as cooped up Americans went on an extended spending spree. Could it happen again – a century later?

Stephen D. Slifer

NumberNomics

Charleston, S.C.

If there’s a GDP choaker over the 4th qtr horizon, it might could be C-19 taking off again across the country and globe, followed by more socialization constraints.

Hi Patrick,

You raise a very valid point. But yet we as consumers seem like we are so tired of being cooped up we don’t seem to care as evidenced by the housing market and retail sales. Businesses even now through mid-October seem very willing to hire. Does that change between now and yearend? I guess we are going to find out.

Steve

I come from a country in the middle of it’s second lock down. People treat it differently the second time around and there is a much larger business blackmarket.

Steve,

I enjoy your comments and analysis.

To tag on to the previous comment, as more people go back to work aren’t you concerned you will see an uptick in the C-19 cases which will then mean people either go to work sick because they have bills to pay – and risk infecting other workers and their family – or get too sick to work and lose their job, placing a greater stress on the healthcare system especially if they lose their healthcare coverage. So if the businesses are willing to hire, they may not have a pool to draw from if they need skilled workers – because they are sick or don’t want to risk infecting the vulnerable at home.

Based on your research, have you been able to quantify the impact of a strategy that just lives with C-19 will have on GDP?

On the home sales, I would assume people are selling their old homes. Are you seeing a glut of inventory in the urban centers where, I assume, many of those purchasing these homes are moving from?

And finally, could you share your thoughts on what we should be looking for when talking about a “V” or “K” shape recovery?

Thanks,

Hi Yair,

Thank you for you comment. You have some experience with the second wave which is just beginning in the U.S. Perhaps it is still early, but people STILL do not seem to be treating this seriously. And in the U.S. any sort of nationwide lockdown like what we had in the spring would not work. There would be serious resistance. People want to go to bars and sporting events. Restaurants and airplanes not so much. Yearend is only about 2 months away and, hopefully, a vaccine will begin to be available. Once that happens, people should gradually fell more comfortable going all sorts of places.

Best.

Steve

Hi Taylor.

Always good to hear from you. I don’t know any more about the course of this virus than you do. But what I am banking on is that a vaccine becomes available sometime around yearend. Once that happens, I think that we will all be far more willing to go to all sorts of things — restaurants, bars, airlines, etc. I fully understand that there may take some time for it to be accepted. But if Fauci takes it I suspect the fear factor will disappear fairly quickly.

Regarding your comment about employers having a hard time finding bodies, it is important to note that the number of people receiving unemployment insurance benefits has been falling by 1 million workers per week for the past four weeks. Presumably, those people are getting hired. It looks like, thus far at least, employers are having no difficulty finding workers. In March and April 22 million people lost their jobs.

Employment has increased by 11.4 million in the past 5 months and I am looking for a further increase of 1 million workers in October. With 12.6 million still unemployed workers, it does not appear that employers are having any problem thus far. Lots of people have gone back to work and the virus has picked up somewhat. But it is not clear they are getting it at the workplace. Seems like bars, football games, huge weddings, etc are the primary culprits. If the vaccine becomes available soon we should be OK.

Finally, re: home sales. They seem to be booming everywhere. I have not seen sufficiently detailed data to be able to answer your question accurately. Sales are are up sharply in each of the 4 regions of the country — northeast, midwest, south, and west — but that is not too helpful. My sense is that what you are suggesting — a glut of unsold homes in large metropolitan areas — is probably true to some extent. But it could also be that many of the ones fleeing are renters. I found some data on rent declines in large, expensive metropolitan areas. They seem to be dropping sharply which is an indication that they are probably some of the ones who may be buying elsewhere. Most of the rent data I found is pretty stale and therefore unhelpful. But try this: https://www.zumper.com/blog/rental-price-data/

Hopefully the economy can hang in there until a vaccine becomes available.

Best.

Steve

Thank you!