August 6, 2021

The economy is charging ahead in the first month of the third quarter. Employment increased by 950 thousand workers in both June and July. The unemployment rate fell 0.5% in a single month to 5.4%. After Labor Day, once the Federal unemployment benefits expire, more workers will jump back into the labor force and almost certainly find jobs. Meanwhile, some of the supply shortages that have been constraining the production-side of the economy will begin to abate. That holds the prospect of turbo-charged GDP growth in the third and fourth quarters. For what it is worth, we currently anticipate 8.9% GDP growth in the third quarter and 10.5% growth in the fourth quarter. Some suggest that the increase in new COVID cases could retard growth in the months ahead. We strongly disagree. Rather than cowering in fear and cancelling vacation plans, consumers are anxious to get life back to normal. Businesses are certain there will be no lockdowns ahead and are hiring every able bodied worker they can find. Growth will eventually slow, but that point in time remains far down the road.

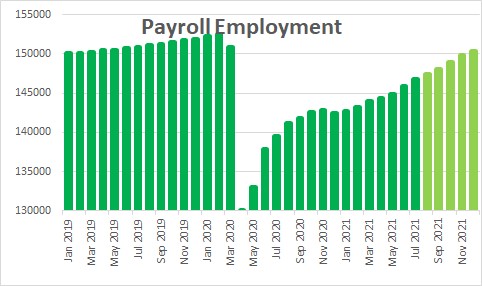

Payroll employment jumped 943 thousand in July after climbing 938 thousand in June. While many workers continue to live off generous unemployment benefits, and others contemplate whether they want to return to their previous low-paying place of employment, the data suggest that those restraints are rapidly disappearing. Employment remains 5.7 million below its pre-recession peak, but it is closing the gap quickly. We expect payroll employment to climb by 700 thousand per month between now and yearend which will reduce the shortfall to 2.2 million by December.

With that pace of job creation the unemployment rate should continue to drop from 5.4% in July to 4.4% by yearend and on to the 3.5% mark by the end of 2022. The Fed considers 4.0% as the full employment threshold. We are not there yet but should reach it early next year.

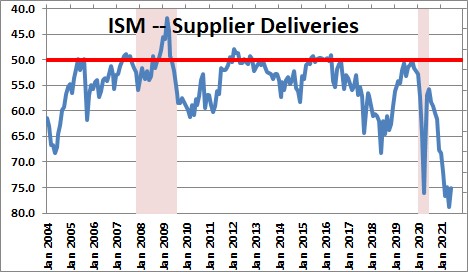

At the same time some of the supply constraints that are curtailing production should abate by yearend. The supplier delivery component of the Institute for Supply Management’s monthly survey shows that supplier deliveries to the manufacturing sector are the slowest in almost 50 years. The ISM Chair for the Survey Committee Timothy Fiore said that in July, “Companies and suppliers continue to struggle to meet increasing demand levels. As we enter the third quarter, all segments of the manufacturing economy are impacted by near record-long raw-material lead times, continued shortages of critical basic materials, rising commodities prices and difficulties in transporting products. Worker absenteeism, short-term shutdowns due to parts shortages and difficulties in filling open positions continue to be issues limiting manufacturing-growth potential.” These supply problems will eventually be overcome but it is likely to be a slow gradual process which should continue until this time next year. Nevertheless, we expect a faster pace of production to enhance GDP growth in each of the final two quarters of this year.

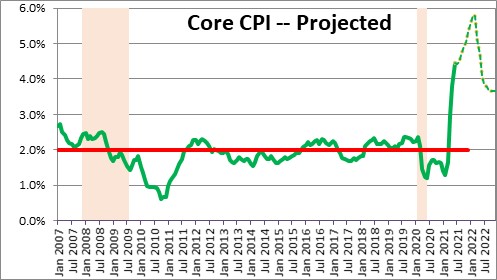

With the demand side of the economy expanding at a torrid pace and production increasing but continuing to fall short of demand, it is inevitable that the inflation rate will expand rapidly in the months ahead. We expect the core CPI to rise 5.3% this year and 3.7% in 2022. That will not be fast enough to entice the Fed to raise rates sooner than the early 2023 framework that it has talked about previously, but it will expedite the discussion about the termination of its $120 billion per month purchases of U.S. Treasury and mortgage-backed securities. We still suspect the so-called “taper” process will begin in January and continue through the end of next year paving the way for higher rates in 2023.

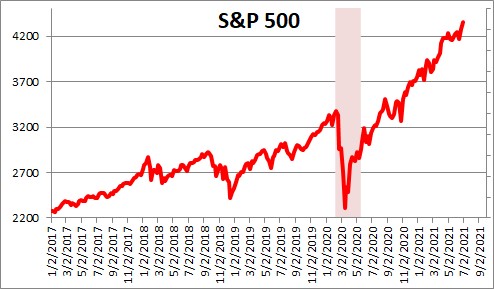

Finally, with rapid GDP growth, moderate inflation (which will boost pricing power), and no chance of any change in rates on the horizon, the stock market should continue to soar. It closed at yet another record high level this week and seems destined to plow its way upwards between now and yearend. None of that precludes some sort of correction in the interim, but any pullback should be viewed as a temporary phenomenon.

Onward and upward!

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me