December 15, 2023

Looking ahead to 2024 the economy should largely shrug off the remaining impact of high interest rates and not slip into recession. Inflation should continue to trend lower but its rate of descent will be less pronounced than in this past year. It is unlikely to reach the Fed’s 2% target until sometime in 2025. With inflation continuously shrinking, the Fed will switch gears and let rates start to decline sometime in the summer. By the end of next year we suspect the current 5.5% funds rate will have declined to 4.75% and will continue its descent in 2025. This is a world with moderate growth, inflation steadily shrinking, and interest rates beginning an extended period of descent. What’s not to like? The Fed may actually achieve the often elusive soft landing. Typically when the Fed lifts rates both sharply and quickly the end result is a disaster. But not this time. The upcoming year seems merry and bright.

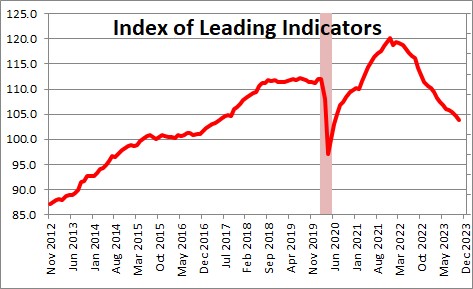

One reason so many economists have been predicting a recession is because the index of leading indicators has been declining for the past two years. This index typically gives 3-6 months warning that the economy is about to tip over the edge into recession. The economy should already be in recession. It is not. It appears that the relationship between the ten leading indicators that comprise this index and the economy has changed and — for now at least – it has become a misleading indicator.

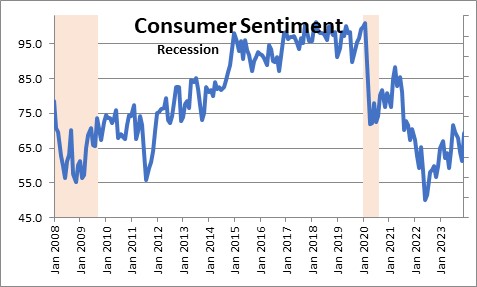

Any discussion of the economy begins with consumers because their spending accounts for two-thirds of GDP. Surveys of consumer sentiment indicate that the consumer is nervous about the direction of interest rates, inflation, the U.S. political environment, and increasing global tensions in a variety of hotspots. Indeed, sentiment is much worse today than it was in 2020 and roughly in line with the 2008-2009 recession which was the longest and deepest recession since the depression in the 1930’s.

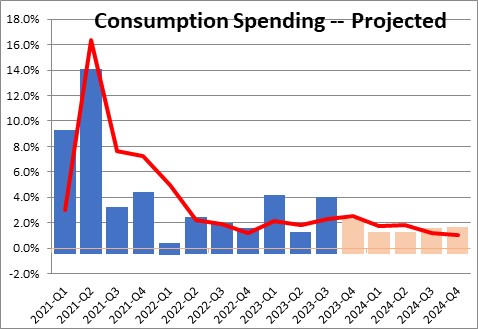

But it is hard to square consumer fears with their pace of spending which, thus far, has not budged. Typically, when consumers get nervous they cut back on spending. But consumer spending has been very steady at a respectable 2.3% pace. Having said that there are reasons to expect this pace of spending to slow. First of all, the savings rate typically averages about 7.0%. Today it is 3.8% or roughly one-half of the norm. When inflation rises and families have to spend more on necessities it is far more difficult to save for a rainy day.

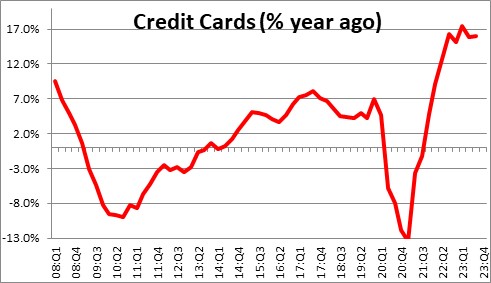

In an effort to maintain their lifestyle consumers have been relying on their credit cards. Credit card borrowing has risen 17% in the past year. But credit card debt is extraordinarily expensive and cannot continue to grow at that pace forever. However, it can continue to climb for a while because the consumer has so little debt.

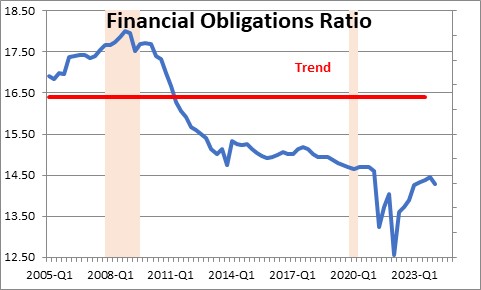

The financial obligations ratio, which is the sum of consumers’ combined monthly payments on the rent/mortgage, car loans, credit card bills, student loans, etc. as a percent of income, plunged shortly after the recession. Presumably consumers used some of the $1,000 stimulus checks to pay down debt. Hence, this ratio fell to its lowest level since the 1980’s. The surge in credit card borrowing has boosted this debt ratio, but given that it started at a record low level and remains far below its average for the past 20 years, consumers can add to credit card debt for at least another year.

In addition, there is the resumption of payments on student loans. For the past three years student loans borrowers have been able to spend their previous monthly student loan payment on whatever they wanted. No longer. They now have to mail off a check to the government for that amount .

For all of these reasons we suspect consumer spending will slow in 2024 from 2.3% currently to perhaps 1.0%.

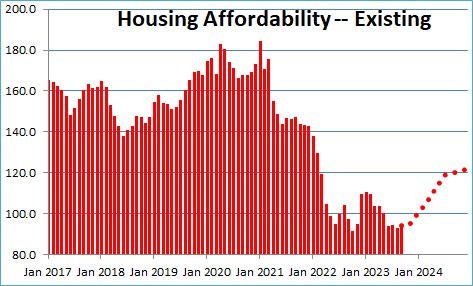

In the housing market, existing home sales have plunged. Mortgage rates climbed from 3.0% to 7.5%. Home prices jumped 45% from the end of the recession to the middle of last year.

Housing affordability has fallen to the point where a median income-earning family has 5% less money than is required to purchase a median-priced house. But as inflation steadily slows and the Fed starts lowering the federal funds rate, mortgage rates will decline. If that is the case, a median income-earning family should have 20% more income than is required to purchase a median-priced home by this time next year. Increased affordability will undoubtedly boost home sales.

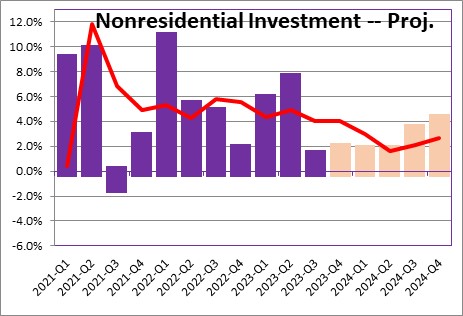

Business people continue to invest at about a 4.0% pace. That is somewhat surprising given that the Fed has been rapidly raising interest rates, wages are rising, and recession fears abound. Typically in that situation investment spending declines. That has not been the case this time. This investment growth has been led by spending on technology. When firms have relatively steady demand for their products, they will usually hire additional bodies. But when those workers are unavailable, firms may opt to spend money on that latest piece of software that will enable them to boost production without increasing headcount. Since the supply of labor will not be any more abundant in the coming year, we envision nonresidential investment continuing to climb at a slightly slower 2.5% pace.

When we put all this together, we come up with a GDP forecast of about 1.5% in the fourth quarter of this year, followed by roughly 1.0% growth in the first half of next year, and 1.5-2.0% growth in the second half once the Fed begins to ease. We are not expecting a recession.

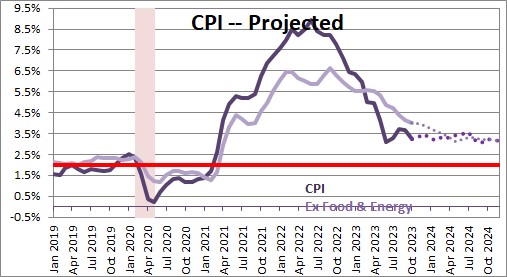

The inflation rate should continue to shrink, but it is unlikely to reach the Fed’s 2.0% target any time soon. The CPI has slowed from its peak of 9.0% to 3.2% but a lot of that drop came from the frequently volatile food and energy components. Economists typically exclude those two categories from the calculation and focus on the remainder which is known as the “core” rate of inflation. It, too, has slowed but less rapidly from a peak of 6.3% to 4.0%.

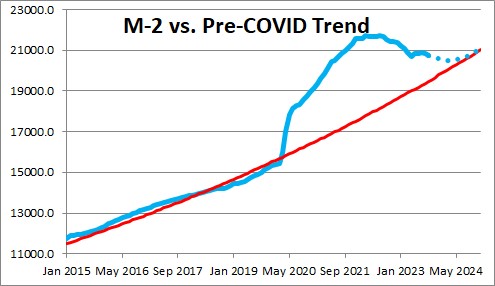

What gives us considerable confidence that inflation will continue to subside is the steady shrinkage of the money supply. We cannot overstate the role that the money supply has played in both the rise and subsequent decline of inflation. Money is simply a measure of liquidity that is available throughout the economy – the sum of cash in our wallets, our checking account, savings account, and money funds. These assets can be instantly tapped to buy anything we want today, tomorrow, or next week. The money supply typically grows at about a 6.0% pace. Did that for years. But when the economy tanked in March and April 2020 the Fed bought $4.0 trillion of securities in the course of a year and the money supply exploded. By the end of 2021 the difference between the actual level of the money supply and where it should have been reached $4.0 trillion. That means the economy had $4.0 trillion of surplus liquidity. No wonder we had an inflation problem! The Fed has since been shrinking its balance sheet by letting securities mature without replacing them and the money supply has been declining. The surplus liquidity today is about $1.0 trillion and, if the Fed continues to shrink its portfolio, the surplus liquidity should be eliminated by spring. Once that surplus liquidity is eliminated we should expect the inflation rate to continue its descent towards the 2.0% target. . For what it is worth we expect the core CPI to increase 4.0% this year, 3.0% in 2024, and return to its targeted rate of 2.0% by the end of 2025.

If the inflation rate slows to 2.0% by the end of 2025 the Fed will believe that it achieved its objective. Once inflation began to rise in mid-2021 the Fed said that the rise in inflation would be “temporary”. But it will take more than four years from the time inflation started rising in mid-2021 until the time it gets back to its targeted 2.0% pace in mid-2025. Sorry. That was not temporary. Furthermore, remember that the Fed is talking about a period in which prices surge by 9.0%, and then continue to increase at a slower rate in subsequent years. At no point do prices decline.

When economists talk about “temporary” it is a much shorter period of time characterized by rising prices which are then countered by a period of falling prices. Take a drought. Food prices rise. But then a new crop arrives, prices decline, and end up not too far from where they started. Or a hurricane. Gasoline prices rise. But when oil rigs come back on line prices decline and end up close to where they started.

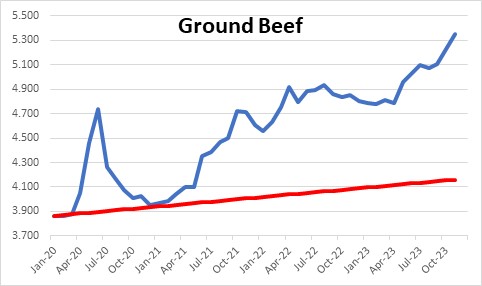

That is not the situation today. Take ground beef prices for example. Prior to the recession they were $3.87 per pound. Today they are $5.23. Even allowing for a normal 2.0% inflation rate, beef prices today are 38% higher than they would have been in the absence of the recession. The charts for eggs, milk, bread, chicken breasts, pork, potatoes, and a variety of other food items and gasoline look virtually identical. Each of these food products and gasoline are 25-45% higher than they would have been in the absence of the recession. The Fed may think that the rise in inflation was temporary but try telling that to any consumer. The increase in prices was not “temporary” – or welcome.

The increase in these prices hits lower income families the hardest. The average family spends about 60% of its take home pay on necessities – rent, food, and transportation. For lower income families that figure jumps to 80%. When the prices of those necessities rises, they get squeezed. There is simply not a lot left over for a family vacation to Disney World or even a movie. The increase in these prices increases the gap between the rich and poor, which is not what any Administration would like to see. We would love for the Fed to aim for a temporary decline in prices. That is not going to happen.

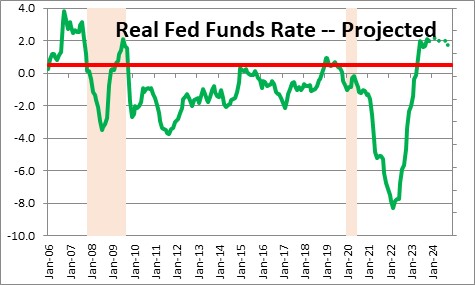

If the pace of economic growth continues to be moderate and inflation steadily shrinks, the Fed should be in a position to ease by summer. The funds rate today is 5.5%. The core CPI is 4.0%. Doing the subtraction, the real funds rate is +1.5%. The Fed’s decision to ease or not to ease will be determined by the level of the real funds rate. The Fed believes the funds rate is “neutral” when the real funds rate is +0.5% (2.5% funds rate less 2.0% inflation). Thus, a 1.5% real funds rate today is mildly restrictive. The Fed is not going to start easing as long as the inflation rate remains near 4.0% because that is still double the Fed’s 2.0% target. By mid-summer the inflation rate should have slowed to 3.2%. If that is the case, a 5.5% funds rate combined with 3.2% inflation implies a “real” rate of 2.3% which means that Fed policy would actually be tighter at that time than it is today. The Fed will need to begin easing. By yearend 2024 we think it will have reduced the funds rate to 4.75%. If at that time the inflation rate is 3.2%, the real funds rate would be +1.5% — roughly the same as it is currently. By the end of 2025 we expect the funds rate to be 3.0% which when combined with a 2.0% inflation rate means that the real rate would be +1.0% — close to, but still not yet at the so-called “neutral” rate of +0.5%. Look for the funds rate to begin falling in the summer of next year and keep sliding through the end of 2025.

Adjusting 0% interest rates to a more normal structure tales a long time, but thus far the Fed seems to be proceeding nicely – it did not overdo the degree of tightness, and it is not being hasty about letting the funds rate decline.

The scenario described above is very positive for both the economy and the financial markets. Moderate GDP growth. A gradual drop in the inflation rate. A steady but gradual decline in interest rates. It is not surprising that the various stock market indexes have reached a record high level.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me