May 26, 2023

The Fed thinks that a 2.5% funds rate — a 2.0% inflation rate combined with a 0.5% real rate – is roughly neutral. But if inflation is 5.5% rather than 2.0% is a 2.5% funds rate still “neutral”. Of course not. The degree of tightness of Fed policy is not determined by the nominal rate but, rather, by the real funds rate. However, determining the real rate is complicated. First, what is the appropriate inflation measure to use in calculating the real funds rate? Second, what if market rates are not rising in sync with the funds rate? For example, since October the funds rate has risen 2.25% from 3.0% to its current level of 5.25%. But the yield on the 2-year is only 0.25% higher than it was in October, and the yield on the 10-year note is 0.25% lower now than it was then. We focus on the real funds rate as a gauge of Fed policy. But if market rates have not risen, exactly how tight is Fed policy? Given the recent Fed tightening initiative almost everyone concludes that Fed policy is tight and the economy is on the cusp of a recession. But is it? Market rates tell a different story

The Fed has told us that over the course of a business cycle it believes that a 2.5% funds rate is “neutral”. That seems about right if the inflation rate is 2.0%. Put the funds rate about 0.5% higher than the inflation rate at 2.5% and the resulting funds rate will, presumably, neither stimulate nor slow the pace of economic activity. A positive real rate is critical. Fed Chair Powell has told us on numerous occasions that the Fed needs to get the real funds rate back into positive territory.

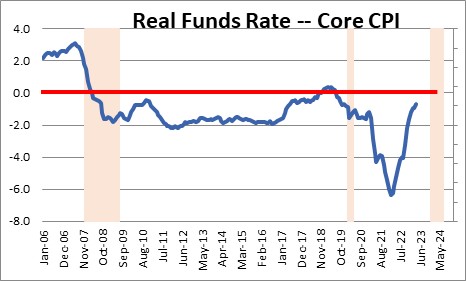

So where are we now? We calculate the real funds rate by using the core CPI as our inflation measure. But nobody has said that the core CPI is the appropriate inflation measure. We do not use the overall CPI index because it can be distorted by the volatile food and energy components. Hence, we calculate the real rate by combining the funds rate and the core CPI measure of inflation. With the funds rate today at 5.25% and the core CPI at 5.5% the real funds rate by our calculation is -0.25%. That is somewhat below the +0.5% real rate that the Fed thinks is neutral. What is clear is that the real funds rate today is a lot closer to where it is supposed to be than it was when the funds rate was 0% and the core inflation rate was 6.5%. At that time the real funds rate was -6.5%. The Fed is getting close. But is it where it needs to be?

The Fed sees things somewhat differently. It does not use the core CPI as its inflation measure. It prefers, instead, the core personal consumption expenditures deflator. So what is the difference and why does it matter? The CPI measures the monthly change in prices for a fixed basket of approximately 365 goods and services that consumers typically purchase in any given month. If we see an increase of 0.4% in April, for example, the prices of that basket of goods rose 0.4% in that month. It is solely a measure of monthly changes in prices.

The core personal consumption expenditures deflator is quite different. First, it is a much broader measure of prices and includes some 5,000 items. That is good. But it is also a weighted measure of inflation which means that it captures not just price changes, but also shifts in consumer spending patterns. To use the classic butter/margarine analogy, if the cost of butter rises and consumers switch to lower cost margarine, the PCE deflator would give a bigger weight to the lower-priced good. So, if the price of butter and margarine do not change the CPI in any given month would be unchanged, but if consumers switch to the lower-priced good the PCE would register a decline in that month even though the prices of butter and margarine did not change. Thus, the PCE deflator captures both price changes and changes in consumer spending habits. Is that the appropriate inflation measure? We do not think that is the case so we use the core CPI, but that point is debatable. But it does not matter what we think, the Fed uses the core PCE as its inflation gauge so that is what really matters.

Currently, the funds rate is 5.25% and the core PCE deflator is 4.7%. Using this different, slightly lower measure of inflation the Fed concludes that the real funds rate is +0.55% or exactly where the Fed thinks it should be. Given that, it has decided to postpone further rate hikes until it sees how the economy digests the cumulative impact of the funds rate increase from 0% initially in late 2021 to 5.25%. That sounds reasonable, but we think the Fed may be making a mistake.

In October of last year the funds rate was 3.0%. Today it is 5.25%. The funds rate has risen 2.25% in the past seven months and, the Fed argues, it will take some time for the economy to respond to the higher funds rate. But in that same period of time the yield on the 2-year note rose by just 0.2% from 4.4% to 4.6%. The yield on the 10-year note fell 0.2% from 4.0% to 3.8%. Market rates have barely changed. So how much more is the economy likely to adjust given that the market has effectively countered Fed policy? That brings up the question of whether the real funds rate is an appropriate measure of whether interest rates are too high or not. Perhaps some market rate is more appropriate.

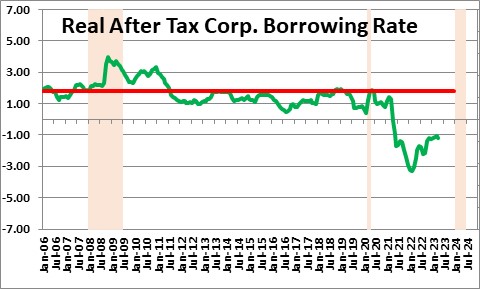

Let us suggest an alternative – the real after tax cost of corporate borrowing. We start with the Baa rate on corporate bonds which is currently 5.5%. Given that the corporate tax rate is 21%, after tax that corporate borrower is really paying 4.3%. If we use the 5.5% increase in the core CPI as our inflation measure, the real after tax cost of borrowing for a typical corporate borrower is -1.2%. Thus, market rates today are not at all burdensome. Corporate borrowers get to deduct the interest expense from their taxes, and get to pay it back with cheaper dollars. It pays a corporate treasurer to borrow at today’s level of interest rates.

The point is that the calculation of whether interest rates are “too high” or not depends upon exactly what interest rate one is using, and the inflation measure one chooses. The only fair way to make that evaluation is to look at several measures. There is no magic answer. The best one can do is get a general sense of where interest rates are today versus where they should be. Our conclusion? The funds rate and other market rates still need to rise by 0.75% or so to have a reasonable chance of slowing the economy enough that the inflation rate will return more quickly to its 2.0% target.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me