May 6, 2025

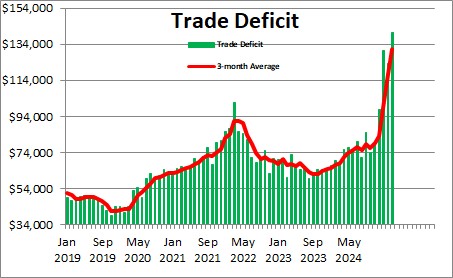

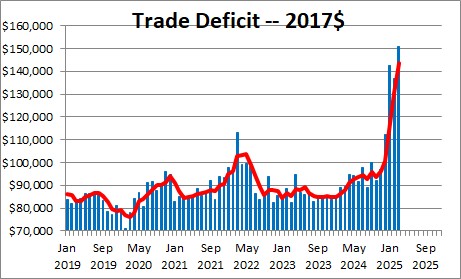

The trade deficit widened by $17.3 billion in March to a record to $140.5 billion after having narrowed by $7.5 billion in February Firms have been racing to import goods prior to the imposition of tariffs.

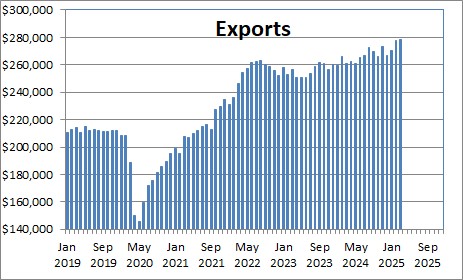

Exports rose $0.5 billion or 0.2% in March to $278.5 billion.

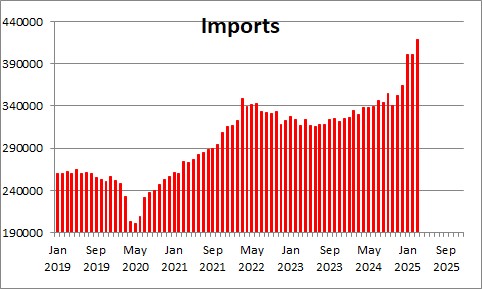

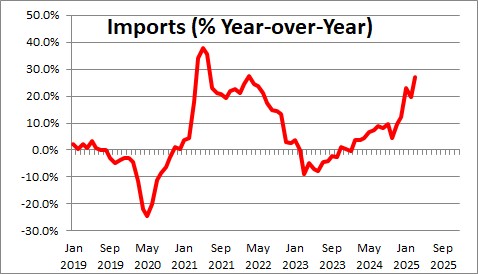

Imports surged by $17.8 billion to $419.0 billion or 4.4% after having been unchanged in February. In the past year imports have risen 27.1%. Of the $209 billion increase in the first three months of the year, $88 billion was in industrial supplies (almost all of which was in finished metal shapes), $45 billion in capital goods (largely computers and computer accessories) and $69 billion in consumer goods (primarily pharmaceuticals).

The trade deficit in real terms widened by $14.0 billion to $150.9 billion after having narrowed by $5.7 billion in February. The trade component subtracted 4.8% from GDP growth in the first quarter.

The trade deficit widened dramatically in the first three months of the year as firms raced to get goods into the country before the imposition of tariffs. GDP declined 0.3% in the first quarter but after adjusting for the big drag from trade and the increase in inventories, GDP growth would have been 2.3% in the first quarter. Consumer spending and capital investment grew significantly.

In the second quarter imports should decline sharply. As a result, we expect 2.5% GDP growth in that quarter after the 0.3% decline in the first quarter.

Stephen Slifer

NumberNomics

Charleston, SC

Hi Steve,

I’m a bit confused, has the deficit increased so sharply as a result of overall reduced economic activity? Or is there some other factor at play here? Material costs? or? This seems surprising with the general weakness of the dollar.

Best,

Hi Chris what we are have seen in the recent trade data as well as what happened to trade in the first few months of the year were wildly distorted by the recession and subsequent rebound. The dramatic narrowing of the trade gap earlier did not mean a lot. Nor does the recent rebound. I guess the only point I was trying to make is that the increases in both exports and imports tells us nothing more than the rebound is underway with the recovery in the U.S. currently outpacing the rest of the world.

Ah, that makes sense.

Thanks