June 9, 2022

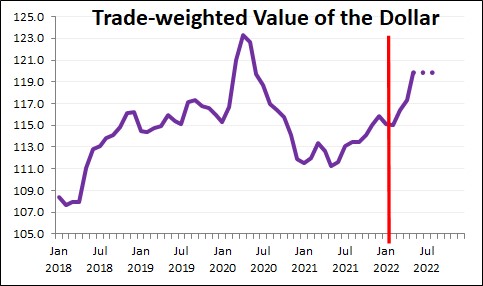

The trade-weighted value of the dollar, which represents the value of the dollar against the currencies of a broad group of U.S. trading partners has risen 7.7% from where it was at this time last year and it is expected to continue to rise in value throughout 2022. Much of that increase has occurred in the past three months once the Fed began to raise short-term interest rates.

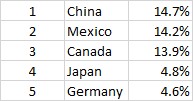

When you try to figure out the impact of currency movements on our trade, you have to weigh the movements depending upon the volume of trade we do with that country. For example, our largest trading partners are:

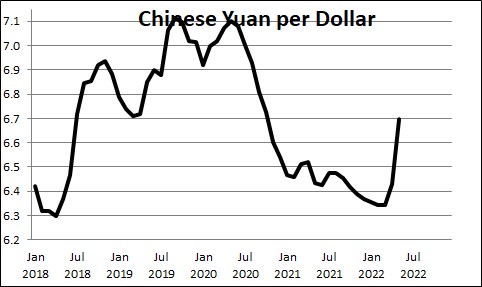

With respect to the Chinese yuan the dollar has risen 4.1% over the past year. A year ago one dollar would buy 6.4 yuan. Today it buys 6.7 yuan.

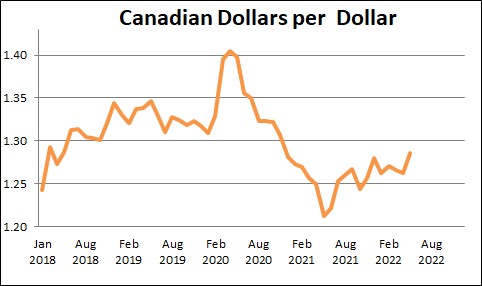

The U.S. dollar has risen 6.1% versus the Canadian dollar during the past year. For example, a year ago one U.S. dollar would purchase $1.21 Canadian dollars. Today it will buy $1.28 Canadian dollars.

And against the Mexican peso the dollar has risen by 0.5% during the past year. A year ago one dollar would buy 20.0Mexican pesos. Today it will buy 20.1 pesos.

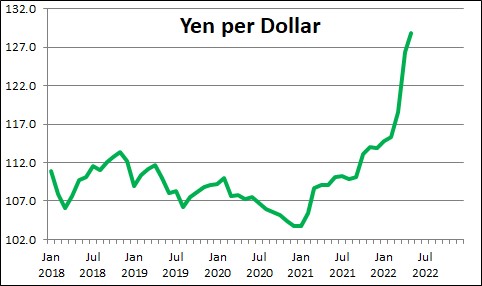

The dollar has risen by 18.2% against the yen during the course of the past year. A year ago one dollar would buy 109.1 yen. Today that same one dollar will buy 128.8 yen.

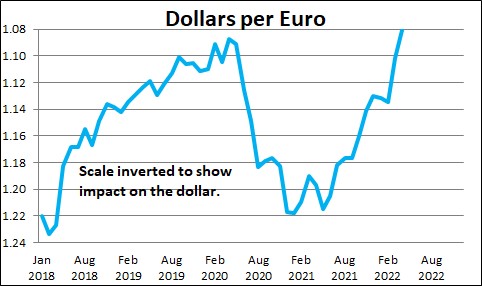

The dollar has risen 13.0% relative to the Euro during the past year. A year ago one Euro cost $1.21 Today one Euro costs $1.06.

Thus, the dollar has strengthened against almost every major currency during the course of the past year. As a result, the trade-weighted value of the dollar, as noted earlier, has risen 7.7% during the past year.

Currency changes can affect the economy in several ways. First, a rising dollar can reduce GDP growth of U.S. exports because U.S. goods are now more expensive for foreign purchasers to buy. Similarly, a rising dollar can increase growth of imports because foreign goods are now cheaper for Americans to buy. Fewer exports and more imports will reduce GDP growth that year. A rising dollar can also reduce the rate of inflation in the U.S. because the prices of foreign goods are now lower. A falling dollar will do the opposite — increased growth in exports, slower growth in imports, and a faster rate of inflation.

The dollar’s recent strength is partially attributable to the fact that GDP growth in the U.S. is growing much more rapidly than almost any country in the world. That makes it an attractive place to invest. At the same time with considerable economic and political uncertainty regarding the degree to which the war between Ukraine and Russia might spread elsewhere, the U.S. dollar becomes a safe haven currency. Finally, the Fed is expected to increase interest rates sharply between now and the end of the year which means U.S. interest rates are much more appealing to foreign investors than other low rate countries. But because the trade sector is only 10% of the U.S. economy the dollar’s strength is unlikely to significantly slow the pace of economic expansion between now and yearend.

Stephen Slifer

NumberNomics

Charleston, SC

Steve –

The paragraph above is contradictory. When describing the individual currencies

you describe the dollar weakening against all except he peso. In the first paragraph you say the trade weighted dollar has weakened in the past year. Yet in the third paragraph above you state the dollar has strengthened against most other currencies, which is directly contrary to most of what you have written. Which is it?