July 2, 2024

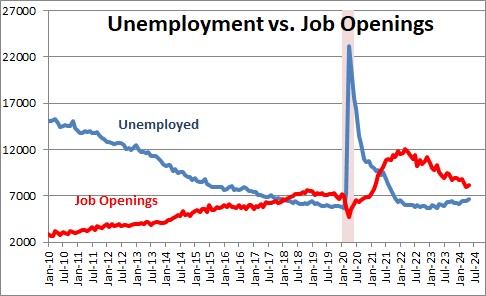

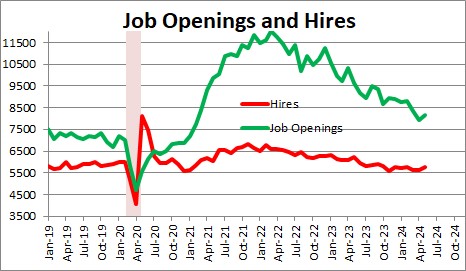

The Labor Department reported that job openings rose 221 thousand in May to 8,140 thousand after declining 436 thousand in April The pace of economic activity has remained solid and the labor market has softened very gradually. Job openings have fallen from their peak of 12,027 thousand in March of last year, but remain higher than the 7,000 thousand level that existed prior to the recession.

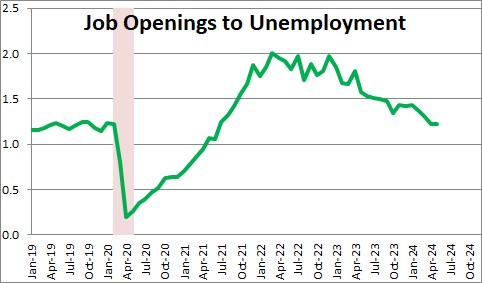

As shown in the chart below, there are currently more job openings than there are unemployed workers. Specifically, there are 1.2 jobs available for every unemployed worker. Prior to the recession this rate was steady at about 1.2, but if one looks at the decade prior to the recession there are typically fewer job openings than there are unemployed workers. A ratio of 0.6 would be regarded as normal during that period.

The Labor Department also provides information on hires each month. Hires rose 141 thousand in May to 5,746 thousand after having fallen 2 thousand in April Employment remains quite steady.

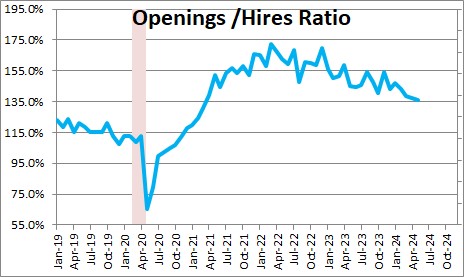

The rate of job openings rose 0.1 in May to 4.9 while the rate of hires also rose 0.1 to 3.6. Thus, the ratio of job openings to hires edged lower in April (thanks to rounding) to 136.1%, which means that job openings continue to outpace hiring. If that is true, employment should continue to climb in the months ahead. Prior to the recession job openings were 15% higher than hires. Unemployed workers today do not always have the skills required by employers, have chosen to become gig workers and go into business for themselves, are unable to find affordable day care, and/or are willing to live off generous government benefits for as long as they can.

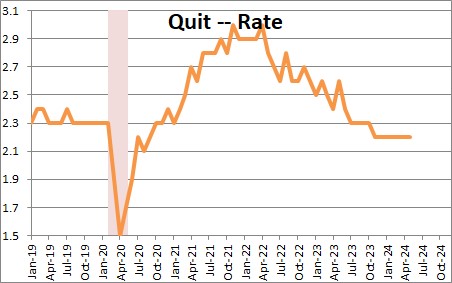

The quit rate was unchanged in May at 2.2 The willingness to quit one’s job has declined for a couple of years as workers concern about slower growth occurring in the not-too-far-distant future made them slightly less willing to quit their job than they had been. Prior to the recession the quit rate was 2.3. It is just slightly lower today than it was prior to the recession.

Stephen Slifer

NumberNomics

Charleston, SC

Steve, with my background in community and technical colleges I agree wholeheartedly with your comment that workers do not have the skills required by employers today. That is were the education system has to come to grips with the situation. We do our best, but sometimes that is not enough to keep up with the ever-changing demand.

Darrel Staat

Hi Darrel,

You are just the guy I need to talk to. I am really impressed with what Mary Thornley and TT are doing here in the Charleston area re: working with local businesses (like Boeing) and coming up with programs designed to fit the specific needs of the firm. I am also finding that more and more firms are willing to offer some sort of apprenticeship program for younger workers and/or tuition reimbursement if they agreed to stay with the firm for x number of years.

Went to a TED conference here in Charleston back in April. Had a lot of tech type people who have started their own firms. Not a single one of them developed their tech skills from school. They seemed to learn it from their peers. One guy was only going to the College of Charleston as a favor to his parents and grandparents who put up the money for him to start his own firms. In some sense he was taking a time out from his job to go to college. Makes me wonder if our entire economic model is off on the wrong track.

Thoughts?

Steve

Among many other concepts, this touches on the difference between our more passive, curriculum-based “education” system which provides or pushes knowledge and the more active curiosity-based “learning” which is pulled by individuals at their discretion. It’s why higher education is being carefully scrutinized and good tech schools are increasing in popularity. Which one is more closely aligned with the jobs available? I think we have some very interesting years in education ahead of us.

Hi Jim,

The honest answer to your question re: which type of education is more closely aligned with the jobs available today is — I don’t know. Sounds like something that you all at USC may be in a better position to answer. But I would venture a guess that the technical college system today is geared more towards satisfying the needs of employers. I have been impressed by the extent to which, for example, Mary Thornley at Trident Tech here in the Charleston area works with all sorts of employers to tailor programs to satisfy their needs. When a student graduates from TT, and sometimes long before they graduate, they have a job. That is not always the case with students graduating from your curriculum based four year colleges and universities. I try to look back at my undergraduate days and wonder about the usefulness of many of those required courses. Sounds like a discussion we should continue at some point! Thanks for sharing your thoughts.

Steve

Steve, I think the reason that so many job openings are not being filled has to do mostly with the fact that the skill level of applicants are not meeting the needs of industry. The business community is now extremely global and have to compete on the international level. When higher education not turn out enough workers with the skills needed to meet the needs, we are failing the workforce, the business community and the country in general. We know things change in the business world at a ferocious rate of speed and higher education is stuck in old ways or thinking and acting which are very gradual and just plain slow. How to get higher ed moving at the speed needed is a good question that at present we do not have the answer to. Where is the next John F. Kennedy when you need him? We got to the moon in less than 10 years. Encouraging higher ed to get a move-on is possible, but will take some dynamic leadership in WDC and the in states. Thanks again for your insight. I really appreciate it. …Darrel Staat

Stephen, as you probably know, the jobs of the 21st century are beginning to be significantly different from those of the 20th. That change, dominated by technology, will continue, most like with increasing speed into this century. I think that explains the situation with openings and hires. Education and training continue to be of utmost importance to the future of jobs in our economy. I know I am prejudiced in that regard, but the facts are beginning to point in that direction.

Darrel Staat

Enjoying your reports. Regarding this one, one factor you did not mention which I know comes into play is what I call the “Background Check” factor. Many applicants do not get hired because of negative information contained in their background reports, including drug test results. I don’t know if there is any way to measure this, but from employers I have personally talked to about the difficulty of finding “good help”, this gets get mentioned more than anything else, including skill sets.

Hi Dennis,

Thanks for your response. I have no idea to what extent an applicant’s failure of drug tests is the reason behind their not getting hired, but I would agree that it is probably fairly common. There is certainly another group of individuals who are content with the welfare/unemployment benefits they are receiving that they choose not to work. My point is that many of the unemployed/underemployed individuals are not qualified for the positions they seek — whether that is lack of skills, or drugs, or simply an unwillingness to accept the position offered. The jobs seem to be available, but for a variety of reasons they are not getting filled.

Steve

Your comment seems to have gotten cut off. You are right that not every unemployed worker is qualified for the position. Many do not have the skill set required. Many flunk the drug test. The solution in my mind is through education and not necessary a 4-year degree. In many cases a tech school will work just fine and we seem to be gradually moving in that direction. Also, getting that required education takes time and money. That is why I am so supportive of apprenticeship programs and companies paying for a worker’s education if they agree to stay for x number of years after graduation.

At the turn of the century i noticed an increased negative attitude by employers toward new and replacing employee. Seems it has only increased. This is one reason GP margins have continued to rise.

Hi Walter,

Thanks for your comment. Not sure I understand why employers would have a negative attitude toward new employees and replacing employees. Are they using technology to reduce the need for some of these workers? Believe they have a lousy work ethic? Maybe the new hire’s skill set just does not match up with their needs. Why do you think that is the case.

Steve

I’ll bet that CNN and MSNBC will NEVER quote this!

Honestly, unless this comes with income data, it isn’t very reliable for determining reasons why people aren’t working. Almost every article I’ve read about the worker shortage completely fails to acknowledge that workers are not content with working these jobs for low wages. People are fed up with the decades of stagnant wages and are now demanding more from employers.

You are right that we do not know exactly why people are not working. All I know is that there are 9.7 million unemployed workers out there (Versus 5.7 million that were unemployed prior to the recession), and there is a near record level of job openings. If you want a job, there are jobs available.

I fully understand that people may be fed up with decades of stagnant wages, but to rise above that they need to have some sort of a skill that is useful to their own employer or some other employer. If they do not have that skill, they are likely to remain in a relatively low paying job.

In today’s environment good paying jobs are available in construction, manufacturing, restaurant, and in transportation. Restaurant owners cannot find enough workers despite many of their former employees remaining unemployed, Amazon and WalMart need thousands of people to work in their distribution centers. And those are not all low paying jobs.

I look at the vote at that Amazon distribution center in Alabama. the workers voted 79% to 21% NOT to be represented by the union. The union was trying to convince them that they were downtrodden and that union representation would help them. Does not seem like the Amazon workers — many of whom are relatively low paid (with starting wages of $15 plus they get full health care benefits from day 1) — do not see it that way. Those relatively low paid workers do not sound too fed up to me.

I talk to HR managers who have legitimate positions to offer who find that people can not even be bothered to show up for their job interview. They forget. Or just simply do not show. Even if the firm wants to hire them many then fail the drug test.

In the restaurant world, restaurants are reopening and restaurant sales are close to what they were prior to the pandemic. Everybody wants to hire and nobody can find enough workers. It sure sounds to me like there are a lot of people in this country who are quite content with what they are getting from the combination of their state unemployment benefits + $300 per week from the federal government.

If we cut out the federal benefits my guess is that suddenly we would have a big jump in employment.

I think you all need to get out more. Every restaurant has “now hiring” sings. How much education do you need for that. The healthcare industry is not getting any applications. In need of cooks, servers, caregivers. Not a lot of education needed for any of those.

I believe the government has given out unemployment money that exceeds the income of these people and now they don’t want to work. Why should they.

Tax money, Stimulus, Unemployment. Living better than us working fools.

It’s hard to get people to want to work if they’re receiving benefits they don’t have to work for. The stimulus checks and unemployment are keeping them from wanting to work.

Agreed. Writing my commentary now.

If you are 55+ with a salary pre Covid of 150+k per year plus benefits, travel, health, 30 days vacation + holidays + sick pay. Then suggestion a fast food restaurants or anywhere would hire thus person with zero experience in hospitality or service. Bad on their feet, can’t stand or lift anything over 5lbs. A genius in logistics but not the jobs you mention. Mortgage forebarance is only going to last so long. There’s a huge section of society don’t qualify for these job’s you mentioned.

Hi Sandra,

Thanks for taking the time to send me your note. The older person you describe who has a good salary and great benefits will face a challenge in obtaining a job just like what he or she left. The economy has gone through some wrenching changes in the past year and many of the jobs that were previously available are no longer around. That means some people will get left out with skills that are not very helpful to employers in the economy that is evolving as we speak. Whenever there is a period of rapid change people have to adjust. But that re-education process can take time. I fully understand that.

It happened in the industrial revolution as factory jobs replaced jobs on the farm. It is happening today as technological skills are required for many jobs and some folks without those skills are getting left behind.

Having said that, there are a record number of job openings in the U.S. economy. See: https://stats.bls.gov/news.release/jolts.t01.htm

Employers are crying for help in all sorts of different industries. When I talk to people in construction, manufacturing, retail trade, restaurants, and at staffing agencies I get the same answer. They cannot even get people to show up for an interview. And sometimes they do not even show up for a job that they have just secured. It is called “ghosting”. Jobs are out there if people are willing to take the time to look and work at it which leads me to the conclusion that people are not trying too hard to get a job in today’s world. In many cases they can earn just as much or more because they are being paid not to work. Once those benefits expire after Labor Day I suspect that many of those people who are unemployed today will find employment.

Best.

Steve

What I am facing in the Denver area, is that employers are so short staffed, are willing to pay over minimum wage for entry level positions in retail, office jobs, and hospitality, yet have such a hard time with people showing up to work after being hired or just people not applying for jobs. I am wondering/speculating, if the stimulus payments, additional unemployment payments and pre-payment of dependent credits are causing people to not want to work. I get it, child care is expensive, but as a single mom when my kids were very young, I made it all by myself with no federal or state benefits given. I wish people would get back to work…that are able.

Hi Brandi,

Search firms here in the Charleston SC area are having the same experience you are. They get so frustrated when they get a placement and the candidate does not bother to show up for the job interview, does not show up when hired, flunks the drug test, can’t find/pay for child care, etc. I agree completely that the work ethic seems to have disappeared. People find all sorts of excuses about contemplating a career change, or fear of getting COVID. But it is real easy to make (and perhaps believe) those excuses when you are being paid not to work. We’ll see what happens after Labor Day when the federal unemployment benefits expire. As it turns out 25 states have already refused the extended federal benefits. Could explain why the July jobs report was so strong.

Thanks for taking the time to respond.

Steve

Where are these statistics coming from cited on this page? Please cite the sources of the data.

They come from the Bureau of Labor Statistics.

https://www.bls.gov/news.release/pdf/jolts.pdf

Where is this data coming from? The BLS says that there are 0.5 unemployed people to every open job, not 1.9.

Source: https://www.bls.gov/charts/job-openings-and-labor-turnover/unemp-per-job-opening.htm

Hi Mike,

It is the same data. The chart you show looks at the number of unemployed people vs. the number of job openings. I look at it the other way — the number of job openings for every unemployed worker. You can look at it either way, but to me it makes more sense the way I look at it. There are nearly two job openings for every person that is unemployed.

Steve