September 5, 2024

Unit labor costs might be a term that is not familiar to you. Unit labor costs represent the increase in compensation adjusted for the gains in productivity. You might think that if labor costs are rising that would put upward pressure on inflation. It does not matter so much what wages are doing, but what wages adjusted for the change in productivity is doing. Think of it this way. If I pay you 3% more money, on the surface you might think that my costs as a businessman have just gone up by 3%. That is not quite true. What if you are 3% more productive? Then I am getting 3% more output from you, so I really do not care. I am very happy to pay you 3% more money. In this case, unit labor costs, or labor costs adjusted for the gain in productivity, are 0%. To take the example one step farther, if I pay you 3% higher wages but you are no more productive, then unit labor costs are rising by 3% and I am probably going to raise my prices to offset the higher cost of labor. So, a gain of that magnitude in unit labor costs is quite likely to exert upward pressure on inflation. So always watch what is happening to unit labor costs and not just wages.

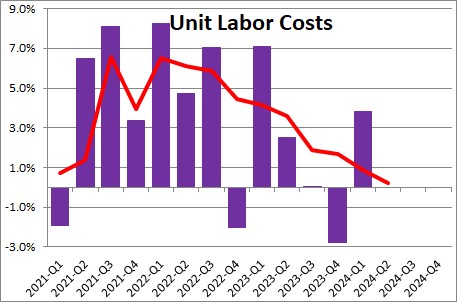

Unit labor costs rose 0.4% in the second quarter after having risen 3.8% in the first quarter following a decline of 2.8% in the fourth quarter. In the second quarter compensation rose 3.0% while productivity rose by 2.5%. which, when combined, resulted in a 0.4% increase in unit labor costs. in the past year unit labor costs have risen 0.3% versus an average increase in the previous decade of 1.4%. Steady increases at their current pace are reasonably consistent with roughly a sub-2.0% inflation rate.

Stephen Slifer

NumberNomics

Charleston, SC

Stephen, I am sorry but I had not heard of Unit Labor Costs before, my problem, but I found your explaination most interesting and sensible. If I am thinking properly, I would guess that the reason the labor costs would increase while the productivity would decrease has to do with the fact the the labor force got raises because of a reduced pool of workers and the workers in place just continued to produce as they had previously. Am I making sense? Seems a possible answer to the question.

I continue to enjoy reading your weekly commentary. Writing easily understood explanations of complex subject matter is a real talent that you have. Thanks for sharing with the rest of us.

…Darrel