January 19, 2024

Most economists expect the economy to slow in the first half of 2023 and some still anticipate a recession in the months ahead. That appears to be an increasingly unlikely scenario. The economy closed out last year on a strong note and that strength appears to be carrying over into January. Consumer confidence has soared in the past two months. The stock market has reached a new record high level. Homebuilders are enthusiastic as mortgage rates have fallen. Housing affordability will jump sharply as the year progresses. The weekly data for initial unemployment claims (layoffs) suggests that employment likely rose a solid 160 thousand in January and the unemployment rate remained near a 50-year low of 3.7%. The Fed has kept the funds rate at 5.5% for now, but market rates – the mortgage rate in particular — have fallen by more than a percentage point in the past two months. As the inflation rate continues to subside, it is just a matter of time before the Fed begins a protracted easing cycle. Economic headwinds are soon to become tailwinds. The economic slowdown, in our opinion, is history. Expect 1.8% GDP growth in the fourth quarter of last year to be followed by steady 1.5% gains in the first two quarters of 2024.

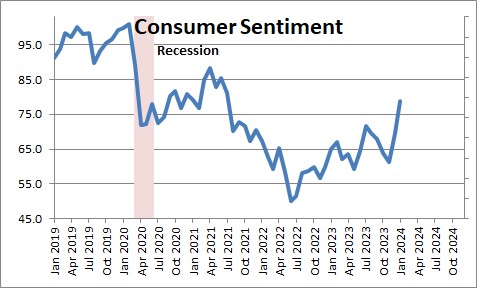

Consumer sentiment is on the rise. It has risen 28% in the December/Janury period as consumers expect to see reduced inflation, continuing job gains, steady GDP growth, and lower interest rates as the year progresses. It is now at its highest level since July 2021.

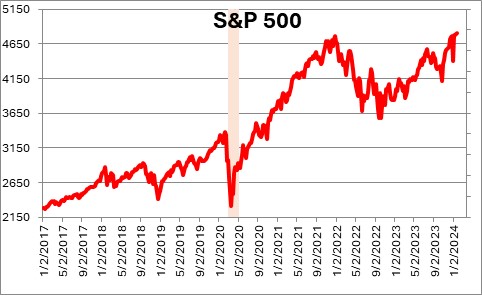

Part of the gain in consumer sentiment is almost certainly associated with the stock market climbing to a record high level in mid-January.

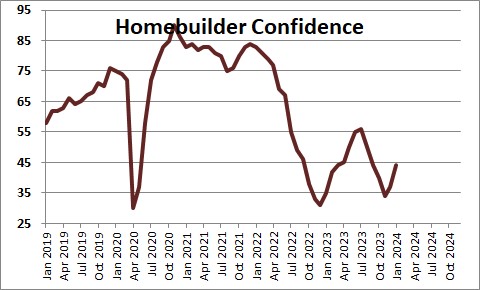

Homebuilder confidence jumped 10 points in the December/January period and now stands at 44. The surge in confidence was fueled by a decline in mortgage rates from a peak of 7.8% in October to their current level of 6.6% on their way to 6.25% by yearend. This gain in builder confidence is almost certain to translate into a further increase in housing starts as the year progresses.

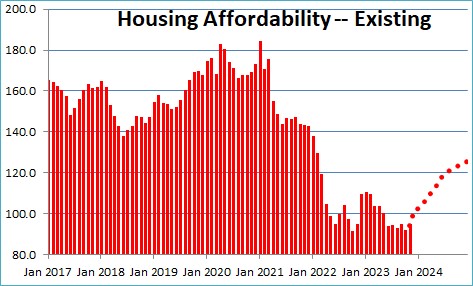

On the demand side of the housing market the drop in mortgage rates is going to significantly boost housing affordability as the year progresses. In October the housing affordability index hit bottom at 91 which means that a potential home buyer had 9% less income than required to purchase a median-priced home. But with the drop in mortgage rates and a likely decline in home prices as builders increase the supply of homes, that median-income family should have 25% more money than required to purchase a median-priced home by the end of this year. The required down payment and the monthly payments should fall sharply as the year progresses and provide considerable stimulus to the housing market.

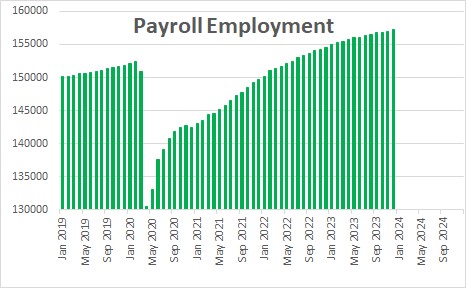

In the labor market, initial unemployment claims — a measure of layoffs — has been steady through mid-January which suggests that payroll employment will likely rise by about 160 thousand in that month. If at the same time earnings increase steadily, consumer income will continue to climb which will provide the fuel for additional gains in consumer spending.

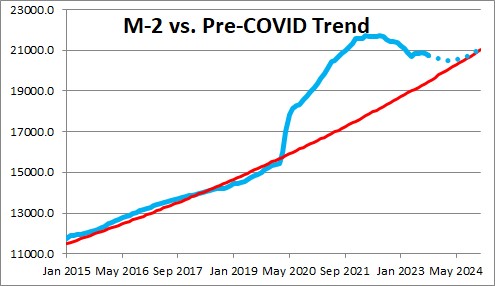

Given declines in the money supply in the past year, the excess liquidity in the economy — which fueled the run-up in inflation for the past couple of years — should disappear entirely by spring.

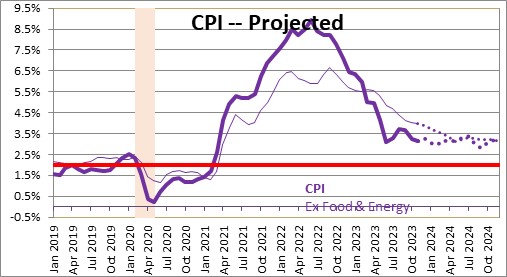

That, in turn, suggests that the core inflation rate should drop from 3.9% currently to perhaps 3.1% by yearend.

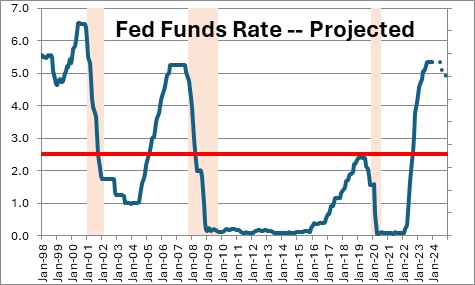

Against this background the Fed will almost certainly begin a lengthy easing cycle by summer. We expect the funds rate to fall from 5.5% currently to 4.75% by yearend, but then continue to slide towards the 2.5% mark during the course of 2025 and into 2026.

The combo of rising consumer confidence, a record level of stock prices, a sharp jump in housing affordability, steady job gains and rising wages, reduced inflation, and the beginning of a protracted cycle of lower interest rates is not a recipe for a slowdown in the pace of economic activity. Accordingly, we have raised our forecast for the first half of the year from 0.7% to 1.5%.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me