October 13, 2023

The economic situation was already complicated with the resumption of payments on student loans, the ongoing UAW strike, and a dysfunctional Congress with the prospect of a government shutdown looming. But now the outbreak of war in the Middle East trumps everything else in terms of potential importance. As always, in times of political turmoil investors flee to the safety of the U.S. bond market. That was the case this past week as the yield on the Treasury’s 10-year note declined. But also in times of uncertainty stock investors typically get a case of jitters, the stock market declines, and volatility spikes. But that has decidedly not been the case this time. In our opinion, the stock market is far too complacent about the almost certain spread of war in the Middle East and its potential to disrupt economic activity, not just in the U.S. but around the globe. Oil prices could surge to the $120 mark or higher. The flow of shipping in the Persian Gulf could be threatened by Iranian warships. The result could easily be a global recession combined with a surging inflation rate. Stagflation would be an ugly scenario.

The war has dominated television news, the print media, and social media since the Hamas attack on Israel on October 7. The news stories note that an Israeli invasion of Gaza in the South is both certain and imminent. These media stories also point out the possibility that the war could easily spread to Northern Israel which could bring Iran into the picture. It does not take a lot of imagination to envision a much broader conflict. Fixed income investors are seeking a safe haven in the form of the U.S. bond market. The yield on the 10-year note, which surged from 3.5% in April to a high of 4.8% last week, has retreated to the 4.6% mark.

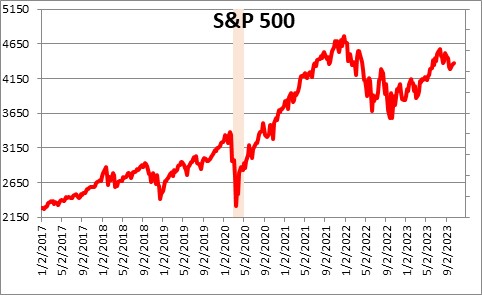

Stock market behavior in this past week is more puzzling. The stock market has been fluctuating in a relatively narrow band for the past several months as investors try to determine whether the Fed funds rate has reached its peak, the economy is going to achieve a soft landing , inflation will continue to retreat, and whether Congress can overcome its dysfunction and deal with pressing budget issues which include funding for both Ukraine and Israel. Failure to resolve these spending issues quickly will almost certainly lead to a government shutdown in mid-November. The daily movements in recent months have been triggered by economic issues regarding the likely course of interest rates, the economy, and inflation. It is rational and data driven. It has not included any particular element of fear which, to us, is surprising given the outbreak of war in the Middle East.

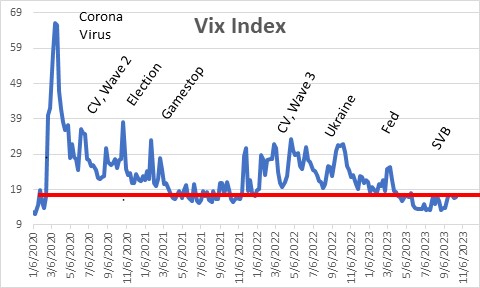

Stock market volatility has been subdued through this entire period. Even during this past week stock investors were unconcerned. The S&P 500 index is almost exactly where it was prior to the outbreak of war. The VIX index of volatility hovers around 17.5 which is virtually identical to the 18.4 average level of volatility in the past 10 years. Business as usual. Nothing out of the ordinary. Why aren’t stock investors more nervous?

The spread of the corona virus caused volatility to spike in the spring of 2020 and several times subsequent to that when cases spread. The outcome of the 2020 election made investors nervous. The outbreak of war in Ukraine in 2021 did the same thing. So why haven’t investors panicked in response to the outbreak of war in the Middle East? It appears that investors have embraced the notion that inflation will continue to shrink, the economy will likely expand at a moderate pace in the months ahead, and that it is only a matter of time before the Fed begins to lower rates in the second half of 2024. That is a rosy outlook, but is it right?

It does not take much imagination to envision a much more troublesome outcome. An Israeli invasion of Gaza is a certainty. But what happens then? Do militants in Lebanon and Syria join the fight and make it a two-front war? What does Iran do? How about the U.S. and Europe?

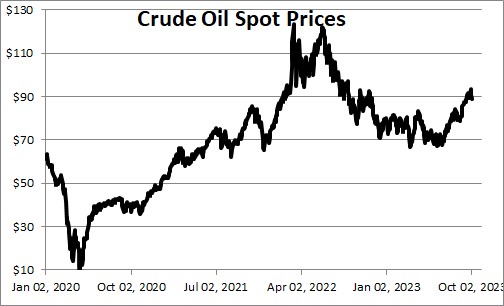

A lot of oil is produced by OPEC countries in the Middle East, most notably Saudi Arabia, Iraq, Iran, the UAE and Kuwait. Production could be interrupted. Mideast oil is then shipped around the globe. But attacks by Iran on shipping through the Persian Gulf could send oil prices sky high – well into triple digits.

The world has just recovered from a bout of inflation triggered by Russia’s invasion of Ukraine. A second spike in oil prices could rekindle a widespread runup in inflation caused not only by surging oil prices but by a dramatic runup in the cost of transportation.

The European economy is particularly anemic at the moment with the IMF expecting GDP growth in the E.U. of 0.7% in 2023. That includes an expected 0.5% contraction in GDP for Germany. A surge in oil prices would almost certainly push the entire European economy into recession. GDP growth in the U.S. is expected to soften to 0.7% or so in the first two quarters of next year. A spike in oil prices could push those growth rates into negative territory and trigger a recession in the U.S. as well.

In our opinion, the stock market is being far too complacent about the potential for the Hamas-Israel conflict to widen. In addition to whatever impact the U.S. economy might experience from a resumption of payments on student debt, a spreading UAW strike, an inability of the Congress to govern, now the stock market must deal with the possibility of a much broader war than just Israel vs. Hamas that could result in both a global recession and a spike in inflation.

Is stagflation next?

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me